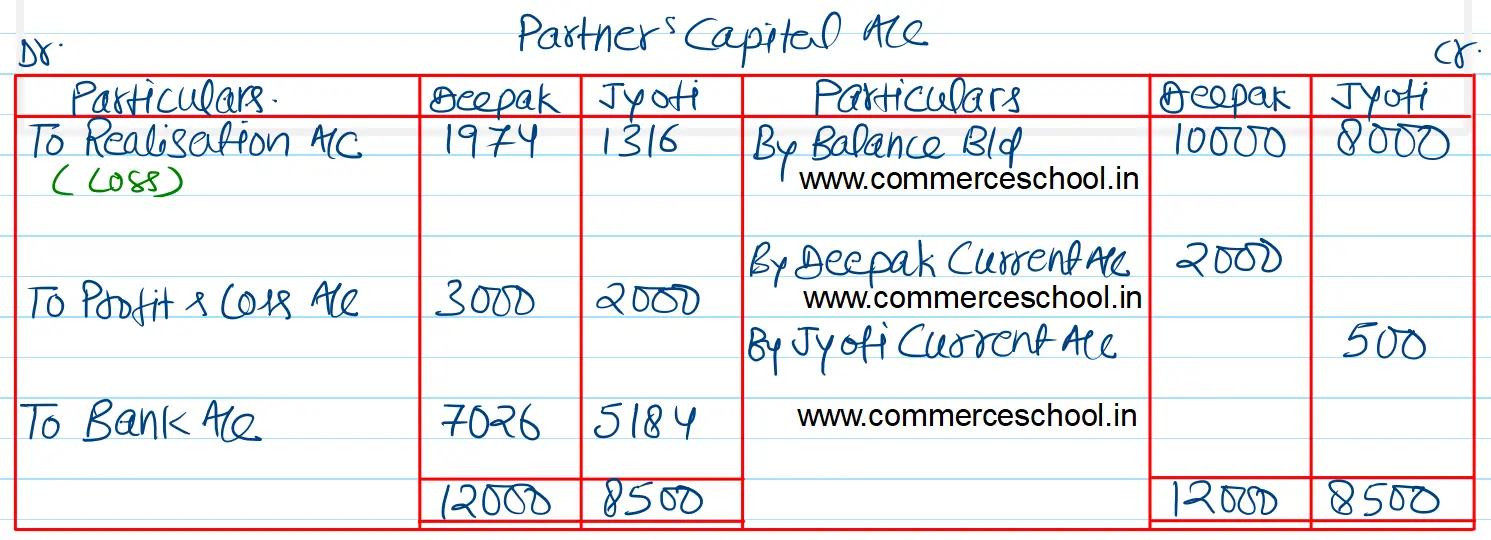

Following is the Balance Sheet of Deepak and Jyoti, who were sharing profit and losses in the ratio of 3 : 2, as at March 31, 2024

Following is the Balance Sheet of Deepak and Jyoti, who were sharing profit and losses in the ratio of 3 : 2, as at March 31, 2024:-

