N, S and B were partners in a firm sharing profits and losses in proportion of 1/2, 1/6 and 1/3 respectively. The Balance Sheet of the firm as at 31st March, 2017 was as follows:

N, S and B were partners in a firm sharing profits and losses in proportion of 1/2, 1/6 and 1/3 respectively. The Balance Sheet of the firm as at 31st March, 2017 was as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Capitals:

N S B Bills Payable General Reserve Sundry Creditors |

30,000

30,000 28,000 12,000 12,000 18,000 |

Freehold Premises

Machinery Furniture Stock Sundry Debtors Cash |

20,000

|

40,000

30,000 12,000 22,000 19,000 7,000 |

| 1,30,000 | 1,30,000 |

B retired from the business on the above date and the partners agreed to the following:

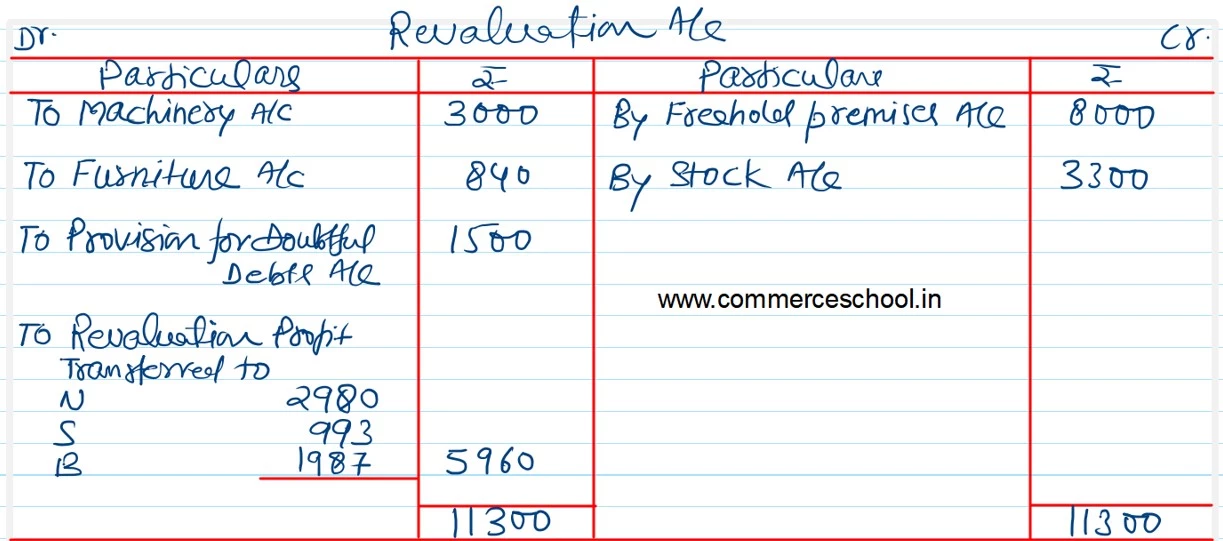

i) Freehold premises and stock were to be appreciated by 20% and 15% respectively.

ii) Machinery and furniture were to be depreciated by 10% and 7% respectively.

iii) Provision for bad debts was to be increased by ₹ 1,500.

