P, Q and R were partners in a firm sharing profits in the ratio of 1 : 2 : 2. Their Balance Sheet as at 31st March, 2024 was as follows:

P, Q and R were partners in a firm sharing profits in the ratio of 1 : 2 : 2. Their Balance Sheet as at 31st March, 2024 was as follows:

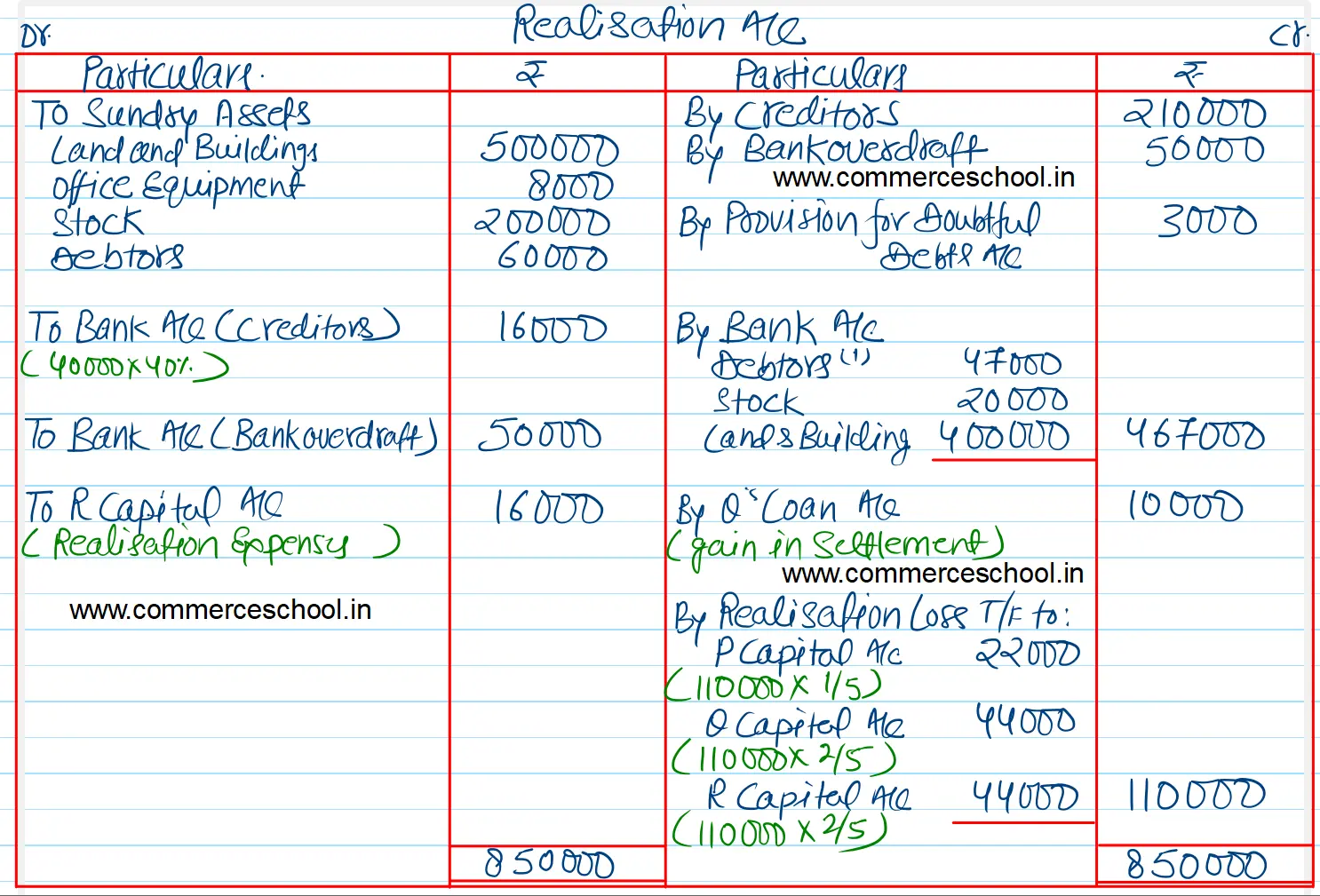

Partners agreed to dissolve the firm on that date. You are given the following information about dissolution:

