Harish and Gopal were partners in a firm sharing profits in the ratio of 3 : 2. On 31st March, 2024, their Balance Sheet was as follows:

Harish and Gopal were partners in a firm sharing profits in the ratio of 3 : 2. On 31st March, 2024, their Balance Sheet was as follows:

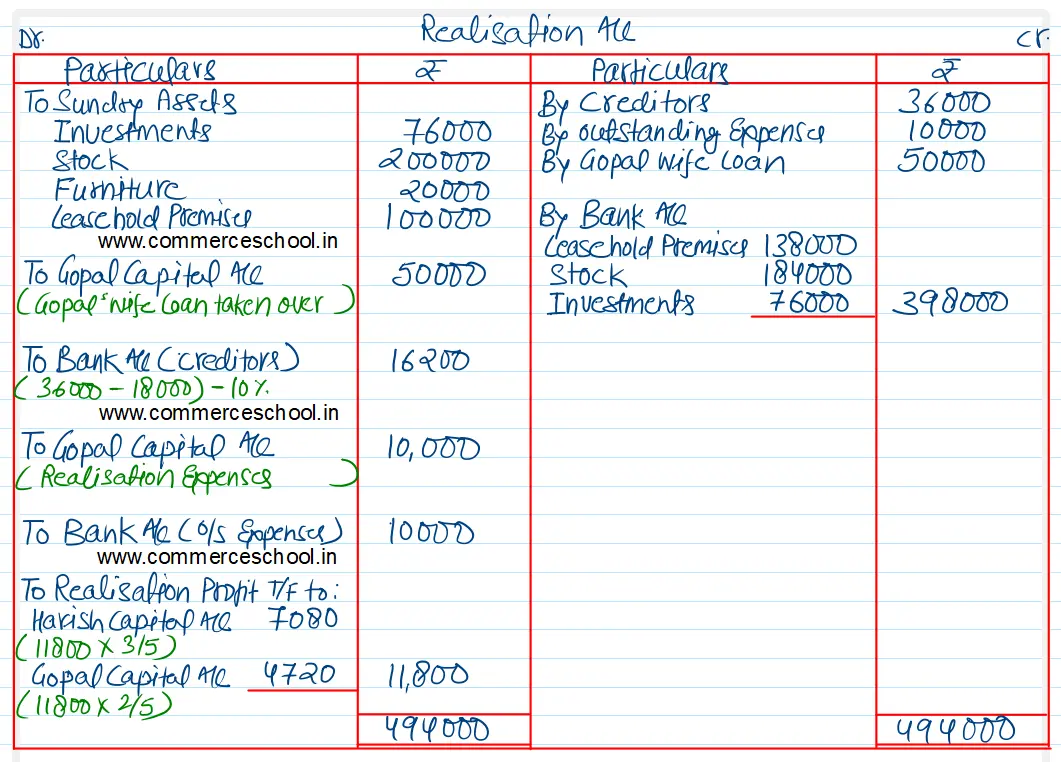

On the above date the firm was dissolved. Various assets were realized and liabilities were settled as under:

(I) Gopal agreed to pay his wife’s loan.

(ii) Leasehold premises realised ₹ 1,38,000.

(iii) Half of the creditors agreed to accept furniture of the firm as full settlement of their claim and remaining half agreed to accept 10% less.

(iv) 50% stock was taken over by Harish on payment by cheque of ₹ 90,000 and remaining stock was sold for ₹ 94,000.

(v) Realization expenses of ₹ 10,000 were paid by Gopal on behalf of the firm.

Prepare Realization Account.

[Ans. Gain on Realisation ₹ 11,800.]

Balance Sheet of Harish and Gopal as at March, 31, 2024

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 36,000 | Cash | 47,000 |

| Outstanding Expenses | 10,000 | Bank | 93,000 |

| Gopal’s Wife’s Loan | 50,000 | Investments | 76,000 |

| Capitals Harish Gopal | 2,80,000 1,60,000 | Stock | 2,00,000 |

| Furniture | 20,000 | ||

| Leasehold Premises | 1,00,000 | ||

| 5,36,000 | 5,36,000 |

Anurag Pathak Answered question