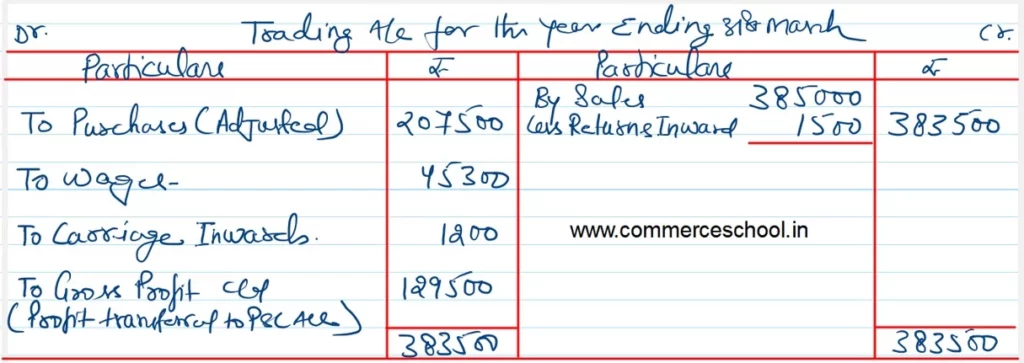

From the following Trial Balance of Shubham, prepare final accounts for the year ended 31st March, 2023 and Balance Sheet as at that date:

From the following Trial Balance of Shubham, prepare final accounts for the year ended 31st March, 2023 and Balance Sheet as at that date:

| Particulars | Dr. | Cr. |

|

Land and Building Purchases (Adjusted) Closing Stock Returns Inward Wages Salaries Office Expenses Carriage Inwards Carriage Outwards Discount Allowed Discount Received Bad Debts Sales Capital Account Subhash’s Loan A/c (taken on 1st Oct, 2022 @ 18% p.a) Insurance Commission Plant and Machinery Furniture and Fixtures Bills Receivable Sundry Debtors Sundry Creditors Cash at bank Office Equipments Bills Payable Expenses Payable |

50,000 2,07,500 45,000 1,500 45,300 39,000 15,400 1,200 2,000 750 – 1,200 – – – 1,500 – 50,000 20,000 20,000 40,000 – 16,000 12,000 – – |

– – – – – – – – – – 1,200 – 3,85,000 1,15,000 25,000 – 1,500 – – – – 25,000 – – 12,350 3,300 |

| Total | 5,68,350 | 5,68,350 |

Note:- Returns Inward is ₹ 45,300

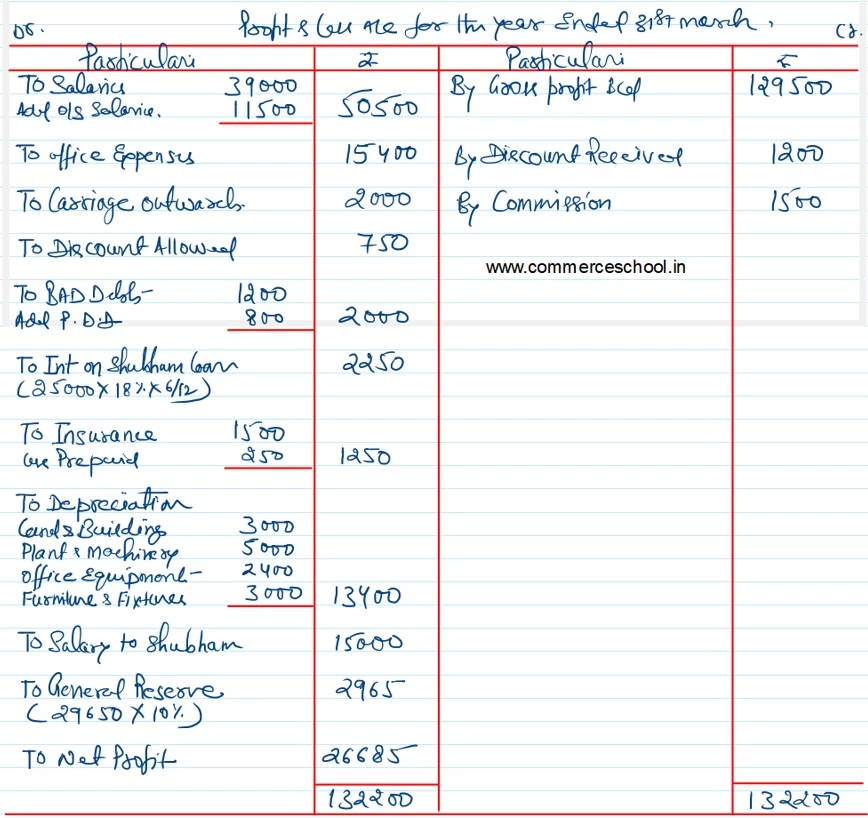

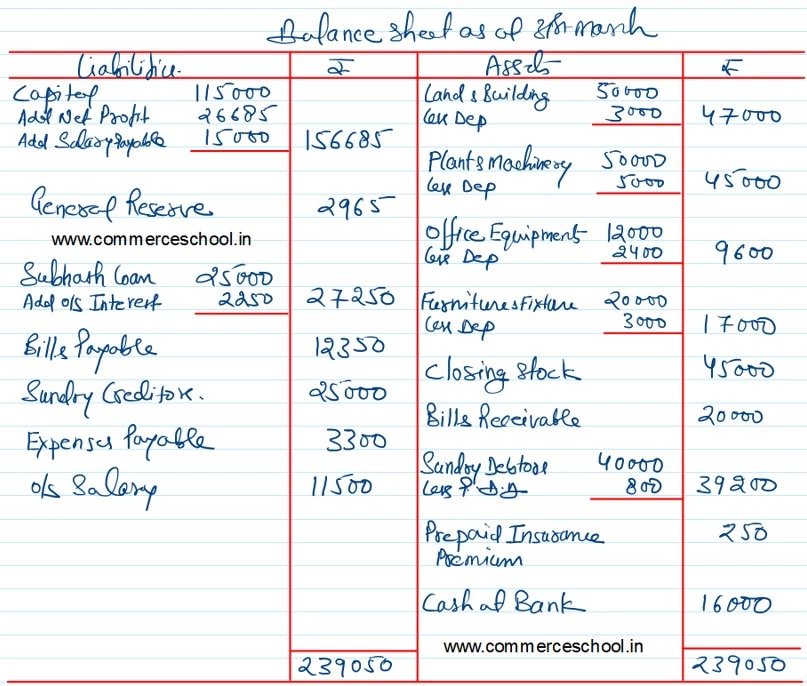

The following adjustments be taken care of:

(i) Depreciate: Land and Building @ 6%, Plant and Machinery @ 10%, Office equipments @ 20% and Furniture and Fixtures @ 15%.

(ii) Create Provision for Doubtful Debts at 2% on Sundry Debtors.

(iii) Insurance premium includes ₹ 250 paid in advance.

(iv) Provide salary to Shubham ₹ 15,000 p.a.

(v) Outstanding Salaries ₹ 11,500.

(vi) 10% of the net profit is to be transferred to General Reserve.