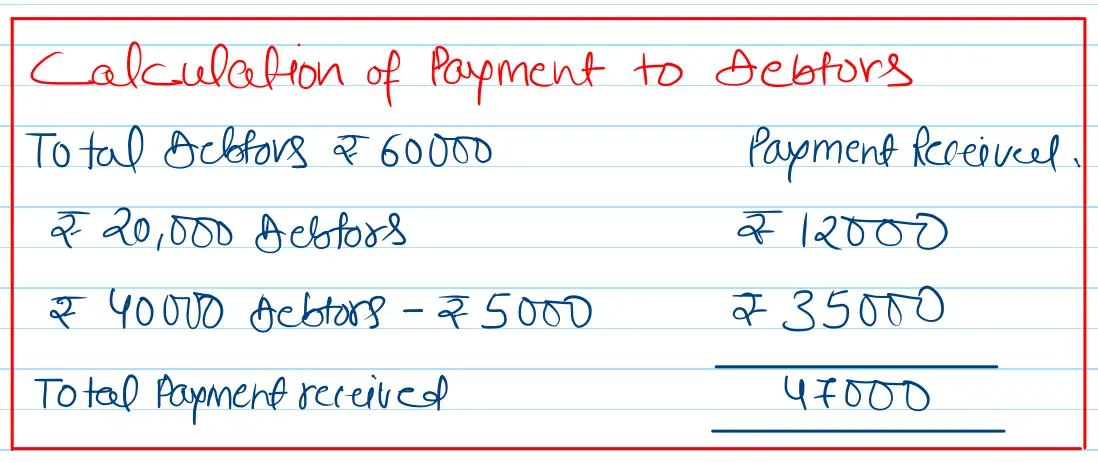

(i) One of the Debtors for ₹ 20,000 paid ₹ 12,000 in full settlement of his account and debtors of ₹ 5,000 were proved bad.

(ii) Part of the stok was sold for ₹ 20,000 (being 25% more than the book value).

(iii) Office Equipment was accepted by the creditor for ₹ 7,000 in full settlement. Another creditor of ₹ 40,000 was paid only 40% in full settlement of his account and remaining creditors accepted remaining stock in full settlement of their account.

(iv) An unrecorded asset of ₹ 20,000 was handed over to an unrecorded liability of ₹ 15,000 in full settlement.

(v) Land & Buildings were sold at a loss of 20%.

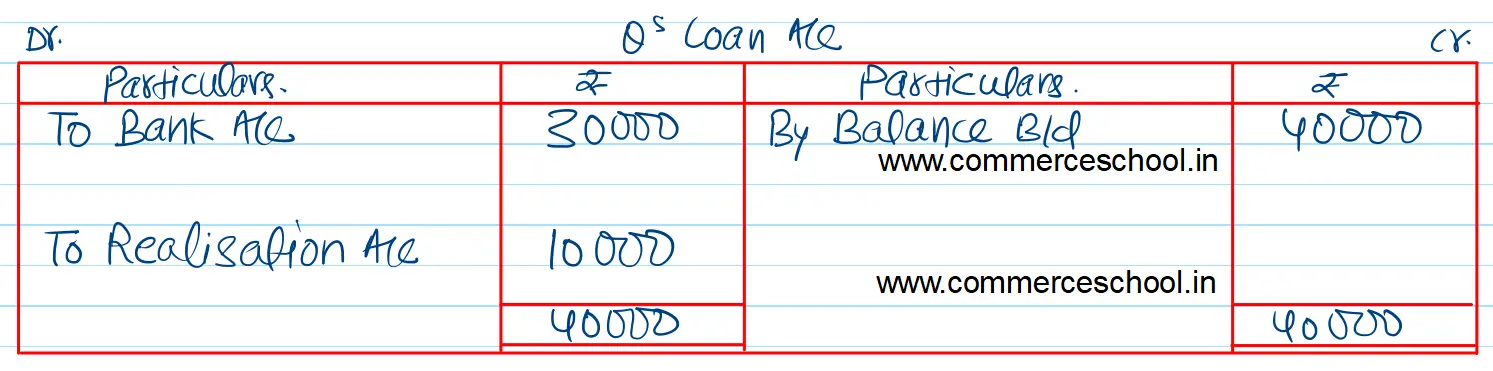

(vi) Q’s Loan was settled by payment of ₹ 30,000.