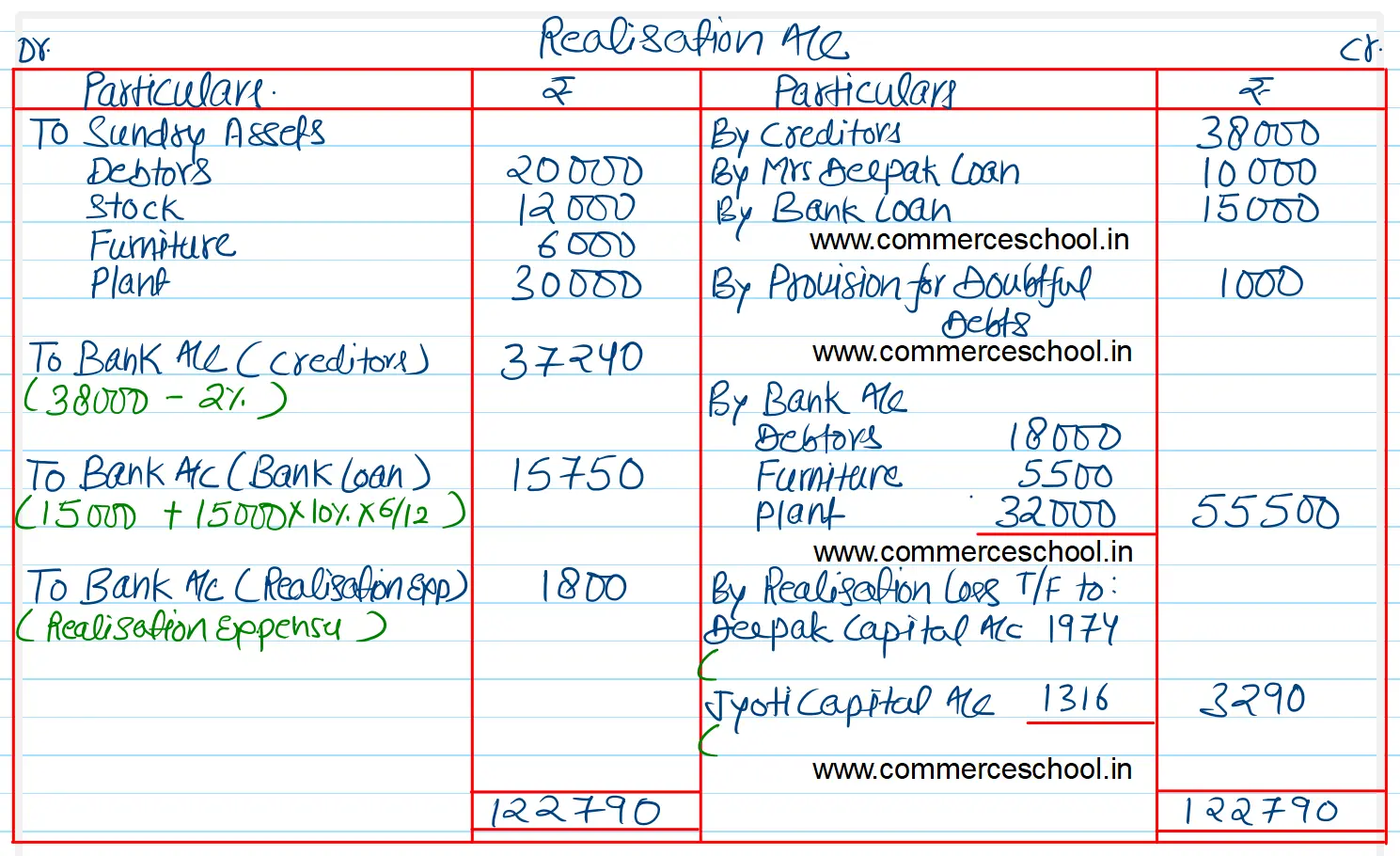

The firm was dissolved on that date and the following arrangements were made:-

(I) Assets realised as follows: Debtors ₹ 18,000; Furniture ₹ 5,500; Plant ₹ 32,000.

(ii) Deepak agreed to take over stock in full settlement of his wife’s loan.

(iii) Creditors were paid at 2% discount and Bank Loan was discharged along with interest due for six months @ 10% p.a. and

(iv) Expenses of realisation amounted to ₹ 1,800.

Show the necessary ledger accounts to close the books of the firm.

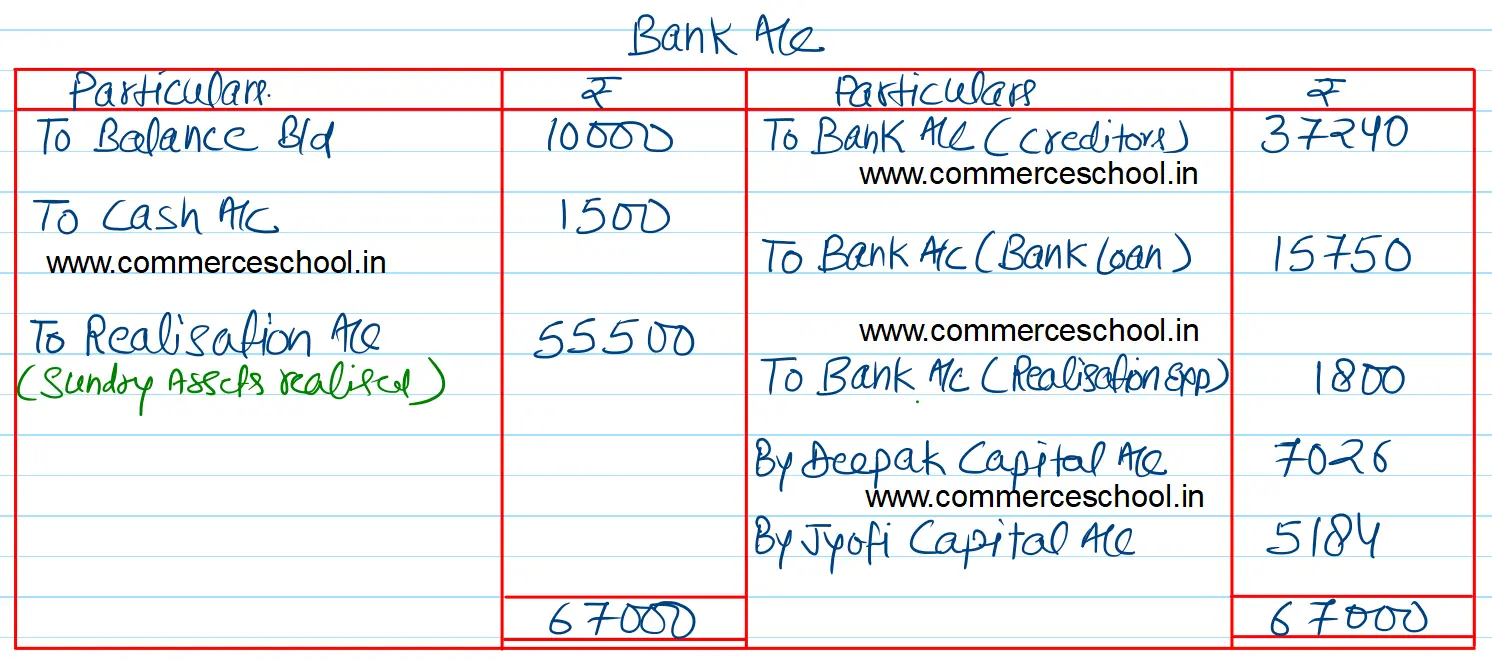

[Ans. Loss on Realisation ₹ 3,290; Final Payments : Deepak ₹ 7,026 and Jyoti ₹ 5,184; Total of Cash/Bank A/c ₹ 67,000.]

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 38,000 | Cash | 1,500 |

| Mrs. Deepak’s Loan | 10,000 | Bank | 10,000 |

| Bank Loan | 15,000 | Debtors 20,000 Less: Provision for Doubtful Debts 1,000 | 19,000 |

| Capital A/cs: Deepak Jyoti | 10,000 8,000 | Stock | 12,000 |

| Current A/cs: Deepak Jyoti | 2,000 500 | Furniture | 6,000 |

| 83,500 | Plant | 30,000 | |

| P & L A/c (Dr. Balance) | 5,000 | ||

| 83,500 | 83,500 |

Anurag Pathak Answered question