Kashish and Harish are partners in a firm sharing profits in the ratio of 3 : 2 with capitals of ₹ 5,00,000 each. Kashish was given loan of ₹ 2,00,000 on 1st October

Kashish and Harish are partners in a firm sharing profits in the ratio of 3 : 2 with capitals of ₹ 5,00,000 each. Kashish was given loan of ₹ 2,00,000 on 1st October, 2023.

Pass the Journal entries for loan and Interest on Loan to Kashish in the following cases:

(i) If the Partnership Deed does not provide for charging interest on Loan to partners.

(ii) If the Partnership Deed does not provide for charging interest on Loan to Partner but it is agreed to be charged @ 10% p.a.

(iii) If the Partnership Deed provides for charging interest on Loan to Partner @ 5% p.a.

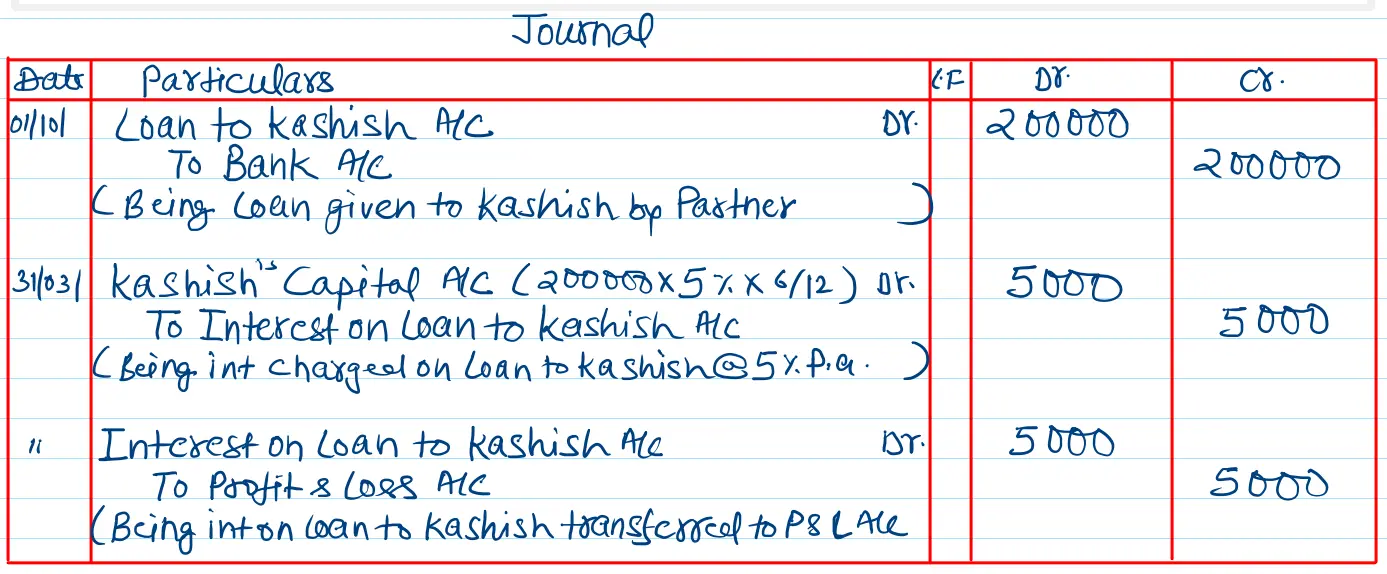

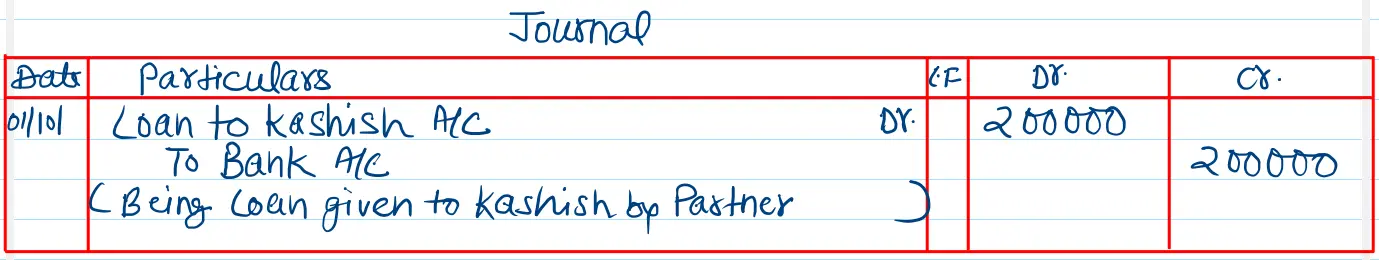

Solution:-

Case – I

Note:- Interest is not charged on the Interest on Loan to partners if it is not mentioned in the partnership deed and not agreed upon among partners.

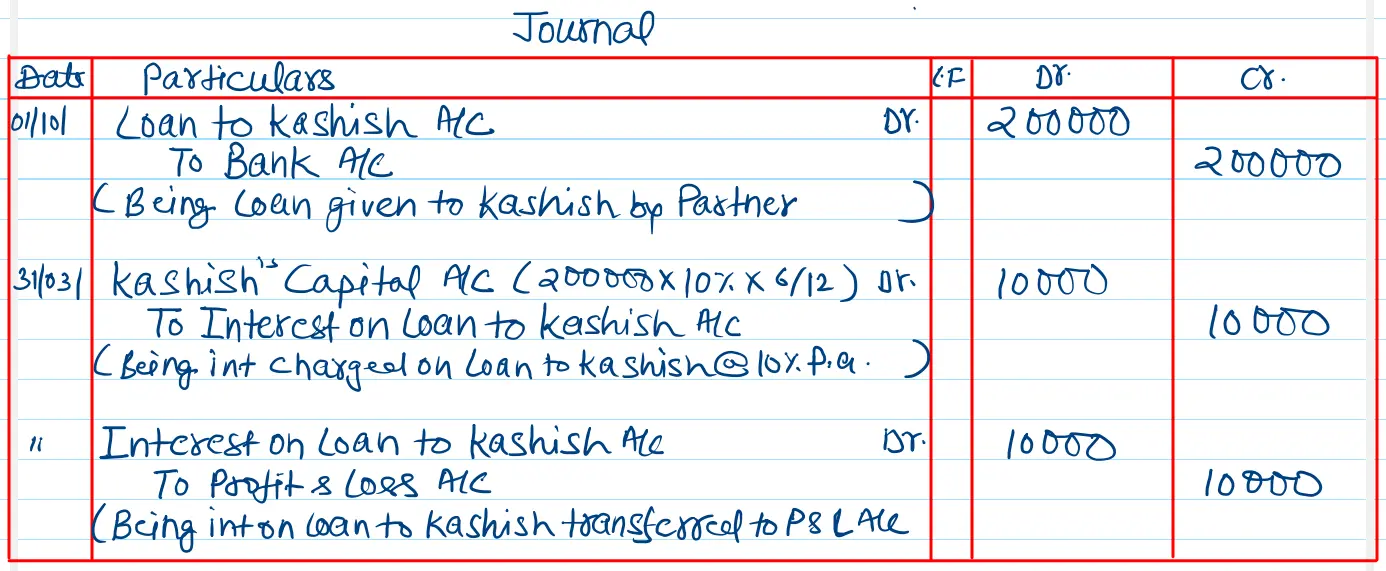

Case – II

Note:- If the rate of Interest on Loan to partners is agreed upon among the partners. It is provided.

Case – III