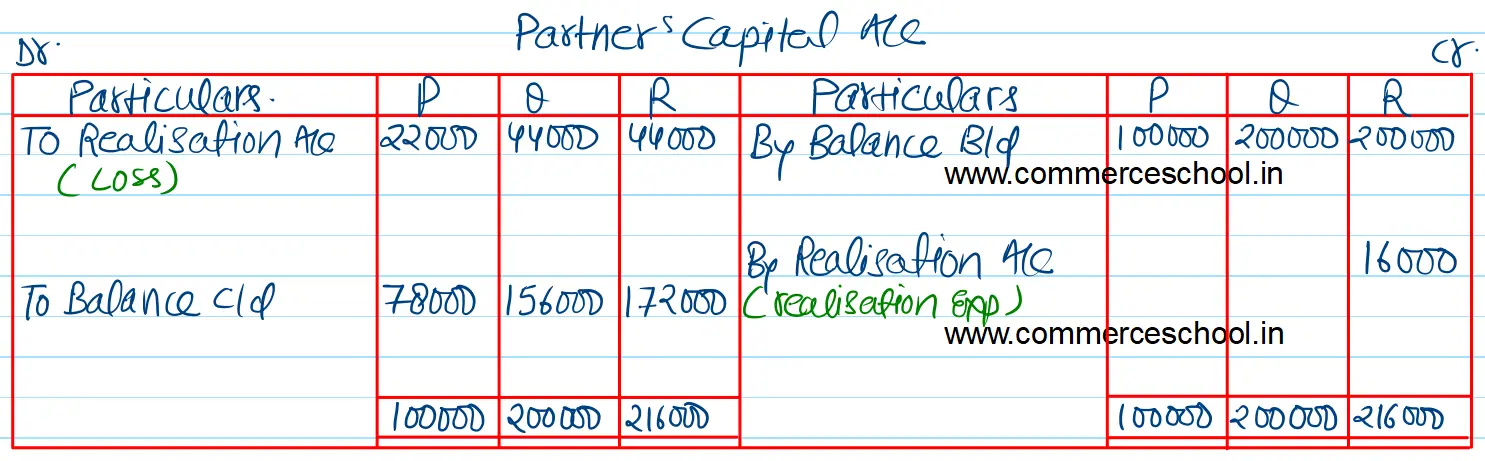

(vii) Realisation expenses ₹ 16,000 were paid by R.

You are required to prepare the necessary accounts.

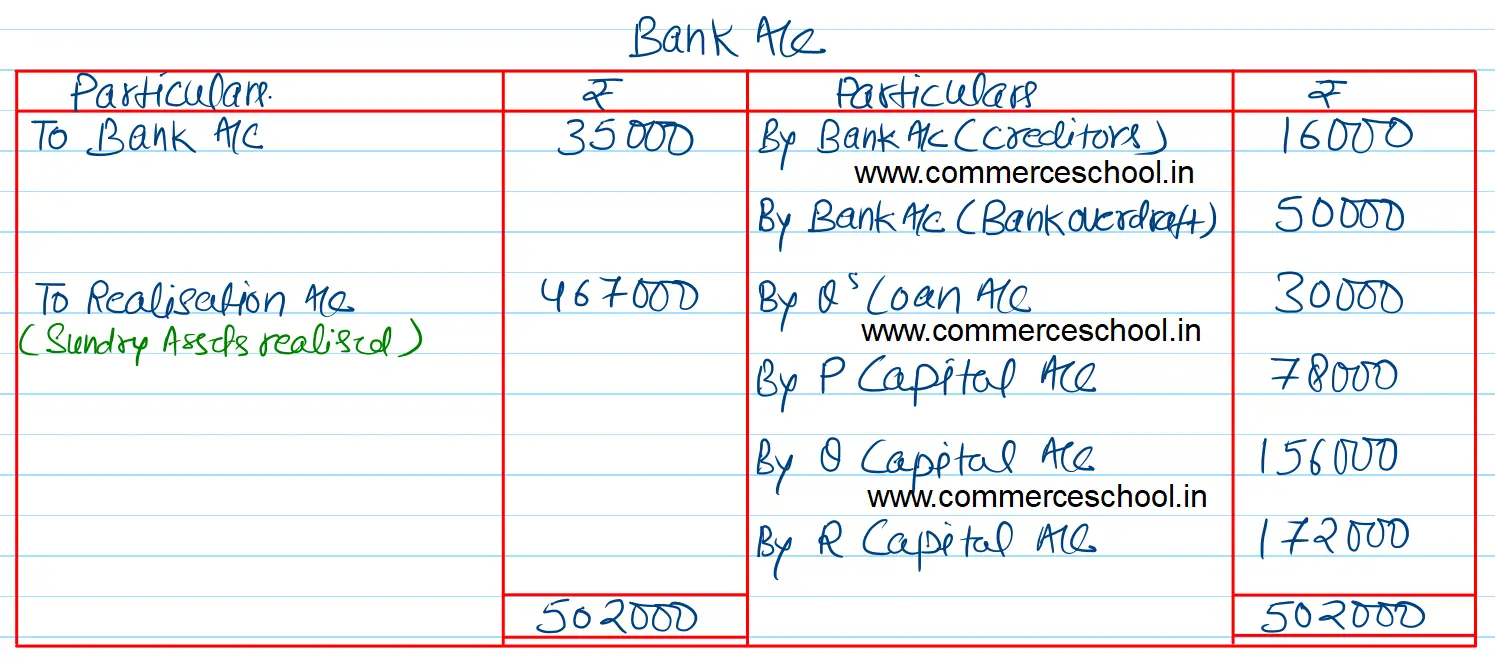

[Ans. Loss on Realisation ₹ 1,10,000; Final Payment to P ₹ 78,000; Q ₹ 1,56,000 and R ₹ 1,72,000; Total of Bank A/c ₹ 5,02,000.]

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 2,10,000 | Land and Buildings | 5,00,000 |

| Bank Overdraft | 50,000 | Office Equipment | 8,000 |

| Q’s Loan | 40,000 | Stock | 2,00,000 |

| Capitals P Q R | 1,00,000 2,00,000 2,00,000 | Debtors 60,000 Less: Provision for Doubtful Debts 3,000 | 57,000 |

| 8,00,000 | Bank | 35,000 | |

| 8,00,000 | 8,00,000 |

Anurag Pathak Answered question