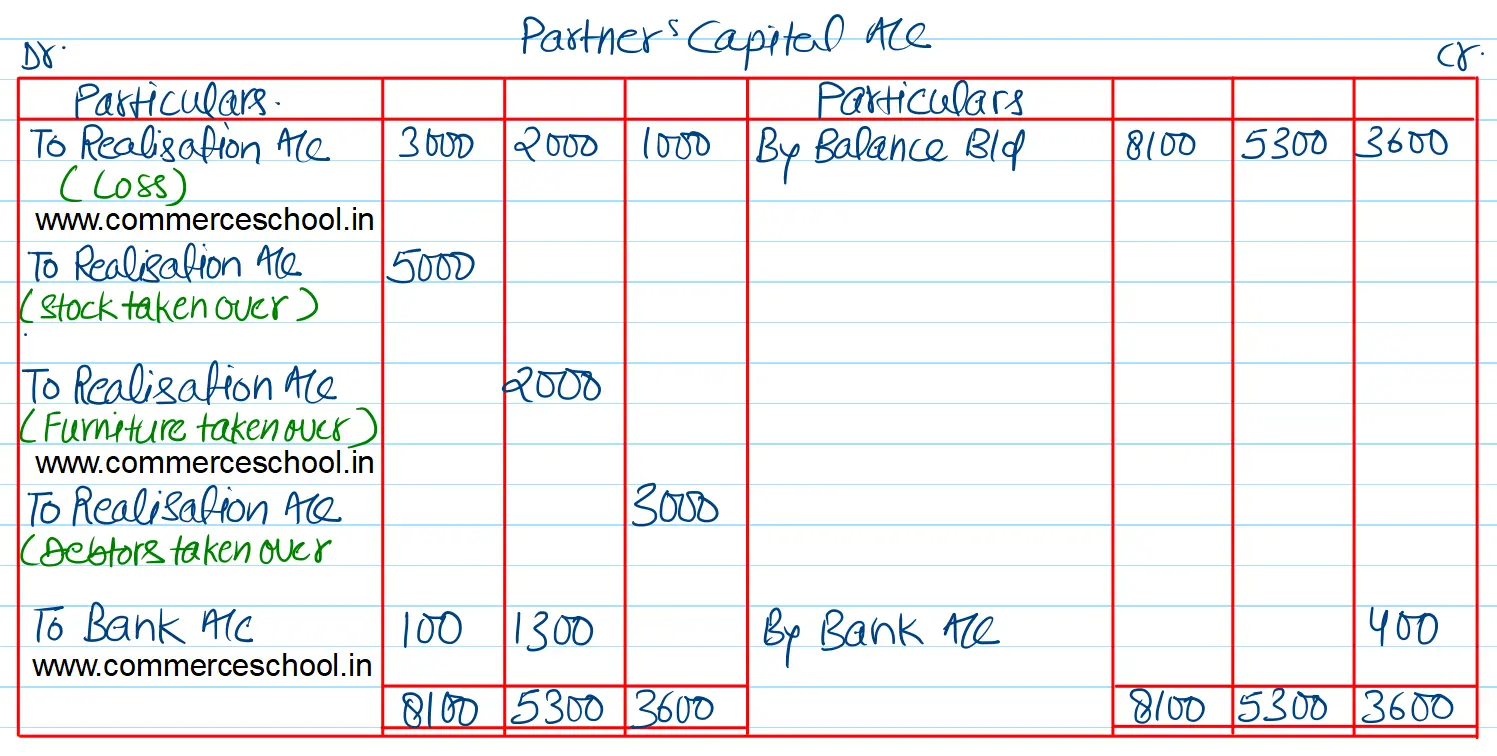

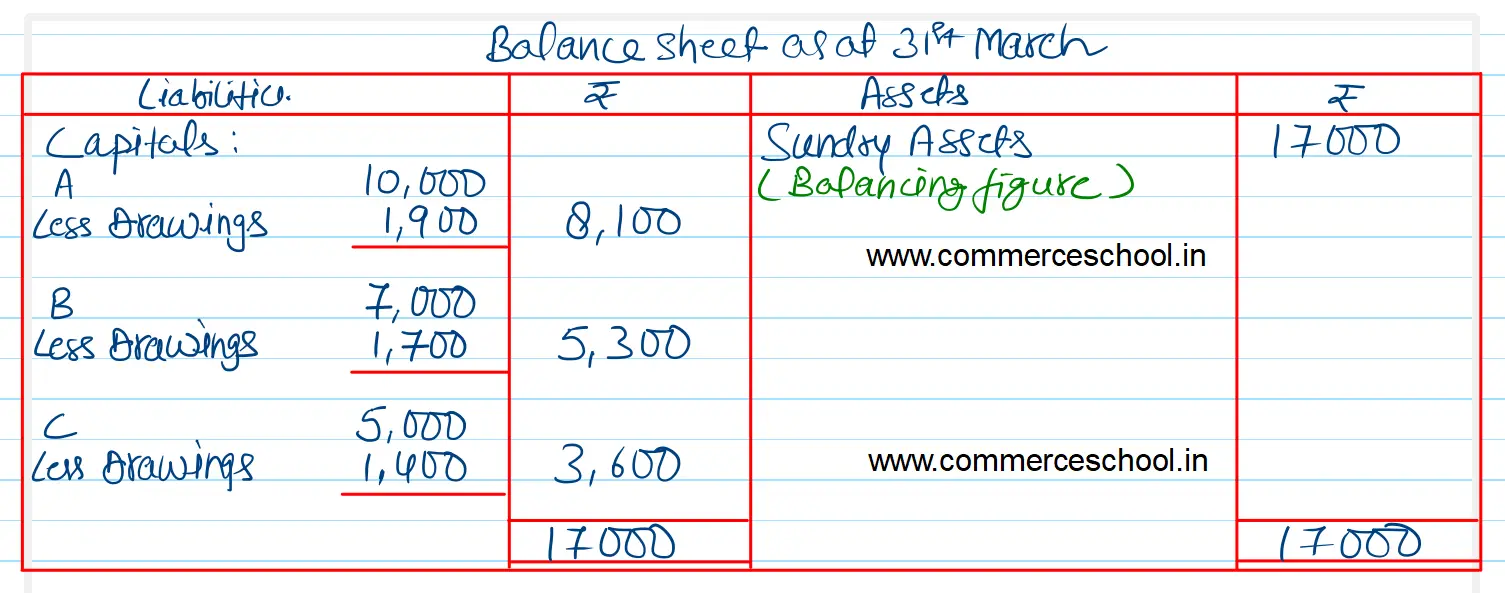

On 1st April, 2023, A, B and C commenced business in partnership sharing profit and losses in proportion of 1/2, 1/3 and 1/6 respectively. They paid into their Bank A/c as their capital ₹ 22,000 being ₹ 10,000 by A, ₹ 7,000 by B and ₹ 5,000 by C

On 1st April, 2023, A, B and C commenced business in partnership sharing profit and losses in proportion of 1/2, 1/3 and 1/6 respectively. They paid into their Bank A/c as their capital ₹ 22,000 being ₹ 10,000 by A, ₹ 7,000 by B and ₹ 5,000 by C. During the year they drew ₹ 5,000, being ₹ 1,900 by A, ₹ 1,700 by B and ₹ 1,400 by C.

