Nitin and Lokesh are partners in a firm sharing profits and losses in the ratio of 60 : 40. Their Balance Sheet as at 31st March, 2023 was as follows:

Nitin and Lokesh are partners in a firm sharing profits and losses in the ratio of 60 : 40. Their Balance Sheet as at 31st March, 2023 was as follows:

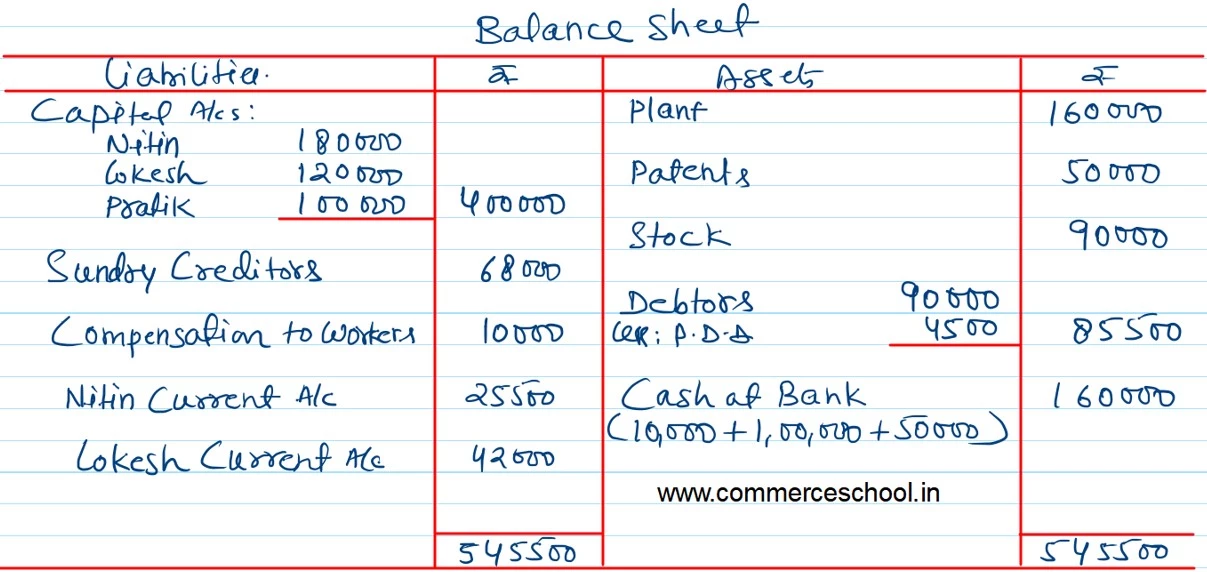

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs:

Nitin Lokesh General Reserve Sundry Creditors |

1,50,000

1,25,000 50,000 75,000 |

Plant Patents

Stock Debtors Cash at Bank |

1,50,000

50,000 1,00,000 90,000 10,000 |

| 4,00,000 | 4,00,000 |

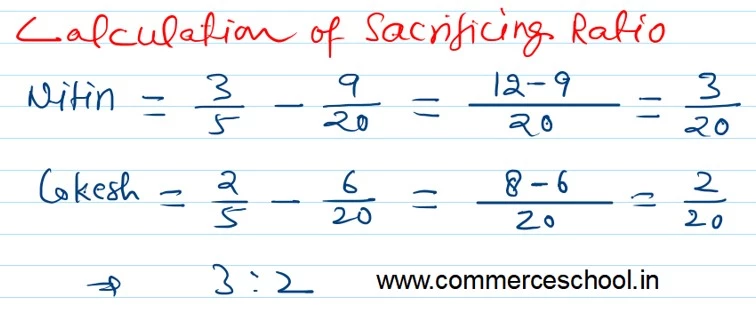

Pratik is admitted as partner w.e.f 1st April, 2023 on the following terms:

