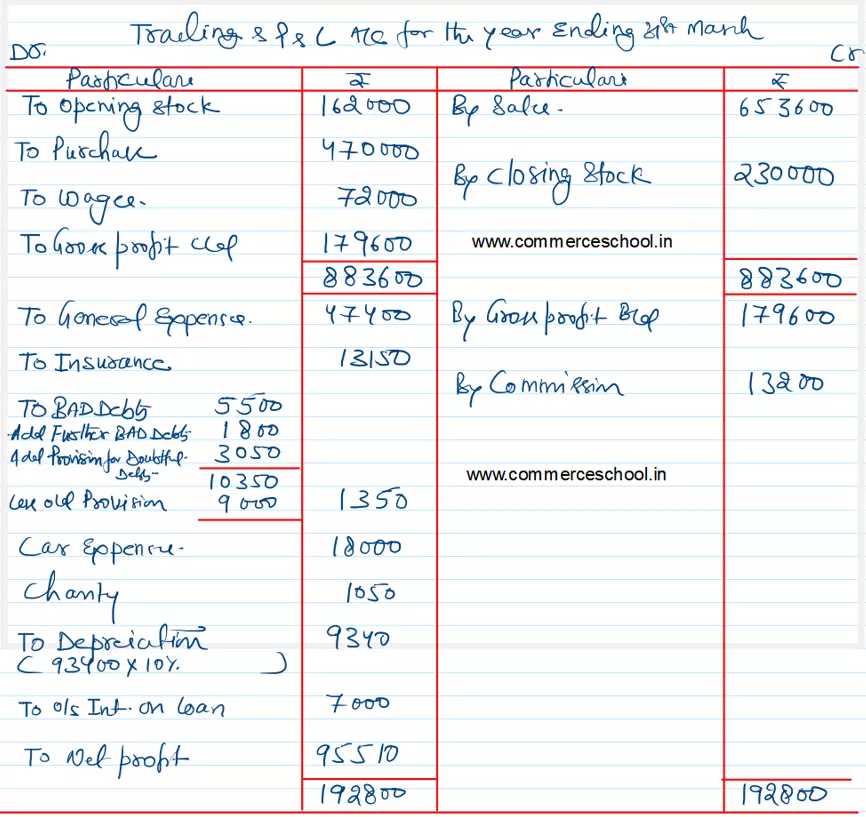

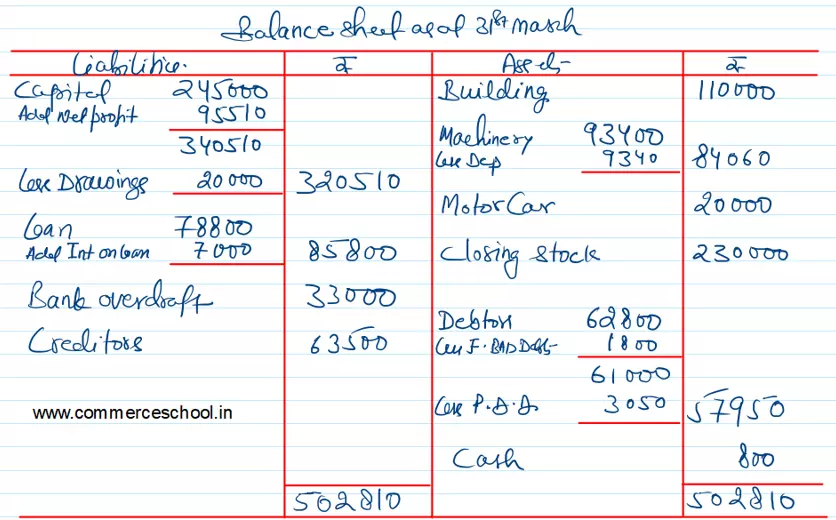

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date from the following balances taken from the books of Vijay on 31st March, 2023 after giving effect to the following adjustments:

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date from the following balances taken from the books of Vijay on 31st March, 2023 after giving effect to the following adjustments:

(i) Stock as on 31st March, 2023 was valued at ₹ 2,30,000.

(ii) Write off further ₹ 1,800 as Bad Debts and maintain the Provision for Doubtful Debts at 5%.

(iii) Depreciate Machinery at 10%.

(iv) Provide ₹ 7,000 as outstanding interest on loan.

| Particulars | ₹ | Particulars | ₹ |

|

Capital Drawings General Expenses Building Machinery Stock on 1st April, 2021 Insurance Wages Debtors Creditors Bad Debts |

2,45,000 20,000 47,400 1,10,000 93,400 1,62,000 13,150 72,000 62,800 63,500 5,500 |

Loan Sales Purchases Motor Car Provision for Doubtful Debts Commission (Cr.) Car Expenses Cash Bank Overdraft Charity |

78,800 6,53,600 4,70,000 20,000 9,000 13,200 18,000 800 33,000 1,050 |

[Gross Profit – ₹ 1,70,600; Net Profit – ₹ 95,510; Balance sheet Total – ₹ 5,02,810.]