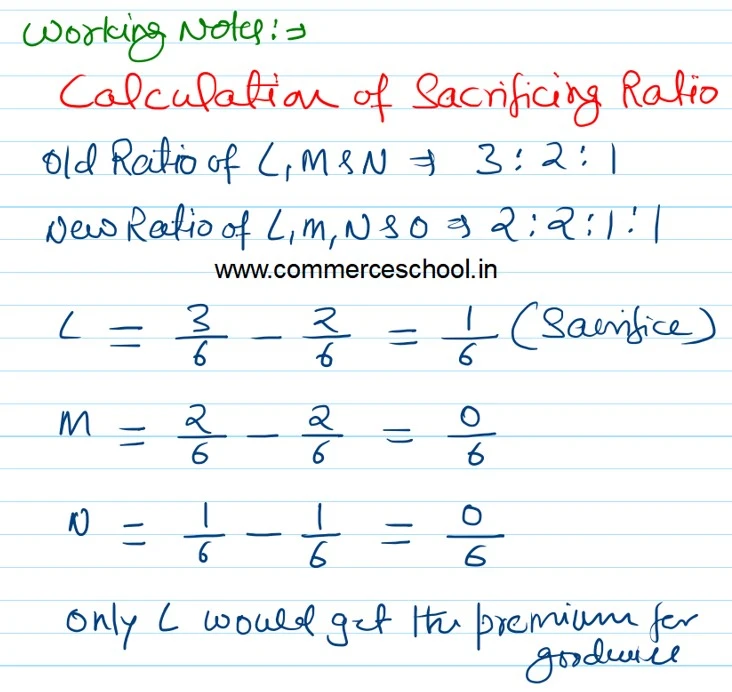

L, M and N were partners in a firm sharing profits in the ratio of 3 : 2 : 1. Their Balance Sheet on 31st March, 2015 was as follows:

L, M and N were partners in a firm sharing profits in the ratio of 3 : 2 : 1. Their Balance Sheet on 31st March, 2015 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors

General Reserve Capital A/cs: L M N |

1,68,000 42,000

1,20,000 80,000 40,000 |

Bank

Debtors Stock Investments Furniture Machinery |

34,000 46,000 2,20,000 60,000 20,000 70,000 |

| 4,50,000 | 4,50,000 |

On the above date, O was admitted as a new partner and it was decided that:

i) The new profit sharing ratio between L, M, N and O will be 2 : 2 : 1 : 1.