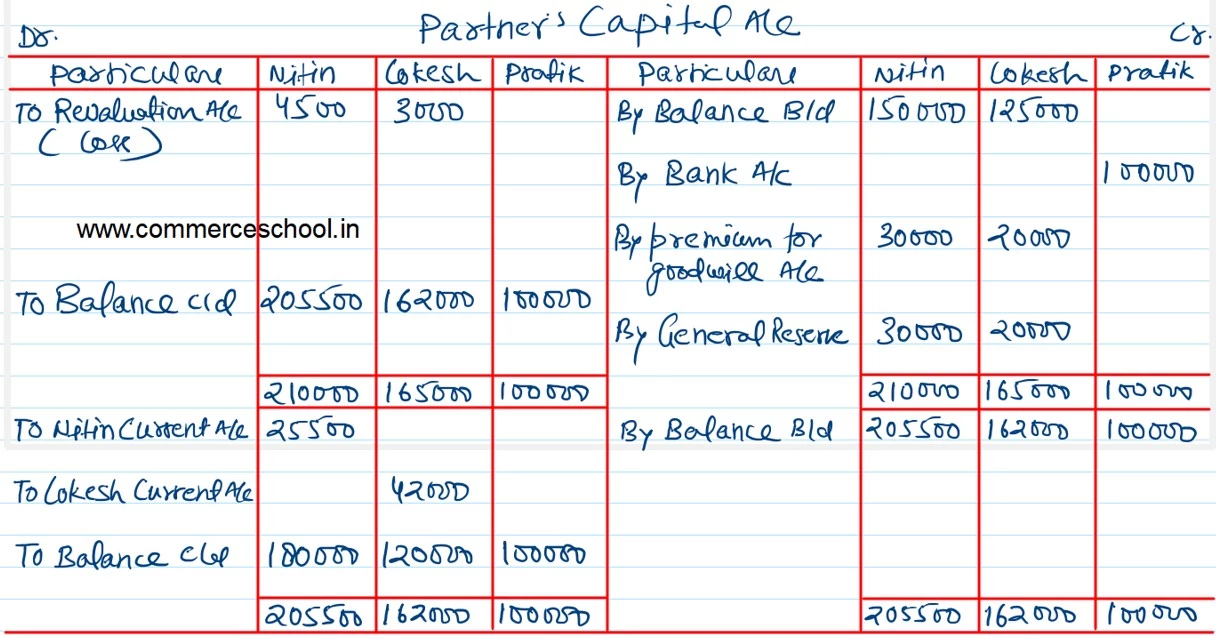

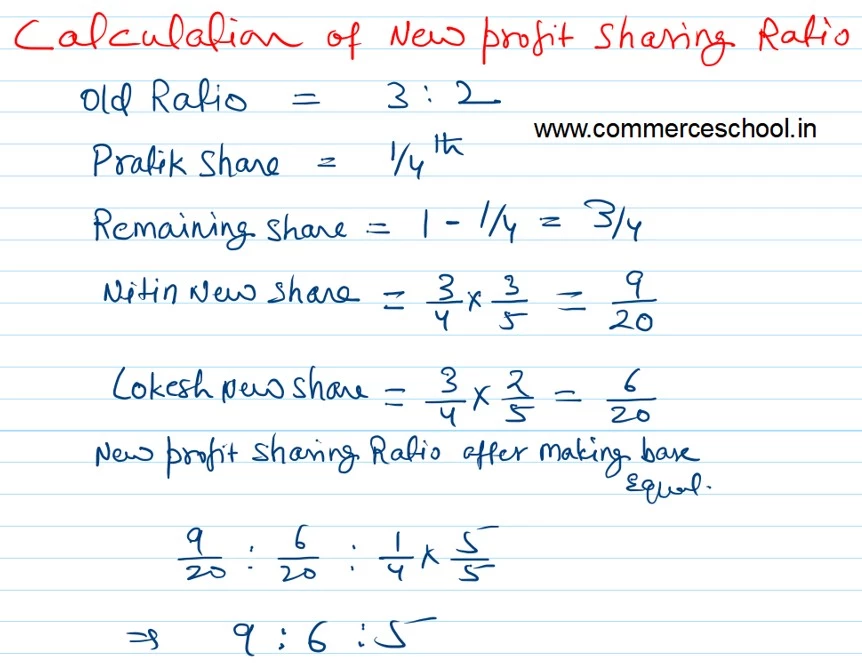

(i) He will pay ₹ 50,000 as Goodwill for 1/4th share in the profits of the firm.

