Lisa, Monika and Nisha were partners in a firm sharing profits & Losses in the ratio of 5 : 3 : 2. On 31st March 2023, their Balance Sheet was as follows:

Lisa, Monika and Nisha were partners in a firm sharing profits & Losses in the ratio of 5 : 3 : 2. On 31st March 2023, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors

Employee’s Provident Fund Capital A/cs: Lisa Monika Nisha |

50,000 10,000 1,07,500 1,02,500 60,000 |

Cash at Bank

Sundry Debtors Stock Fixed Assets Goodwill |

40,000 1,00,000 80,000 60,000 50,000 |

| 3,30,000 | 3,30,000 |

Lisa retired on 1st April 2023 on the following terms:

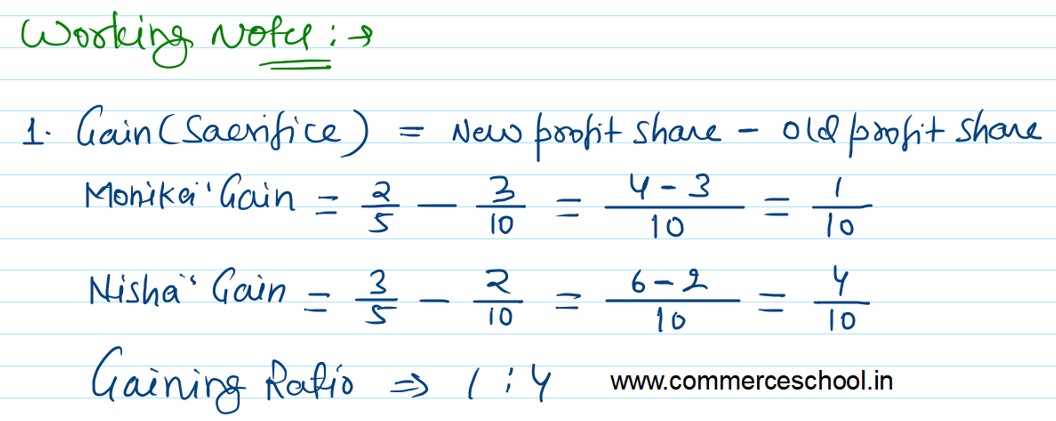

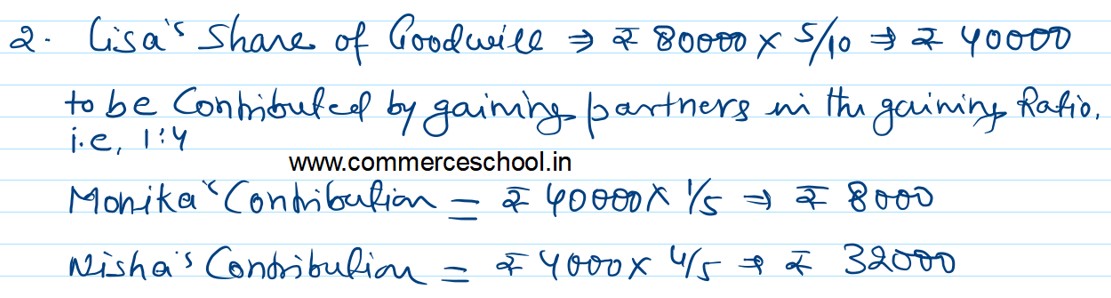

i) Goodwill of the firm is to be valued at ₹ 80,000 and Lisa’s share of the same be adjusted to that of Monika and Nisha who are going to share the future profits in the ratio of 2 : 3.

ii) Fixed Assets are to be decreased to ₹ 57,500.

iii) Make Provision for Doubtful Debts at 5% on Debtors

iv) A claim included in creditors for ₹ 10,000 is settled at ₹ 8,000.

v) The amount to be paid to Lisa by Monika and Nisha in such a way that their capitals are proportionate to their profit sharing ratio and leave a balance of ₹ 15,000 in the Bank Account.