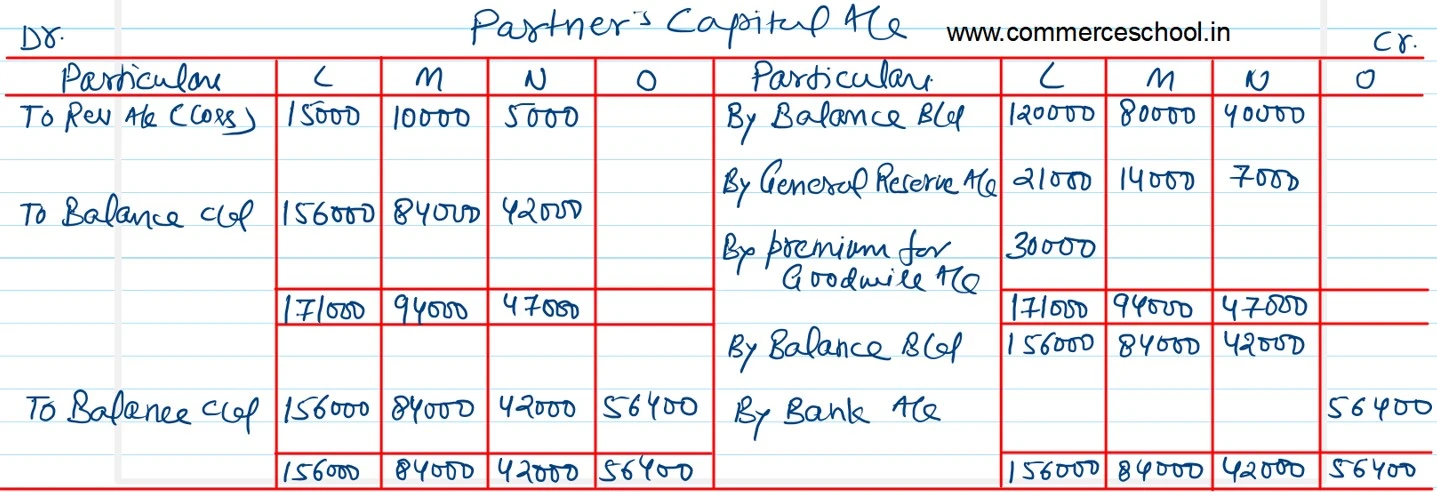

ii) Goodwill of the firm was valued at ₹ 1,80,000 and O brought his share of goodwill premium in cash.

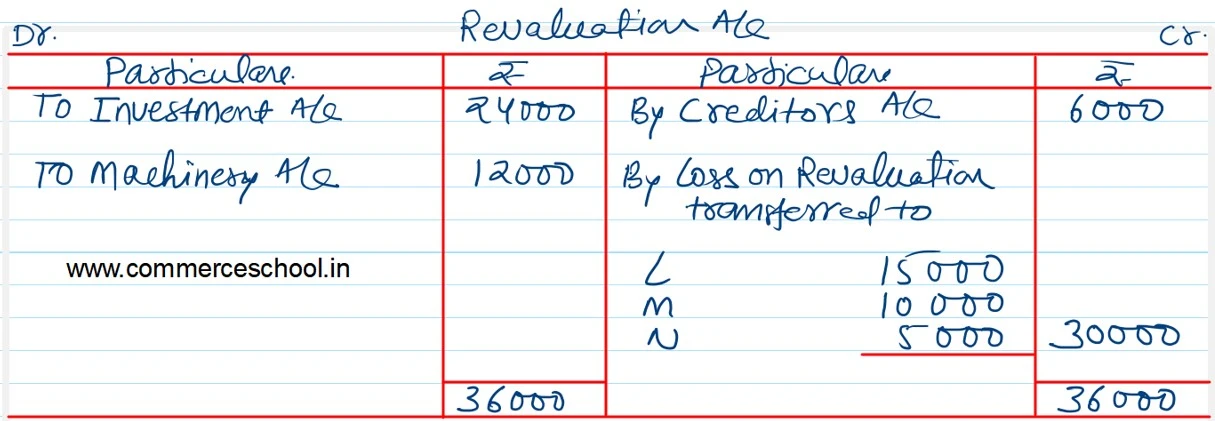

iii) The market value of Investments was ₹ 36,000.

iv) Machinery will be reduced to ₹ 58,000.

v) A creditor of ₹ 6,000 was not likely to claim the amount and hence was to be written off.

