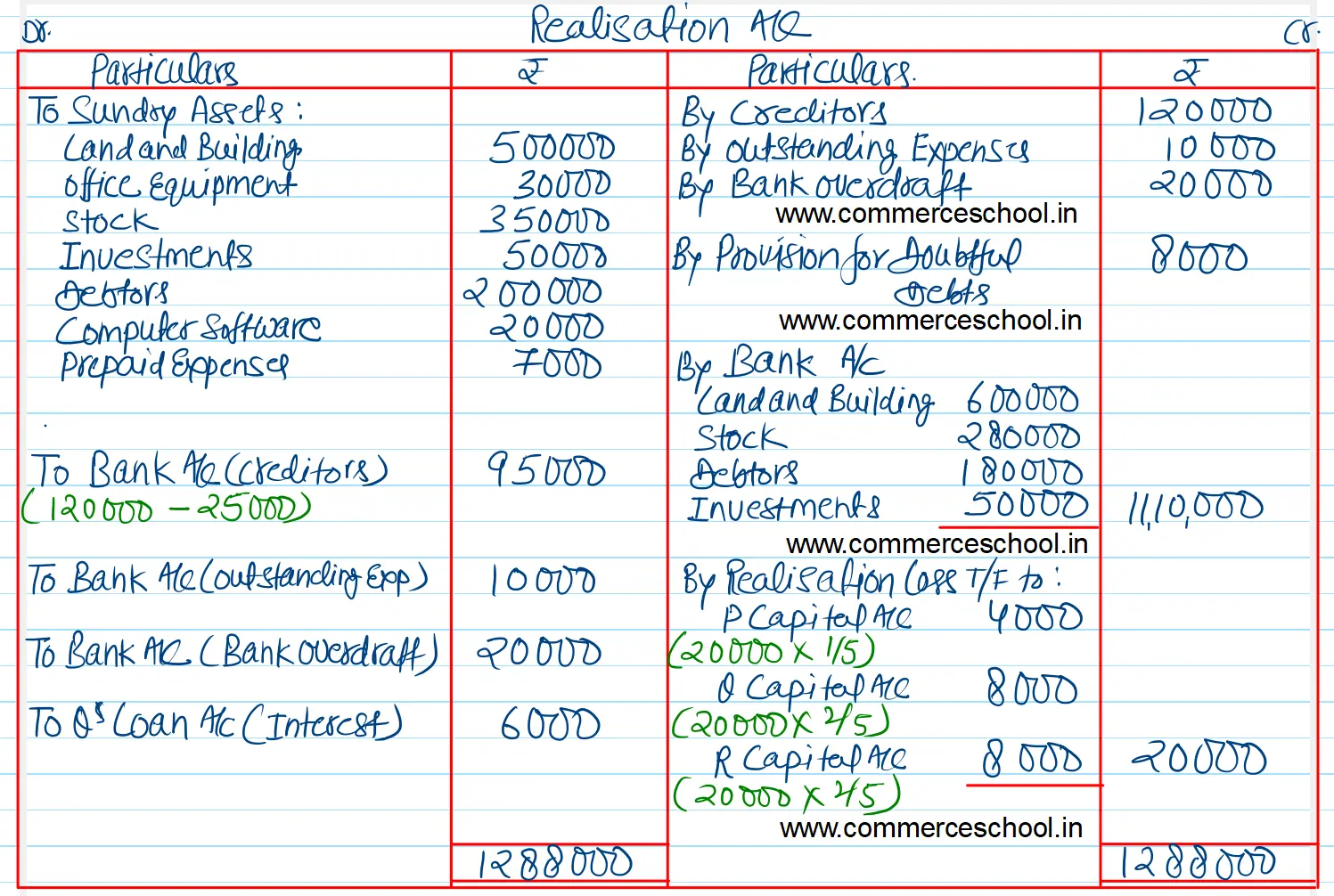

P, Q and R were partners in a firm sharing profits in the ratio of 1 : 2 : 2. Their Balance Sheet as at 31st March 2024 was as follows:

P, Q and R were partners in a firm sharing profits in the ratio of 1 : 2 : 2. Their Balance Sheet as at 31st March 2024 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 1,20,000 | Land and Building | 5,00,000 |

| Outstanding Expenses | 10,000 | Office Equipment | 30,000 |

| Bank Overdraft | 20,000 | Stock | 3,50,000 |

| Q’s Loan | 50,000 | Investments | 50,000 |

|

Capitals: P Q R |

2,00,000 4,00,000 4,00,000 |

Debtors 2,00,000 Less: Provision for doubtful Debts 8,000 |

1,92,000 |

| Computer Software | 20,000 | ||

| Prepaid Expenses | 51,000 | ||

| Cash at Bank | 7,000 | ||

| 12,00,000 | 12,00,000 |

On the above date the firm was dissolved. You are given the following information:

(i) Office Equipment was accepted by a Creditors of ₹ 25,000 in full settlement.

(ii) Q’s Loan was paid alongwith unrecorded interest of ₹ 6,000.

(iii) Land and Building were realised at ₹ 6,00,000; Stock at 80% and debtors at 90%.

Prepare Realisation Account.

[Ans. Loss on Realisation ₹ 20,000.]

Anurag Pathak Answered question