Following is the Balance sheet of Kusum, Sneh and Usha as on 31st March, 2023, who have agreed to share profits and losses in proportion of their capitals:

Following is the Balance sheet of Kusum, Sneh and Usha as on 31st March, 2023, who have agreed to share profits and losses in proportion of their capitals:

| Liabilities | ₹ | Assets | ₹ | |

| Capital A/cs:

Kusum Sneh Usha Employee’s Provident Fund Workmen Compensation Reserve Sundry Creditors |

4,00,000 6,00,000 4,00,000 70,000 30,000 1,00,000 |

Land and Building

Machinery Closing Stock Sundry Debtors Cash at Bank |

2,20,000

|

4,00,000 6,00,000 2,00,000 2,00,000 2,00,000 |

| 16,00,000 | 16,00,000 |

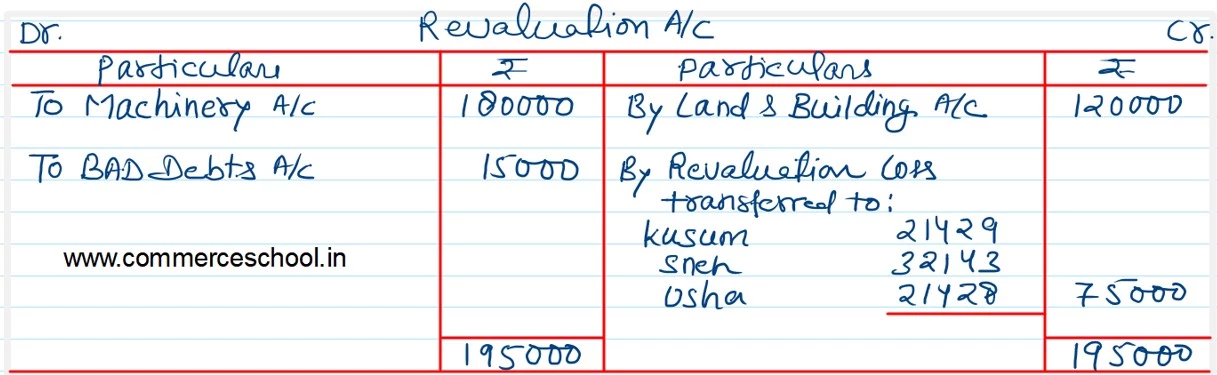

On 1st April, 2023, Kusum retired from the firm and the remaining partners decided to cary on the business. It was agreed to revalue the assets and reassess the liabilities on that date, on the following basis:

a) Land and Building be appreciated by 30%.

b) Machinery be depreciated by 30%.

c) There were Bad Debts of ₹ 35,000.

d) The claim against Workmen Compensation Reserve was estimated at ₹ 15,000.