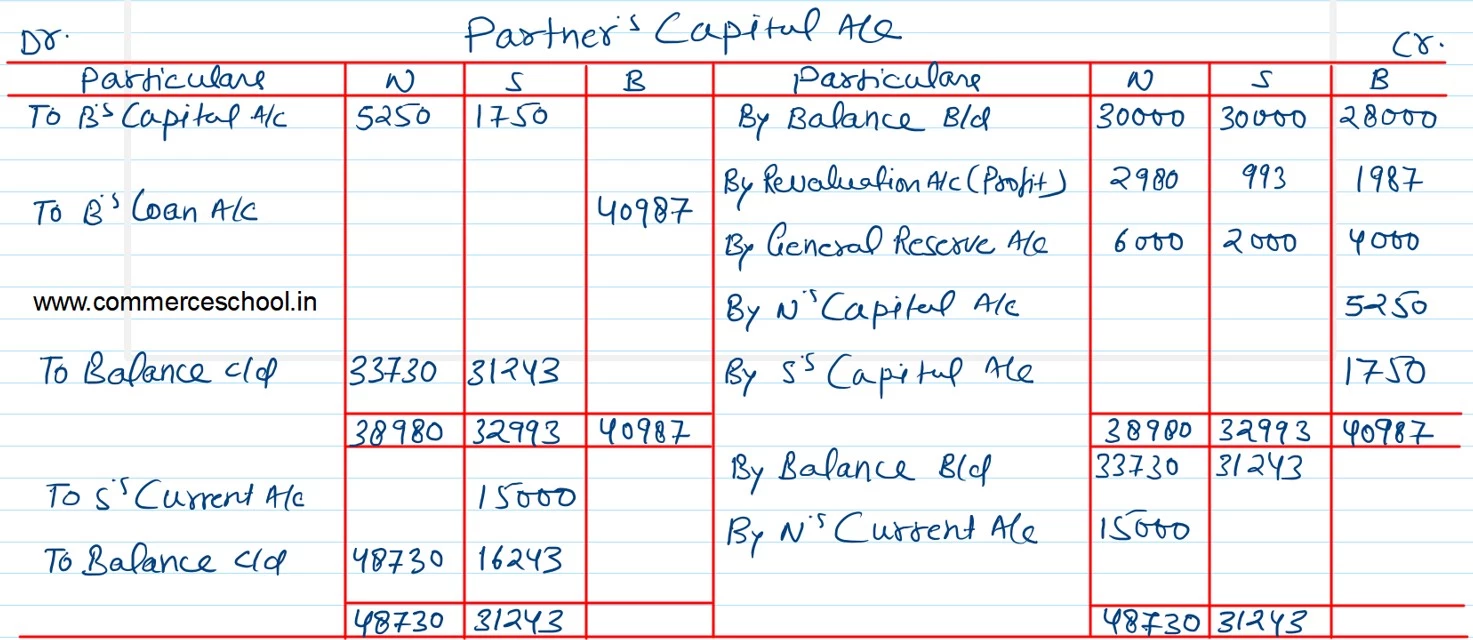

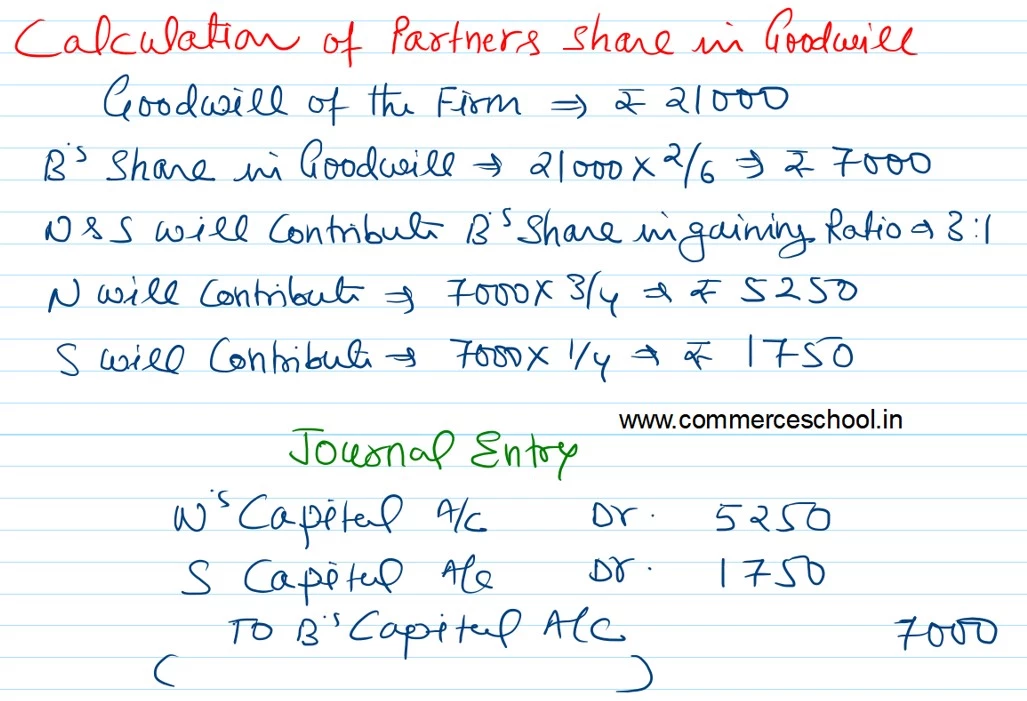

iv) On B’s retirement goodwill of the firm was valued at ₹ 21,000.