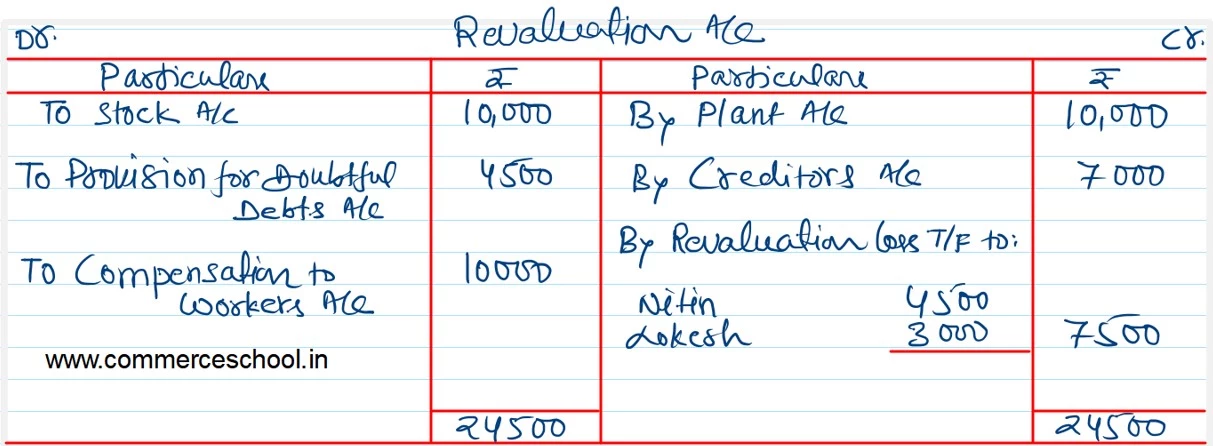

(ii) The assets are to be valued as follows:

Plant at ₹ 1,60,000; Stock at ₹ 90,000; Debtors at book value less provision of 5% for Doubtful Debts.

(iii) Creditors included an amount of ₹ 7,000 which was not to be paid. Also, there was a liability for compensation to workers amounting to ₹ 10,000.

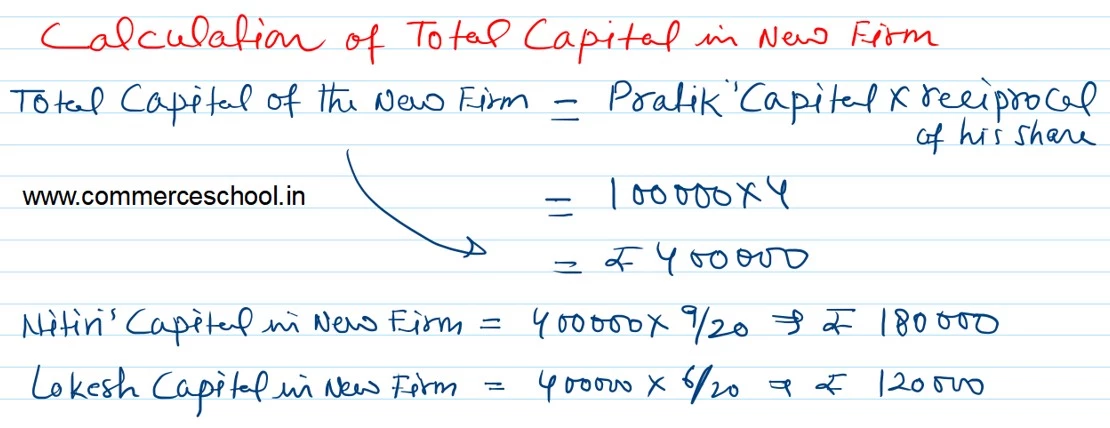

(iv) Pratik introduced ₹ 1,00,000 as Capital and the capitals of other partners were to be adjusted in the new profit sharing ratio. For this purpose, Current Accounts were to be opened.

Give Journal entries to record the above and Balance Sheet after Pratik’s admission.