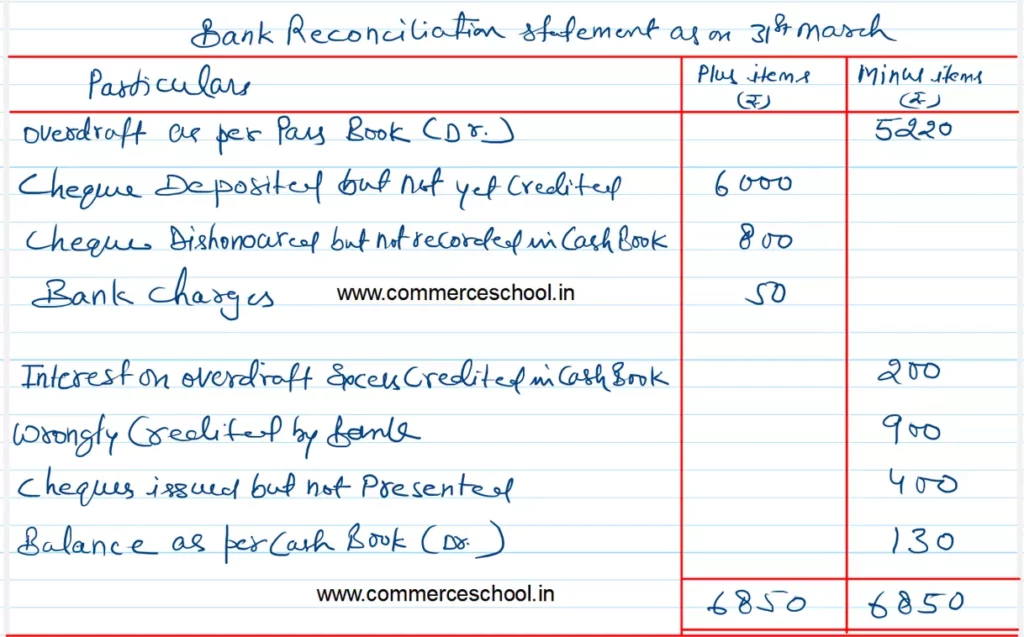

On checking the Bank Pass Book, it was noticed that it showed an overdraft of ₹ 5,220 as on 31st March, 2023 while as per Ledger it was different from bank balance. The following differences were noted

On checking the Bank Pass Book, it was noticed that it showed an overdraft of ₹ 5,220 as on 31st March, 2023 while as per Ledger it was different from bank balance. The following differences were noted:

(i) Cheques deposited but not yet credited by bank ₹ 6,000.

(ii) Cheques dishonoured and debited by bank but not given effect to it in the Ledger ₹ 800.

(iii) Bank charges debited by bank but debit memo not received from bank ₹ 50.

(iv) Interest on overdraft excess credited in the Leger ₹ 200.

(v) Wrongly credited by bank to account, deposit of some other party ₹ 900.

(vi) Cheques issued but not presented for payment ₹ 400.

Prepare Bank Reconciliation Statement.

Anurag Pathak Changed status to publish