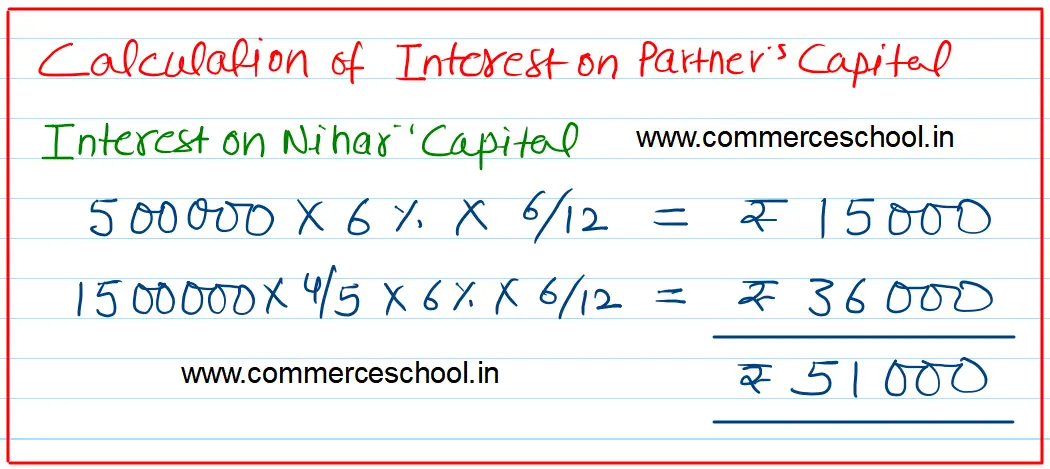

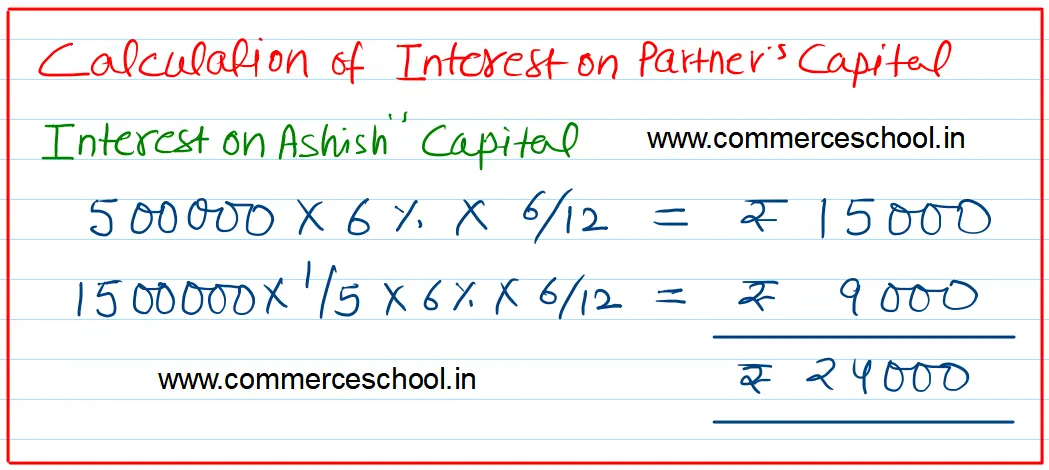

Nihar and Ashish started business on 1st April, 2023 with fixed capitals of ₹ 5,00,000 each. On 1st October, 2023, they decided that total fixed capital of the firm ₹ 15,00,000 should be in their profit sharing ratio of 4 : 1

Nihar and Ashish started business on 1st April, 2023 with fixed capitals of ₹ 5,00,000 each. On 1st October, 2023, they decided that total fixed capital of the firm ₹ 15,00,000 should be in their profit sharing ratio of 4 : 1. Accordingly additional capital was introduced or withdrawn. Their Partnership Deed provided as follows:

