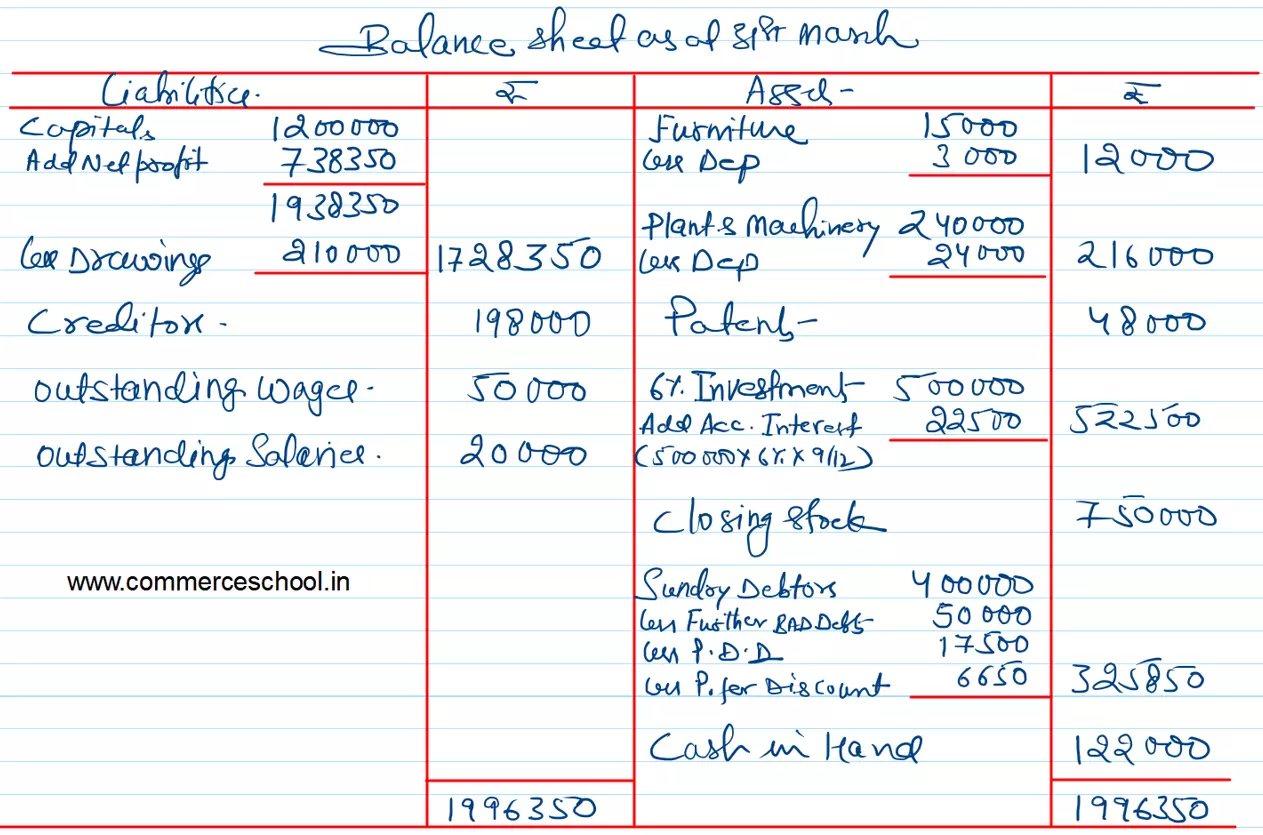

Following balances are taken from the books of Niranjan. Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as on that date:

Following balances are taken from the books of Niranjan. Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as on that date:

| Particulars | ₹ | Particulars | ₹ |

|

Capital Opening Stock Furniture Sales Purchases Return Rent Salaries Bad Debts Sundry Debtors Advertisement Expenses Patents |

12,00,000 4,50,000 15,000 43,50,000 40,000 50,000 2,40,000 10,000 4,00,000 60,000 48,000 |

Drawings Plant and Machinery Purchases Insurances Sales Return Trade Expenses Wages 6% Investments Sundry Creditors Cash Miscellaneous Income |

2,10,000 2,40,000 29,50,000 15,000 70,000 20,000 4,00,000 5,00,000 1,98,000 1,22,000 12,000 |

Adjustments:

(i) Closing Stock ₹ 7,50,000.

(ii) Depreciate Machinery by 10% and Furniture by 20%.

(iii) Wages ₹ 50,000 and salaries ₹ 20,000 are outstanding.

(iv) Write off ₹ 50,000 as further Bad Debts and create 5% Provision for Doubtful Debts. Also, create Provision for Discount on Debtors @ 2%.

(v) Investments were made on 1st July, 2022 and no interest has been received so far.

[Gross Profit – ₹ 12,20,000; Net Profit – ₹ 7,38,350; Balance Sheet Total – ₹ 19,96,350.]