From the following Balance Sheet of Pioneer Construction Ltd. as at 31st March, 2023, prepare Cash Flow Statement

From the following Balance Sheet of Pioneer Construction Ltd. as at 31st March, 2023, prepare Cash Flow Statement:

Balance Sheet of PIONEER CONSTRUCTION LTD. as at 31st March, 2023

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

| I. EQUITY AND LIABILITIES | ||

|

Shareholders Funds (a) Share Capital (b) Reserves and Surplus |

3,50,000 1,75,000 |

2,50,000 1,00,000 |

|

Non-Current Liabilities Long-term Borrowings – Bank Loan |

25,000 | 50,000 |

|

Non-Current Liabilities Long-term Borrowings – Bank Loan |

26,000 25,000 |

27,500 15,000 |

| Total | 6,01,000 | 4,42,500 |

| II. Assets | ||

|

Non-Current Assets (a) Property, Plant and Equipment and Intangible Assets: (i) Property, Plant and Equipment – Equipment (ii) Intangible Assets – Patents (b) Non-Current Investments |

2,50,000 47,500 50,000 |

2,50,000 50,000 2,500 |

|

Current Assets (a) Inventories – Stock (b) Trade Receivables – Debtors (c) Cash and Bank Balances (Cash at Bank) |

65,000 60,000 1,28,500 |

25,000 40,000 75,000 |

| Total | 6,01,000 | 4,42,500 |

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

|

Reserves and Surplus Surplus, i.e., Balance in Statement of Profit & Loss |

1,75,000 | 1,00,000 |

|

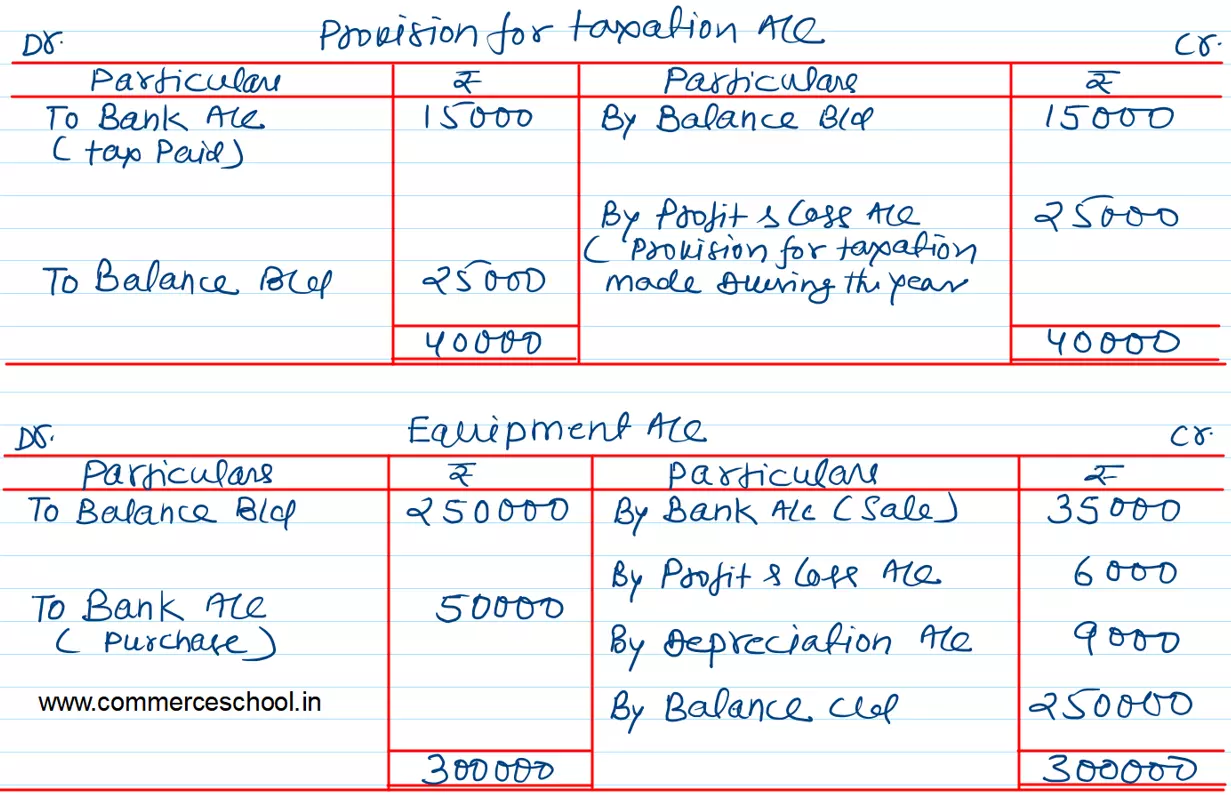

Short-term Provisions Provision for Tax |

25,000 | 15,000 |

Notes: Proposed Dividend for the years ended 31st March, 2022 and 2023 are ₹ 35,000 and ₹ 25,000 respectively.

Additional Information:

- During the year, equipment costing ₹ 50,000 was purchased. Loss on sale of equipment amounted to ₹ 6,000, ₹ 9,000 depreciation was charged on equipment.

- Tax paid during the year was ₹ 15,000.

- An Interim Dividend of ₹ 20,000 was paid during the year.