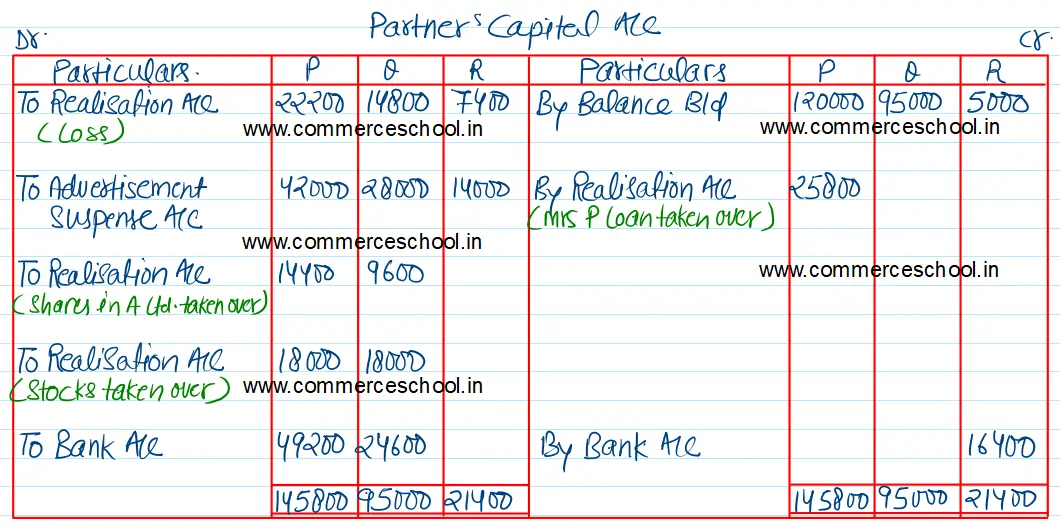

Following is the balance sheet of P, Q and R who were sharing profits and losses in the ratio of 3 : 2 : 1

Following is the balance sheet of P, Q and R who were sharing profits and losses in the ratio of 3 : 2 : 1.