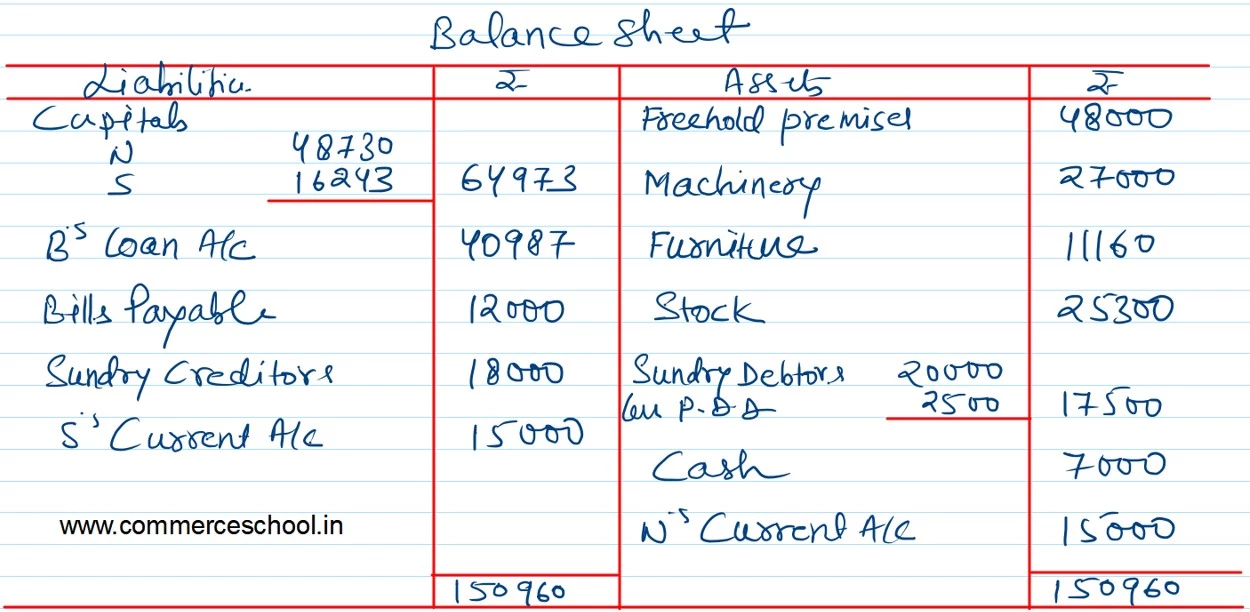

v) The continuing partners decided to adjust their capitals in their new profit sharing ratio after retirement of B. Surplus/deficit, if any, in their Capital Accounts was to be adjusted through their Current Accounts.

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the reconstituted firm.

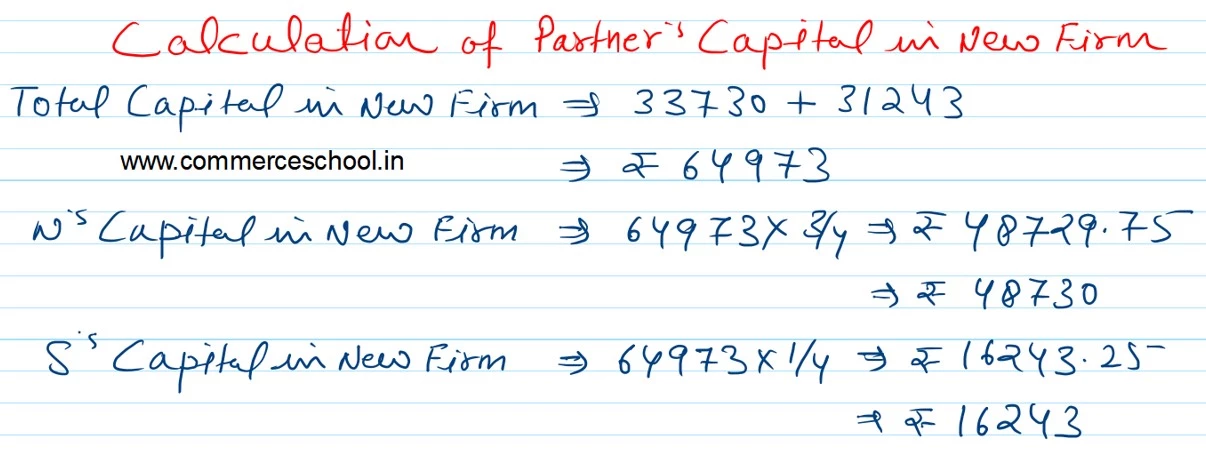

[Ans.: Gain (Profit) on Revaluation – ₹ 5,960; Amount transferred to B’s Loan A/c – ₹ 40,987; Partner’s Capital Accounts: N – ₹ 48,730; S – ₹ 16,243; N’s Current A/c (Dr. Balance) – ₹ 15,000; S’s Current A/c (Cr. Balance) – ₹ 15,000; Balance Sheet Total – ₹ 1,50,960.]