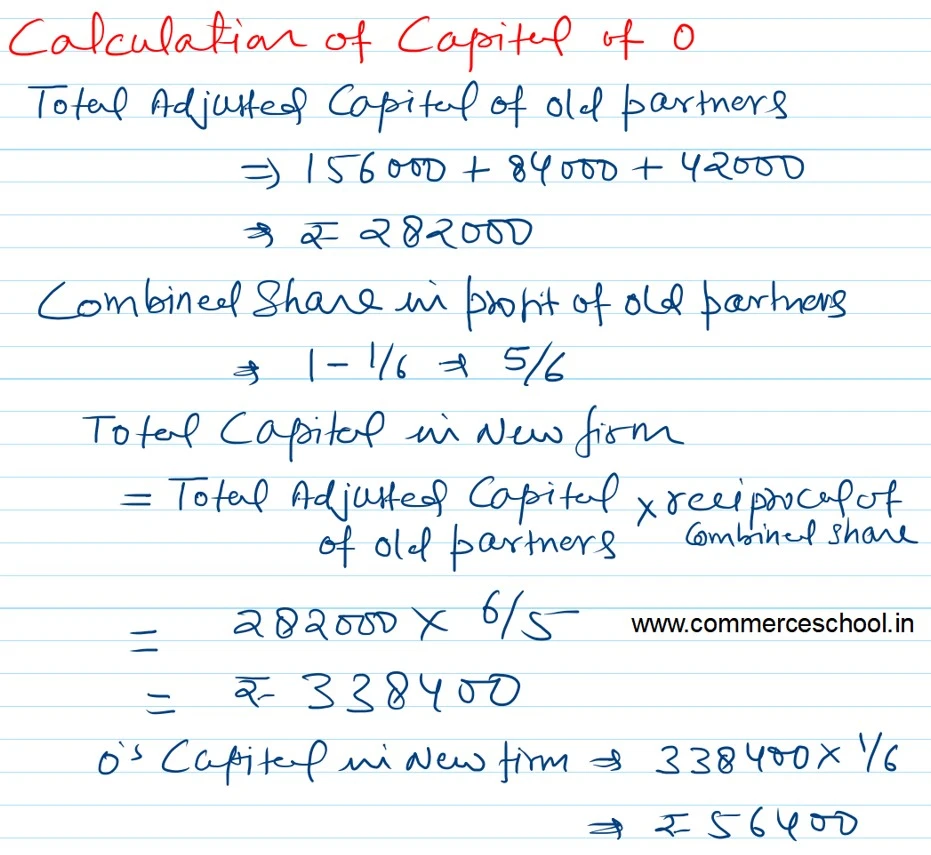

vi) O will bring proportionate capital so as to give him 1/6th share in the profits of the firm.

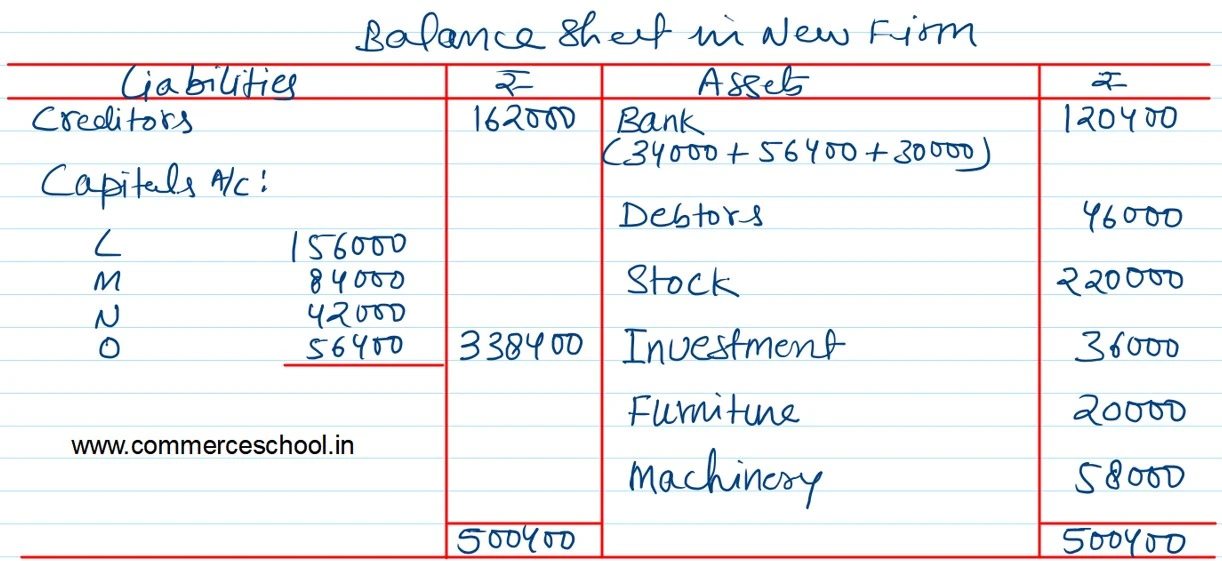

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the new firm.

[Ans: Loss on Revaluation – ₹ 30,000; Capital A/cs: L – ₹ 1,56,000; M – ₹ 84,000; N – ₹ 42,000 and O – ₹ 56,400; Balance Sheet Total – ₹ 5,00,400.]