L a partner, was appointed to look after the dissolution process for which he was given a remuneration of ₹ 10,000

Pass necessary Journal Entries on the dissolution of a partnership firm in the following cases:

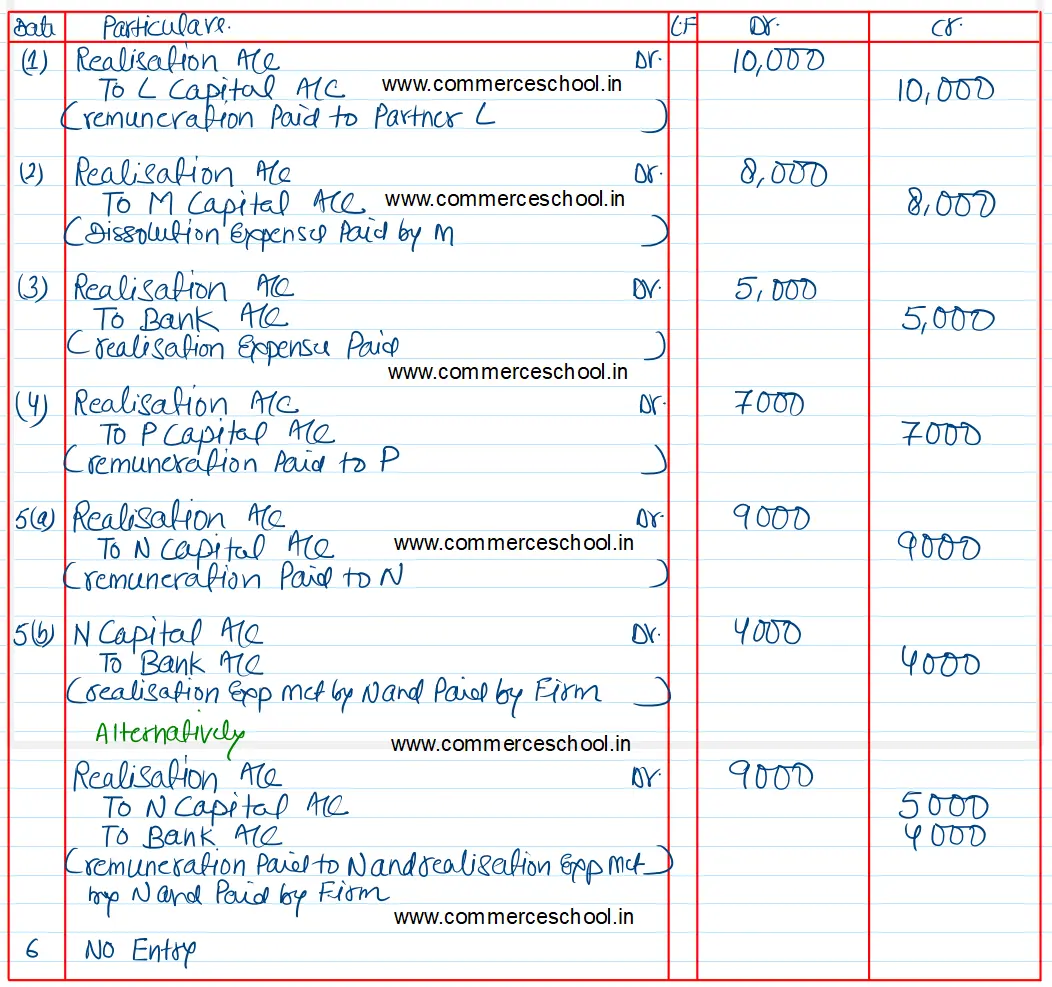

(i) L, a partner, was appointed to look after the dissolution process for which he was given a remuneration of ₹ 10,000.

(ii) Dissolution expenses ₹ 8,000 were paid by the partner, M.

(iii) Dissolution expenses were ₹ 5,000.

(iv) P, a partner, was appointed to look after the process of dissolution for which he was allowed a remuneration of ₹ 7,000. P agreed to bear the dissolution expenses. Actual dissolution expenses ₹ 4,000 were paid by P.

(v) N, a partner, was appointed to look after the process of dissolution for which he was allowed a remuneration of ₹ 9,000. N agreed to bear the dissolution expenses. Actual dissolution expenses ₹ 4,000 were paid by the firm.

(vi) Q a partner was appointed to look after the process of dissolution for which he was allowed a remuneration of ₹ 18,000. Q agreed to take over stock worth ₹ 18,000 as his remuneration. The stock had already been transferred to Realisation Account.