You are required to prepare:

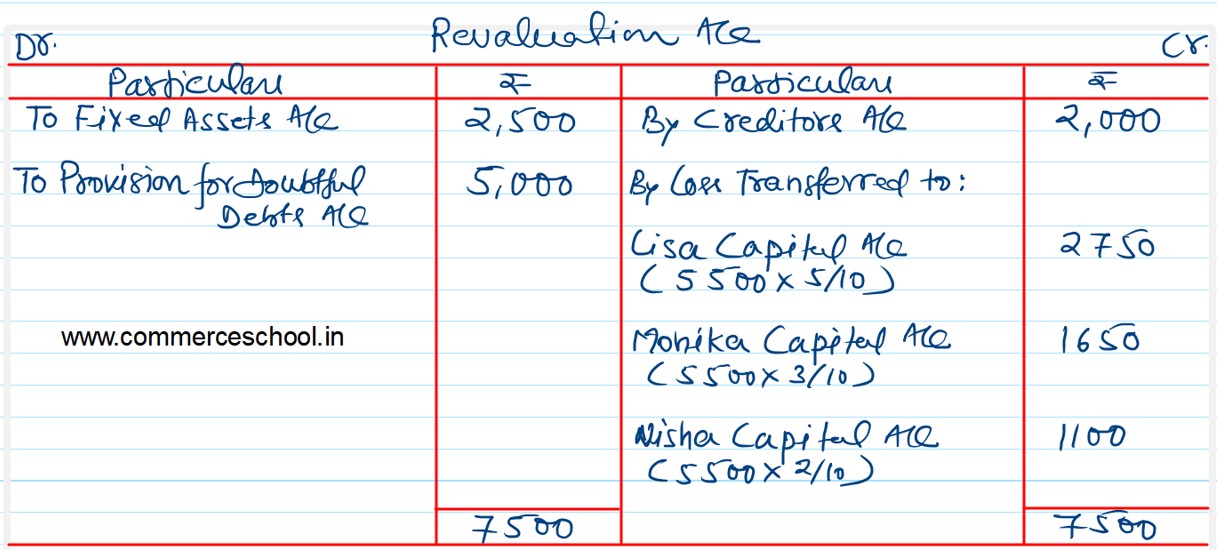

a) Revaluation Account; and

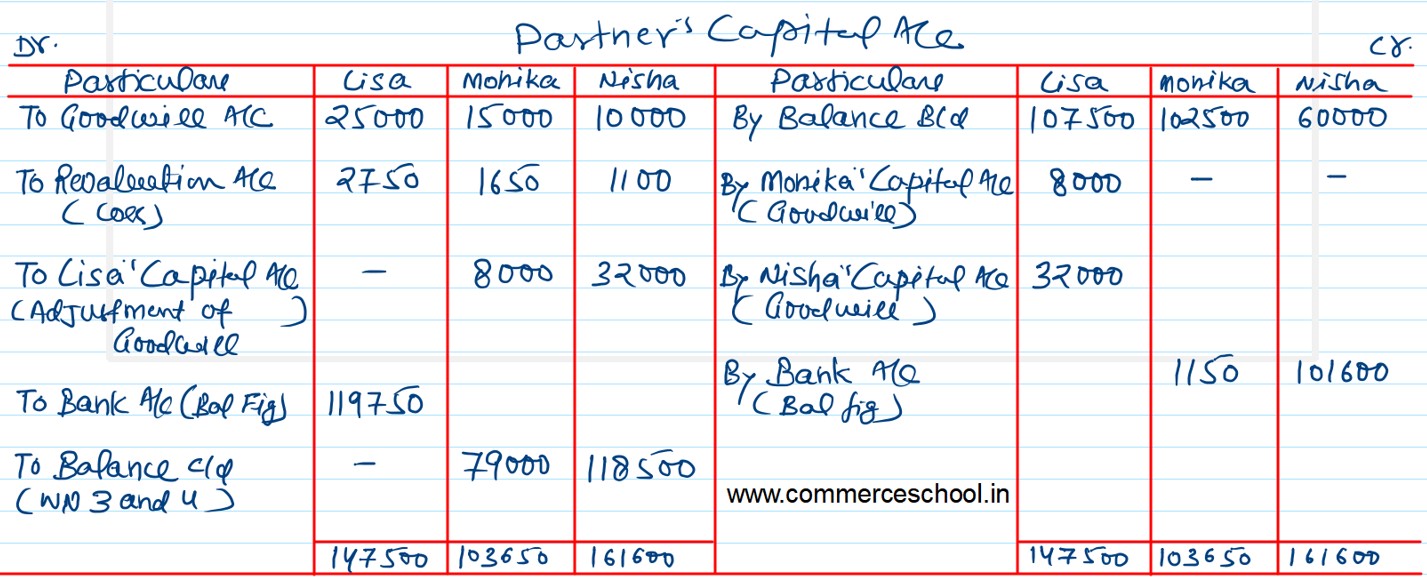

b) Partner’s Capital Accounts