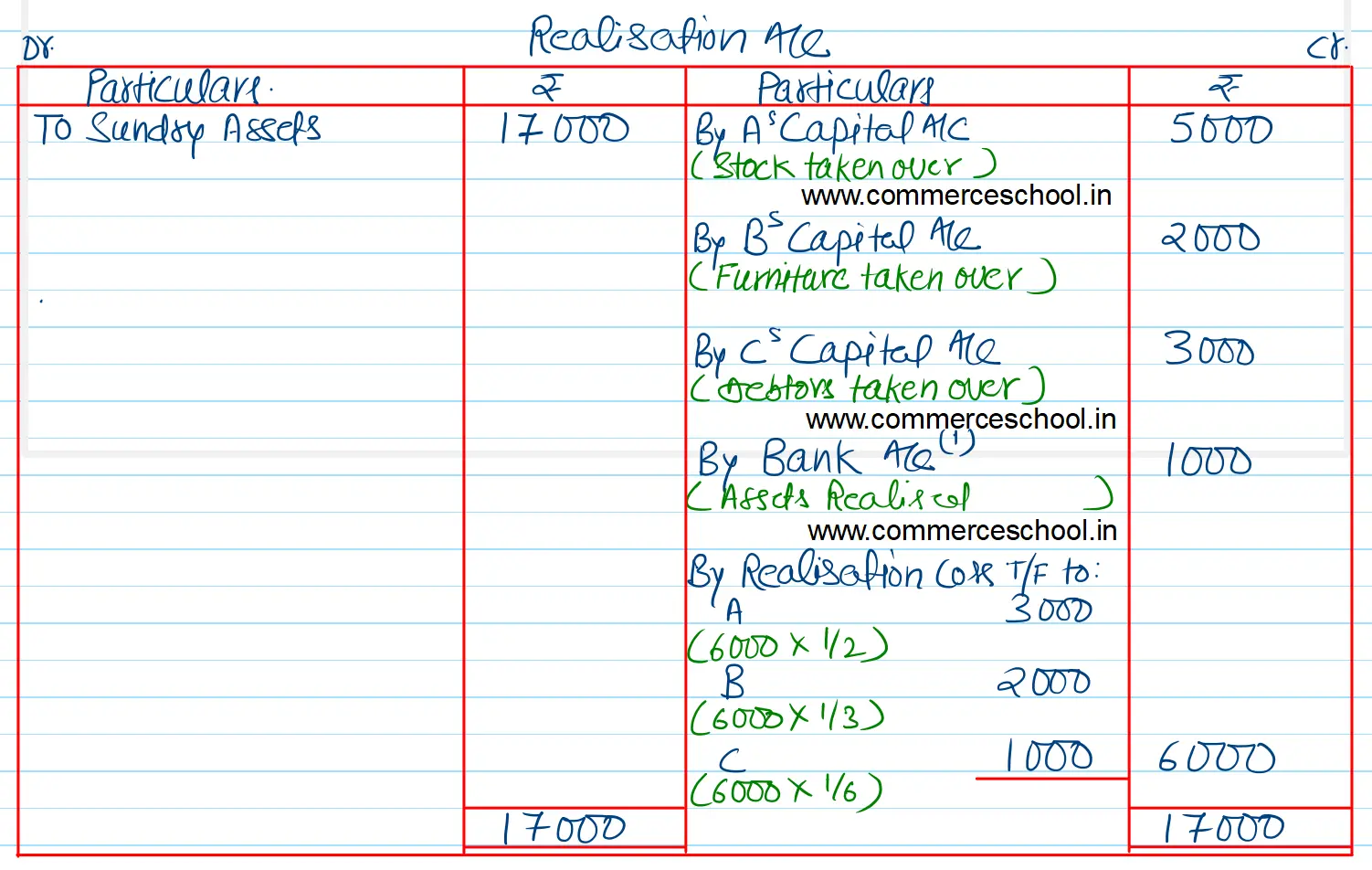

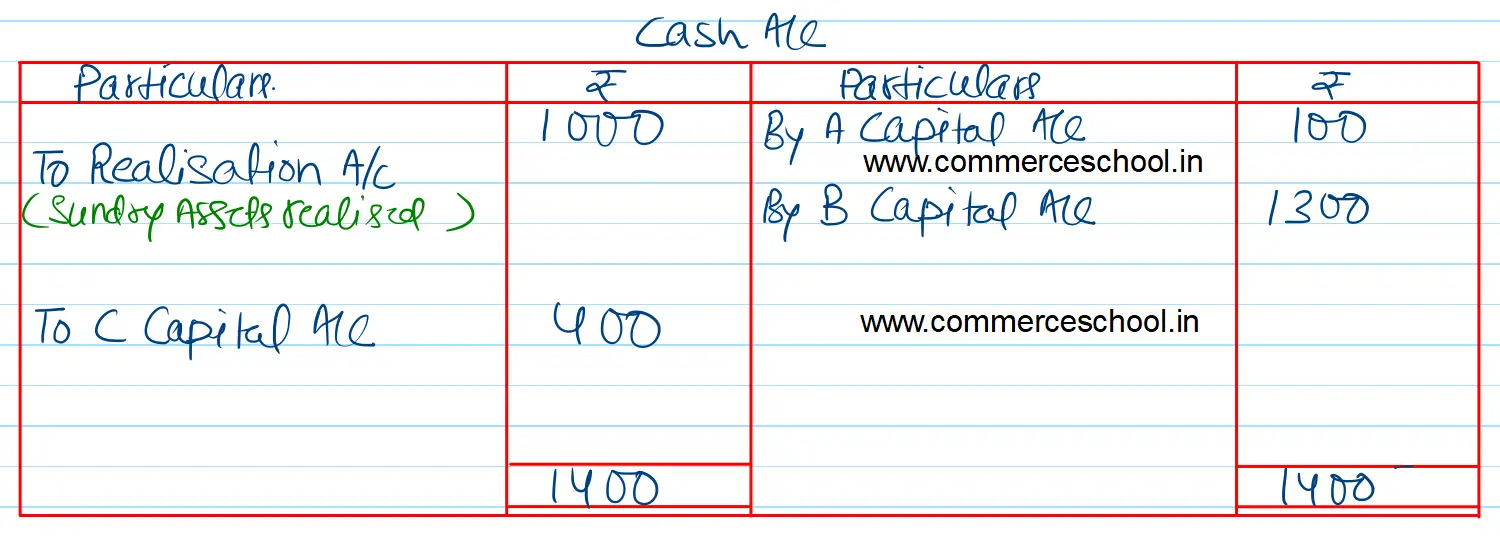

On 31st March, 2024, they dissolved their firm. A taking up stock at an agreed valuation of ₹ 5,000, B taking up furniture at ₹ 2,000 and C taking up debtors at ₹ 3,000. After paying up their creditors, there remaining a balance of ₹ 1,000 at Bank. Prepare the necessary accounts showing the distribution of the cash at the Bank and of the further cash brought in by any partner as the case required.

[Ans. Sundry Assets ₹ 17,000. Loss on Realisation ₹ 6,000; Amount paid to A ₹ 100; Amount paid to B ₹ 1,300. Amount brought in by C ₹ 400; Total of Bank A/c ₹ 1,400.]