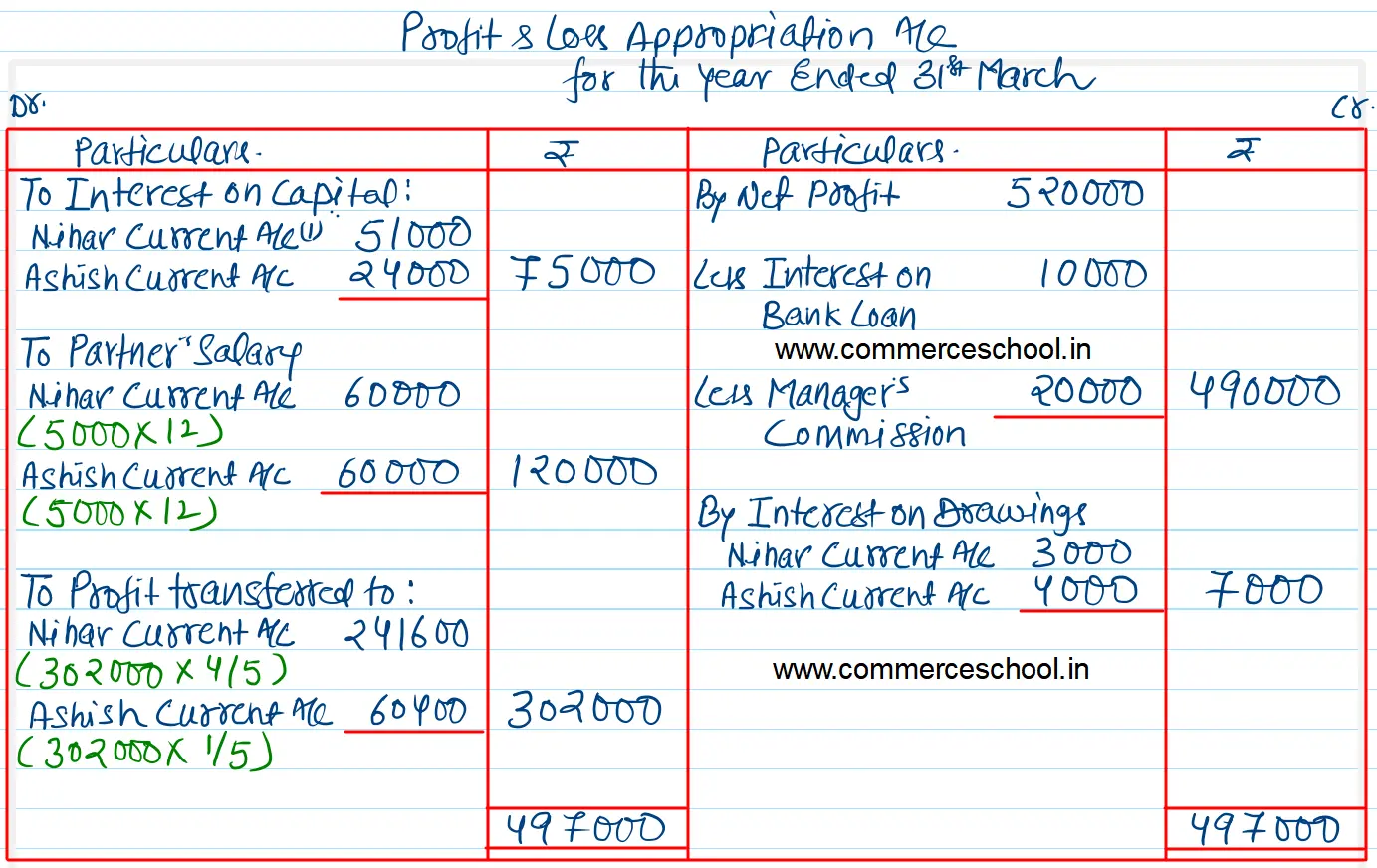

(a) Interest on Capital to be allowed @ 6% per annum.

(b) Salary of ₹ 5,000 per month each is to be allowed.

(c) Interest on Drawings is to be charged @ 10% per annum.

Nihar and Ashish had withdrawn ₹ 60,000 and ₹ 80,000 respectively from time to time during the year. Interest @ 10% per annum was calculated as for Nihar – ₹ 3,000 and Ashish – ₹ 4,000.

Manager was to get ₹ 20,000 as Commission. Interest on Bank Loan was ₹ 10,000.

Profit for the year ended 31st March, 2024 before accounting the above was ₹ 5,20,000.

You are required to:

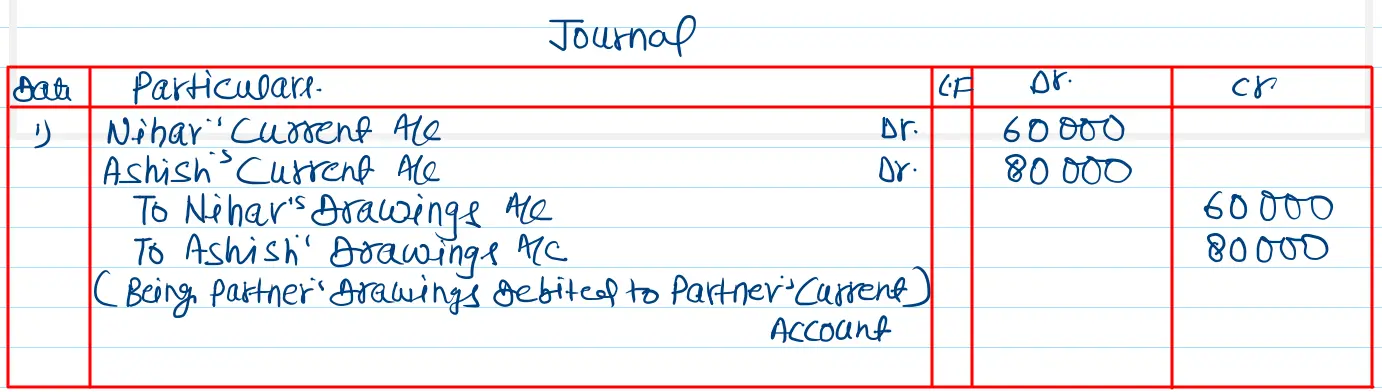

(i) give the Journal entry to close Drawing Accounts of the partners.

(ii) Prepare Profit & Loss Appropriation Account for the year ended 31st March, 2024.