Kamal, Lalit, and Neha were partners sharing profits and losses in the ratio of 3 : 3 : 2. Balances in their capital accounts as on 1st April 2022 stood at ₹ 8,00,000, ₹ 7,00,000 and ₹ 2,00,000 (Dr.) respectively

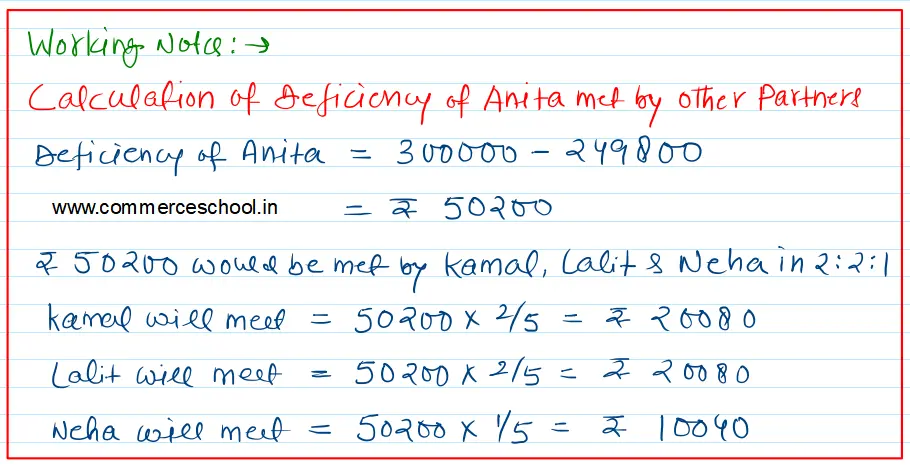

Kamal, Lalit, and Neha were partners sharing profits and losses in the ratio of 3 : 3 : 2. Balances in their capital accounts as on 1st April 2022 stood at ₹ 8,00,000, ₹ 7,00,000 and ₹ 2,00,000 (Dr.) respectively. Anita was admitted as a partner on that date with a capital of ₹ 4,00,000 for 1/5th share of profits with a minimum guaranteed share of profit of ₹ 3,00,000. It was decided that Kamal, Lalit, and Neha will bear an excess of 1/5th share going to Anita in the ratio of 2 : 2 : 1.

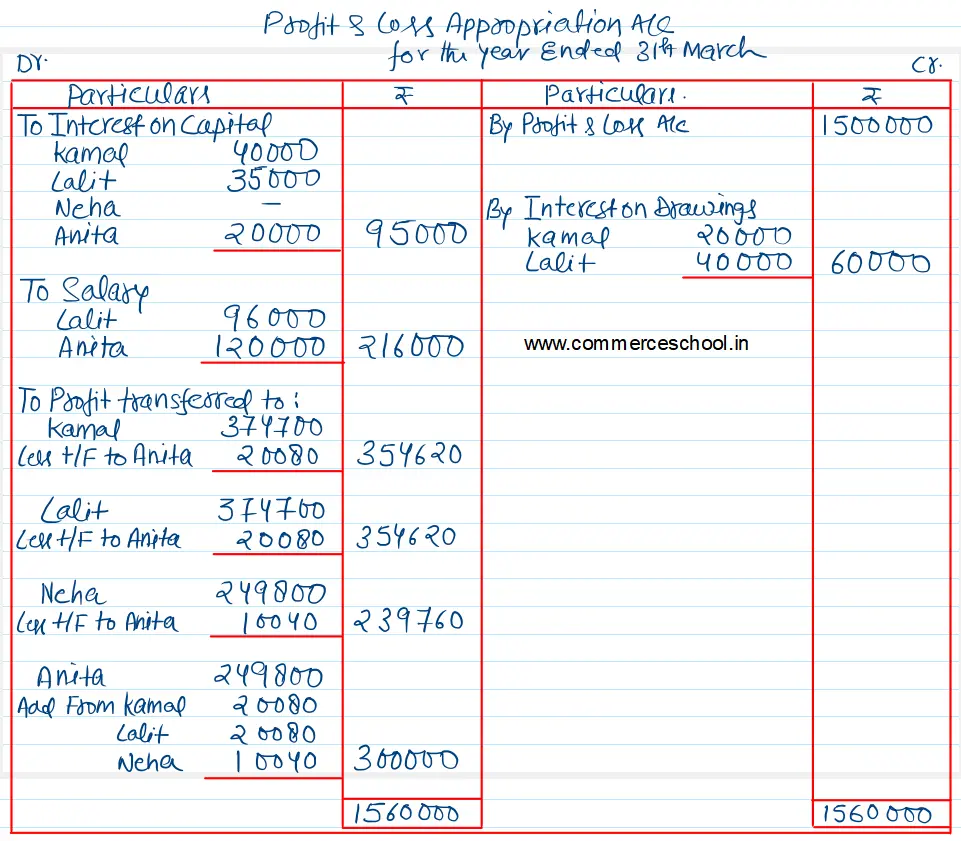

Profit-sharing ratio after Anita’s admission will be 3 : 3 : 2 : 2. Profit for the year ended 31st March 2023 was ₹ 15,00,000 before the following adjustment arising due to the Partnership Deed:

(i) Interest on capital is to be allowed @ 5% p.a.

(ii) Interest on Drawings were Kamal – ₹ 20,000; and Lalit – ₹ 40,000; and

(iii) Salary to Lalit – ₹ 96,000; and Anita – ₹ 1,20,00.

You are required to:

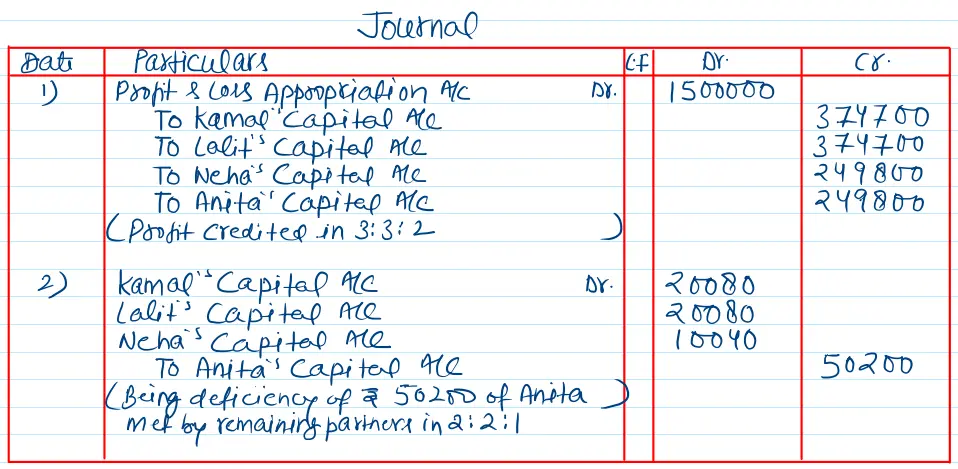

(a) Pass the Journal entry for distribution of divisible profit; and

(b) Prepare Profit and Loss Appropriation Account.