Following is the Balance Sheet of X Ltd as at 31st March, 2018:

| Particulars | 31st March, 2018 (₹) | 31st March, 2017 (₹) |

| I. EQUITY AND LIABILITIES | ||

|

Shareholder’s Funds (a) Share Capital (b) Reserves and Surplus |

19,00,000 6,00,000 |

17,00,000 3,00,000 |

|

Non-Current Liabilities Long-term Borrowings |

5,00,000 | 4,00,000 |

|

Current Liabilities (a) Short-term Borrowings (b) Short-term Provisions |

1,70,000 2,00,000 |

1,75,000 1,65,000 |

| Total | 33,70,000 | 27,40,000 |

| II. Assets | ||

|

Non-Current Assets (a) Property, Plant and Equipment and Intangible Assets: (i) Property, Plant and Equipment (ii) Intangible Assets (b) Non-Current Investments |

24,00,000 2,00,000 3,00,000 |

19,00,000 3,00,000 2,00,000 |

|

Current Assets (a) Current Investments (b) Inventories (c) Cash and Cash Equivalents |

1,40,000 2,60,000 70,000 |

1,70,000 1,30,000 40,000 |

| Total | 33,70,000 | 27,40,000 |

| Particulars | 31st March, 2018 (₹) | 31st March, 2017 (₹) |

|

Reserves and Surplus Surplus, i.e., Balance in Statement of Profit & Loss |

6,00,000 | 3,00,000 |

| 6,00,000 | 3,00,000 | |

|

Long-term Borrowings 12% Debentures |

5,00,000 | 4,00,000 |

| 5,00,000 | 4,00,000 | |

|

Short-term Borrowings Bank Overdraft |

1,70,000 | 1,75,000 |

| 1,70,000 | 1,75,000 | |

|

Short-term Provisions Provision for Tax |

2,00,000 | 1,65,000 |

| 2,00,000 | 1,65,000 | |

|

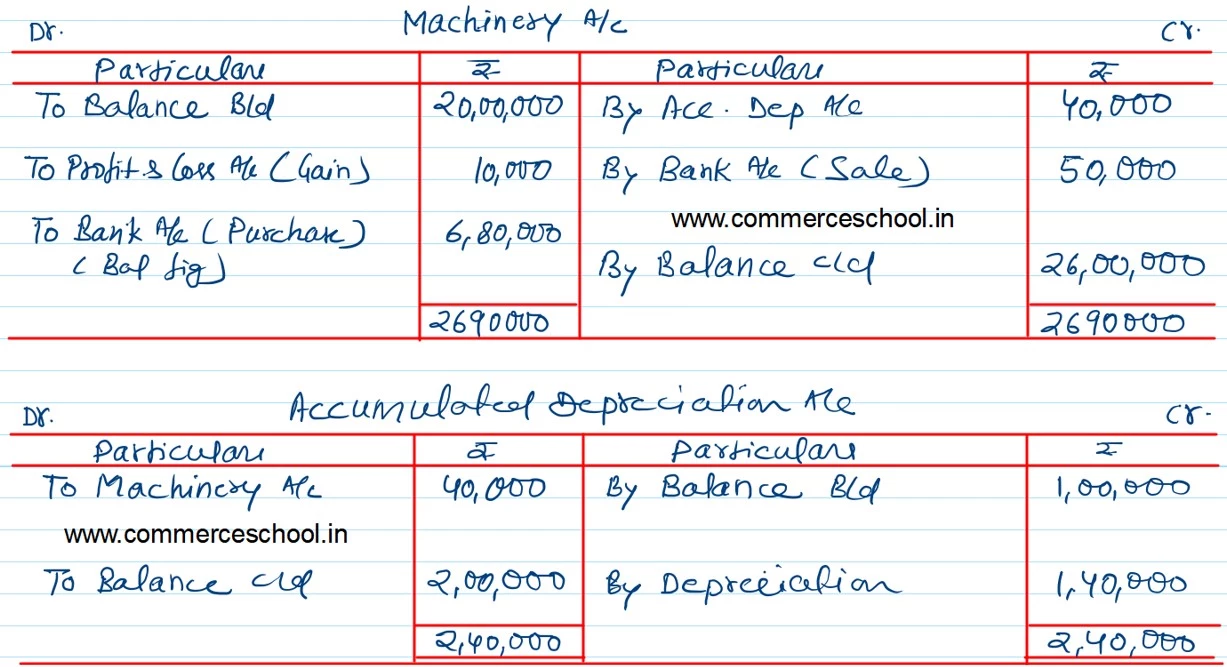

Property, Plant and Equipment Machinery Less: Accumulated Depreciation |

26,00,000 (2,00,000) |

20,00,000 (1,00,000) |

| 24,00,000 | 19,00,000 | |

| Intangible Assets Goodwill | 2,00,000 | 3,00,000 |

| 2,00,000 | 3,00,000 |