From the following extract of Balance Sheet of Cloud 9 Ltd, Calculate Cash Flow from Financing Activities:

From the following extract of Balance Sheet of Cloud 9 Ltd, Calculate Cash Flow from Financing Activities:

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

| I. EQUITY AND LIABILITIES | ||

|

1. Shareholder’s Funds (a) Share Capital (b) Reserves and Surplus |

10,00,000 2,30,000 |

10,00,000 2,00,000 |

|

2. Non-Current Liabilities Long-term Borrowings (12% Debenture) |

6,00,000 | 4,00,000 |

Notes to Accounts:

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

|

1. Share Capital Equity Share Capital 10% Preference Share Capital |

8,00,000 2,00,000 |

6,00,000 4,00,000 |

| Total | 10,00,000 | 10,00,000 |

|

2. Reserves and Surplus (a) Securities Premium Reserve – Received Less: Share issue Expenses Written off |

30,000 5,000 |

– – |

| 25,000 | – | |

|

(b) Surplus, i.e., Balance in Statement of Profit & Loss: Opening Balance Add: Net Profit (as per Statement of Profit & Loss) |

2,00,000 1,35,000 |

1,50,000 50,000 |

| Less: Dividend Payable |

3,35,000 1,30,000 |

2,00,000 – |

| 2,05,000 | 2,00,000 | |

| Total (a + b) | 2,30,000 | 2,00,000 |

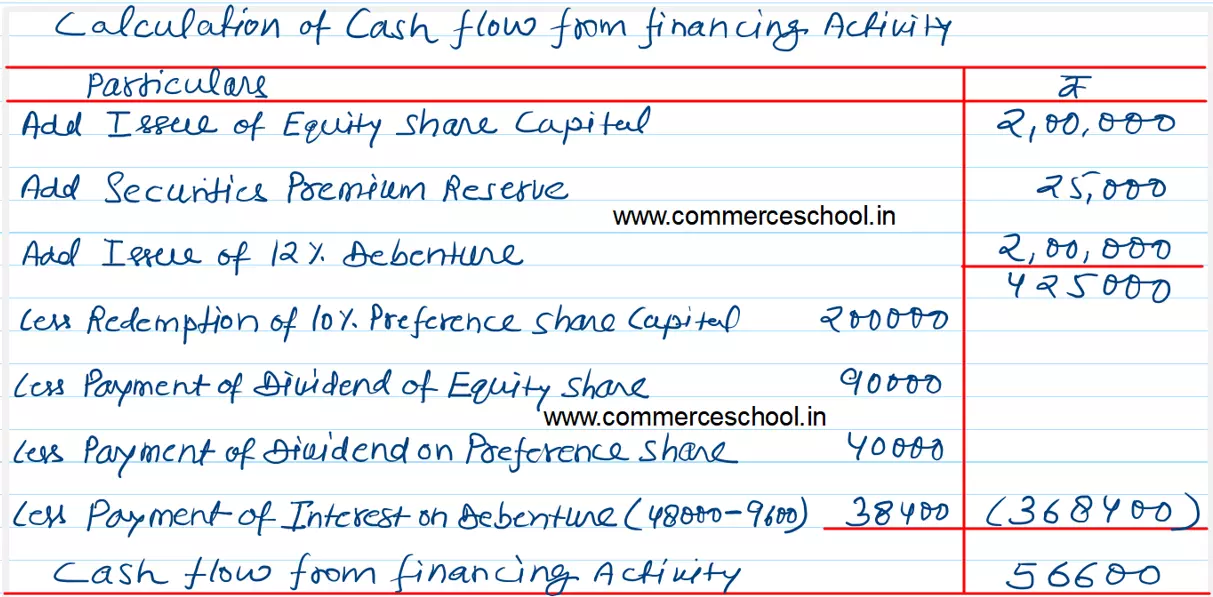

Additional information:

- Dividend @ 15% on Equity Shares and @ 10% on Preference Shares was declared by the Shareholders on 15th September 2022.

- Preference Shares were redeemed at par on 31st March, 2023.

- Debentures were issued on 31st March 2023.

- Equity Shares were issued on 31st March, 2023 at a premium of 15%.

- Interest on 12% Debentures still payable is ₹ 9,600.

Anurag Pathak Changed status to publish