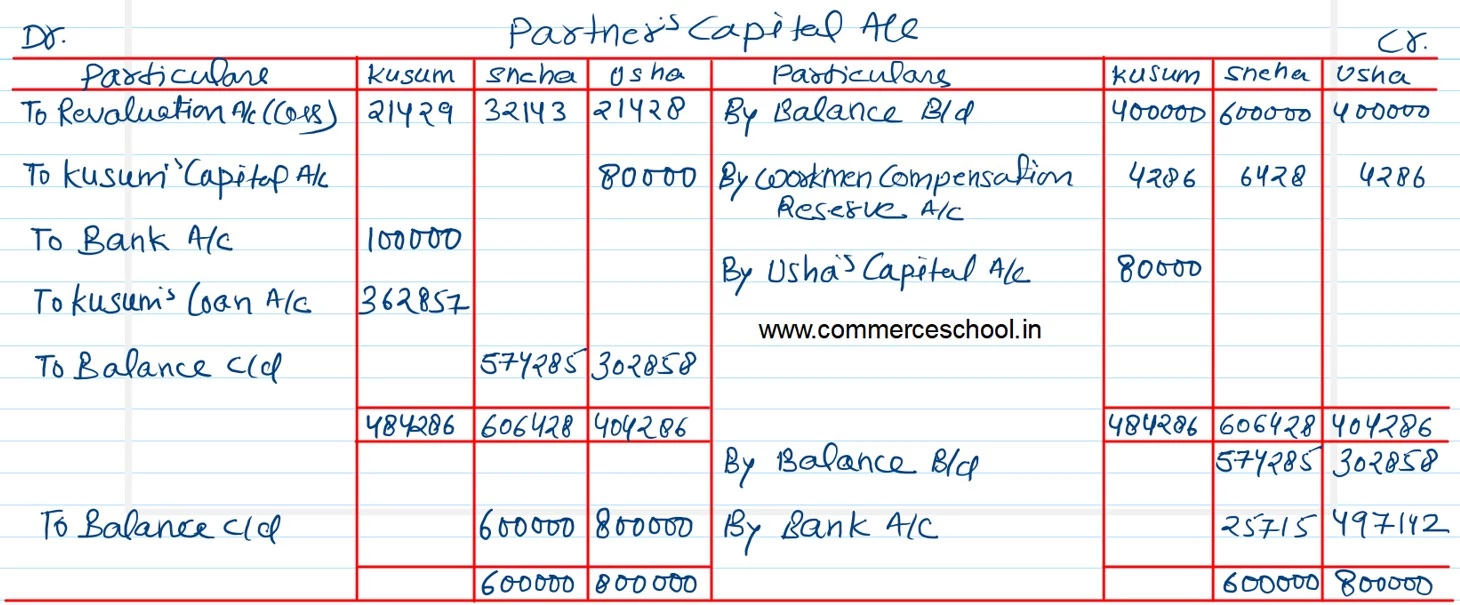

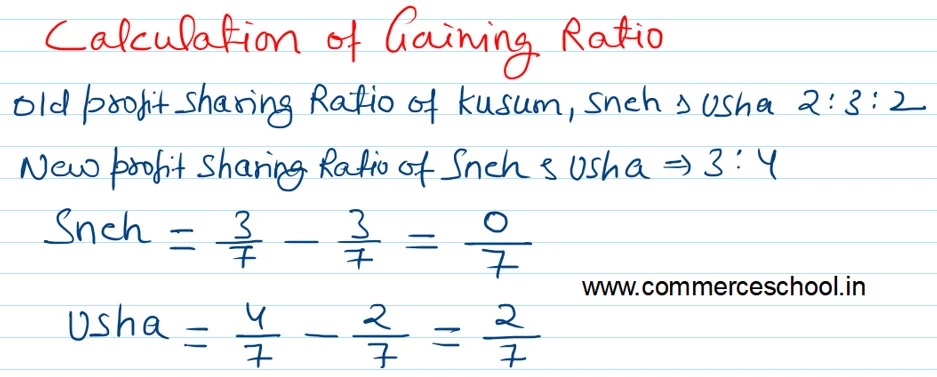

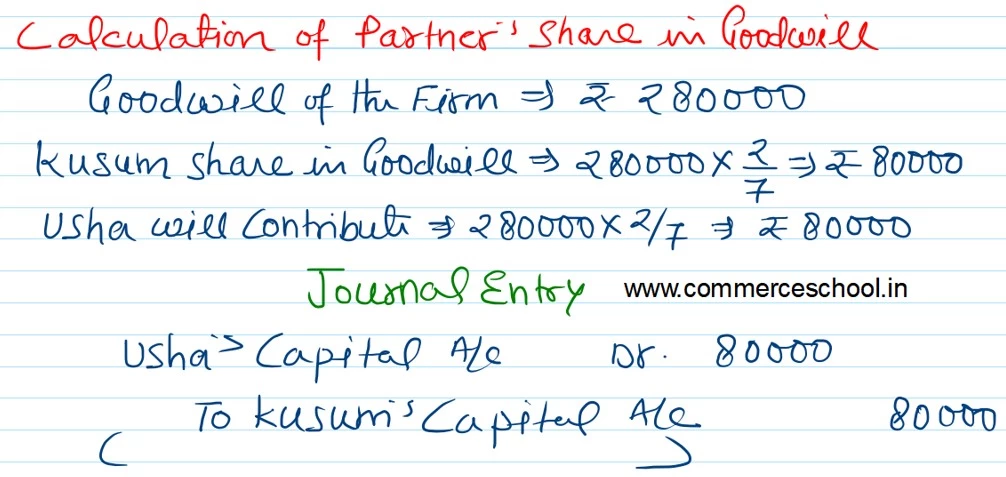

e) Goodwill of the firm was valued at ₹ 2,80,000 and Kusum’s share of goodwill was adjusted against the Capital Accounts of the continuing partners Sneh and Usha who have decided to share future profits in the ratio of 3 : 4 respectively.

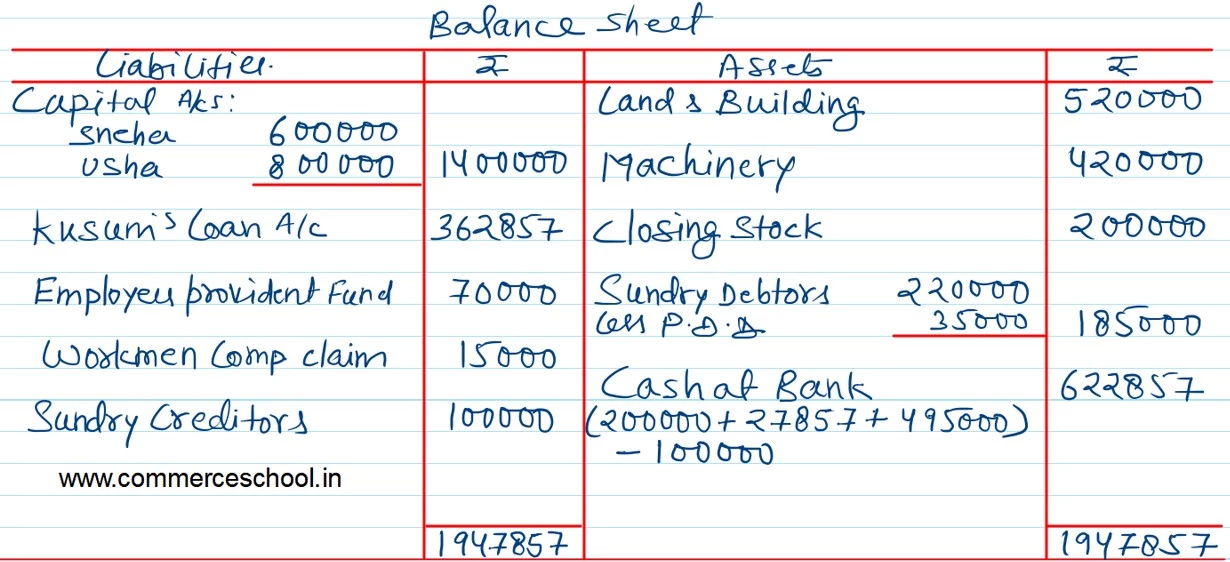

f) Capital of the new firm in total will be the same as before the retirement of Kusum and will be in the new profit sharing ratio of the continuing partners.

g) Amount due to Kusum be settled by paying ₹ 1,00,000 in cash and balance by transferring to her Loan Account which will be paid later on.

Prepare Revaluation Account, Capital Accounts of Partners and Balance Sheet of the new firm after Kusum’s retirement.

[Ans.: Loss on Revaluation – ₹ 75,000; Kusum’s Loan – ₹ 3,62,857; Capital Accounts: Sneh – ₹ 6,00,000; Usha – ₹ 8,00,000; Balance Sheet Total – ₹ 19,47,857; Cash at Bank – ₹ 6,22,857.]

Sir isme usha ka share 2/7 thaa toh aapne usse workmen compensation reserve sneh ke hisse ka kaise de diya