P and Q were partners in a firm sharing profits in 3 : 1 ratio. Their respective fixed capitals were ₹ 10,00,000 and ₹ 6,00,000. The partnership deed provided interest on capital @ 12% p.a

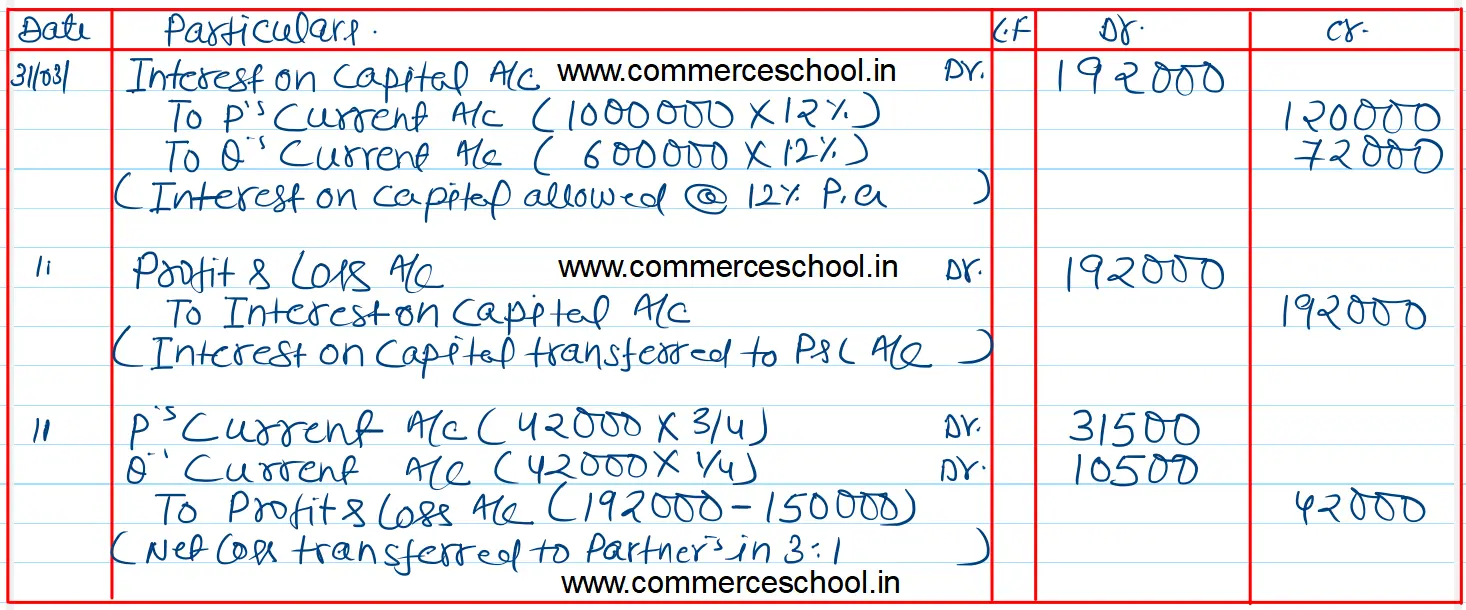

P and Q were partners in a firm sharing profits in 3 : 1 ratio. Their respective fixed capitals were ₹ 10,00,000 and ₹ 6,00,000. The partnership deed provided interest on capital @ 12% p.a. The partnership deed further provided that interest on capital will be allowed fully even if it will result into a loss to the firm. The net profit of the firm for the year ended 31st March, 2018 was ₹ 1,50,000.

Pass necessary journal entries in the books of the firm allowing interest on capital and division of profit/loss among the partners.

[Ans. Net Loss transferred to Current Accounts : P ₹ 31,500 and Q ₹ 10,500.]

Anurag Pathak Answered question May 25, 2024