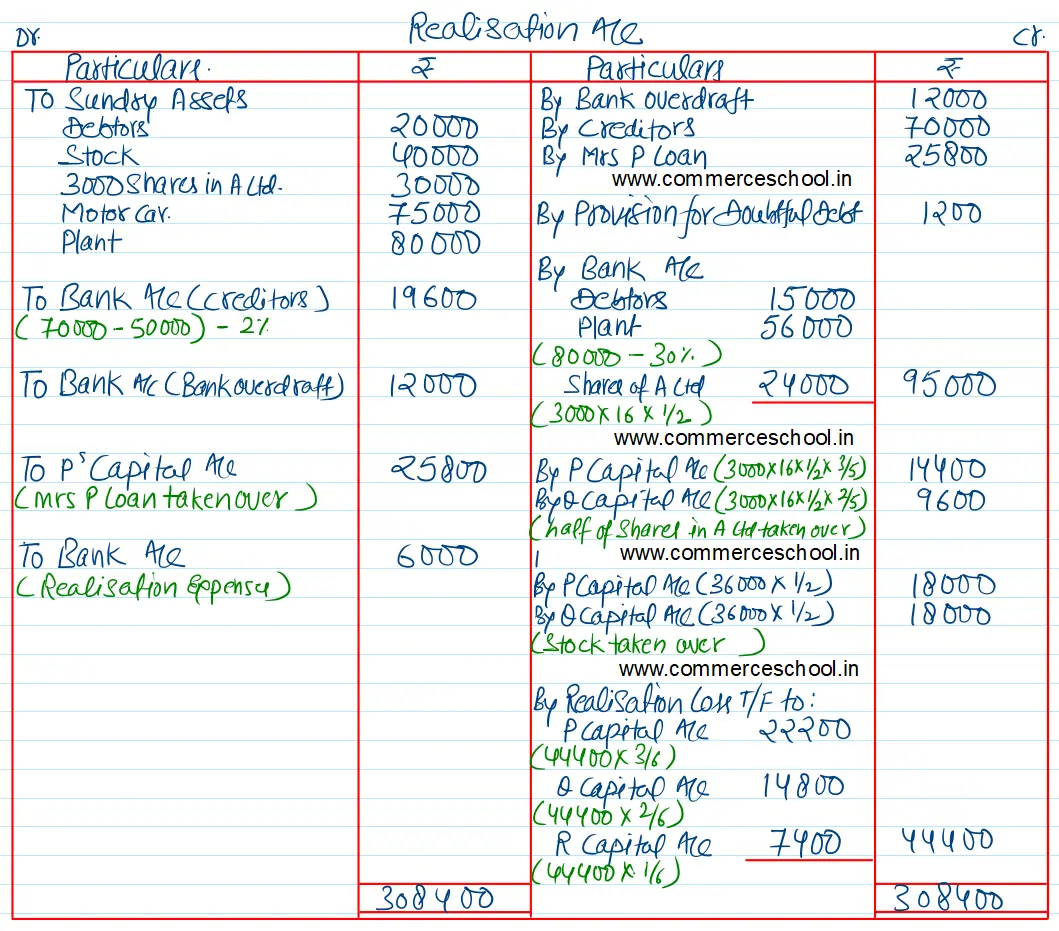

The firm was dissolved on that date and the following arrangements were made:

(i) Assets realised as follows: Debtors ₹ 15,000; Plant and 30% discount.

(ii) Stock was valued at ₹ 36,000 and this was taken over by P and Q equally.

(iii) Market value of the shares of A Ltd. is ₹ 16 per share. Half the shares were sold in the market and the balance half were taken over by P and Q in their profit sharing ratio.

(iv) A creditor for ₹ 50,000 took over Motor Car in full settlement of his claim and the balance of creditors were paid at a discount of 2%.

(v) Expenses of realisation amounted to ₹ 6,000. P agreed to discharge his wife’s Loan.

Prepare Journal entries and Ledger accounts.

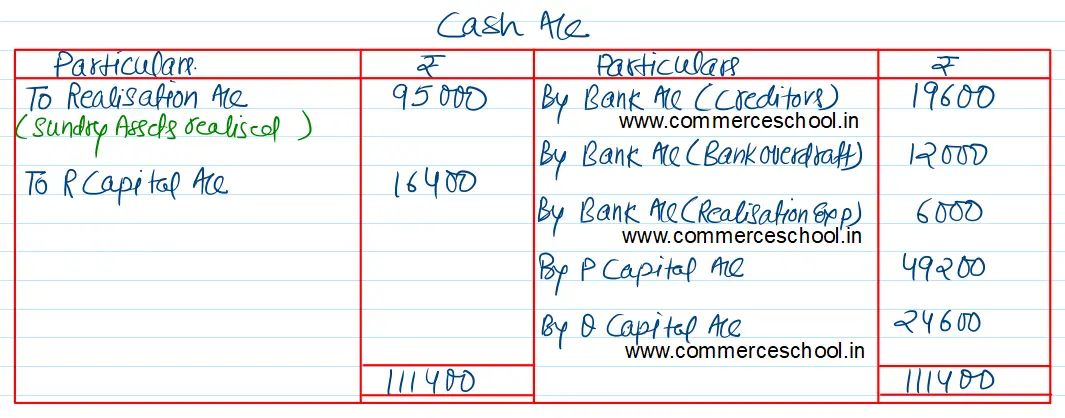

[Ans. Loss on Realisation ₹ 44,400. R brings in ₹ 16,400; Final Payment to P ₹ 49,200 and Q ₹ 24,600. Total of Bank A/c ₹ 1,11,400.]

| Liabilities | ₹ | Assets | ₹ |

| Bank Overdraft | 12,000 | Debtors 20,000 Less: Provision 1,200 | 18,800 |

| Creditors | 70,000 | Stock | 40,000 |

| Mrs. P’s Loan | 25,800 | 3,000 Shares in ‘A’ Ltd. | 30,000 |

| Capital Accounts: P Q R | 1,20,000 95,000 5,000 | Motor Car | 75,000 |

| Plant | 80,000 | ||

| Advertisement Suspense A/c | 84,000 | ||

| 3,27,800 | 3,27,800 |

Anurag Pathak Answered question