Pritam and Naresh decided to dissolve their firm on September 30, 2023, when their Balance Sheet stood as follows:

Pritam and Naresh decided to dissolve their firm on September 30, 2023, when their Balance Sheet stood as follows:

| Liabilities | ₹ | Assets | ₹ |

|

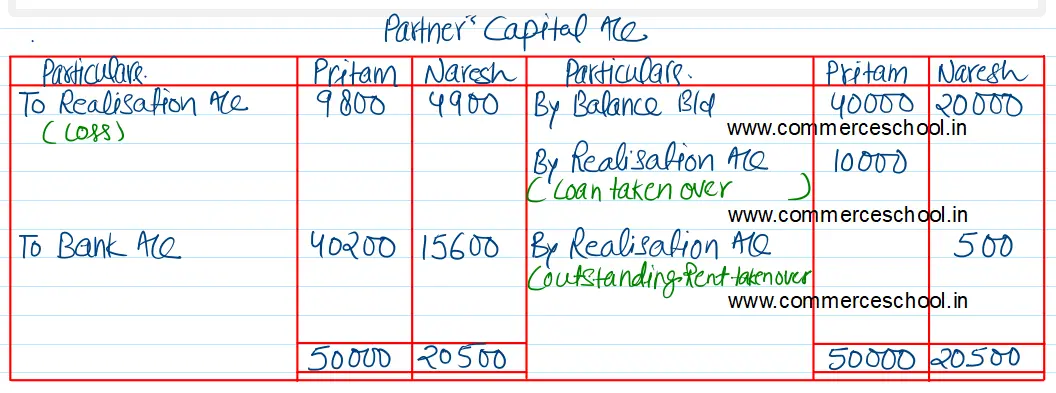

Capital Accounts: Pritam Naresh |

40,000 20,000 |

Cash at Bank | 400 |

|

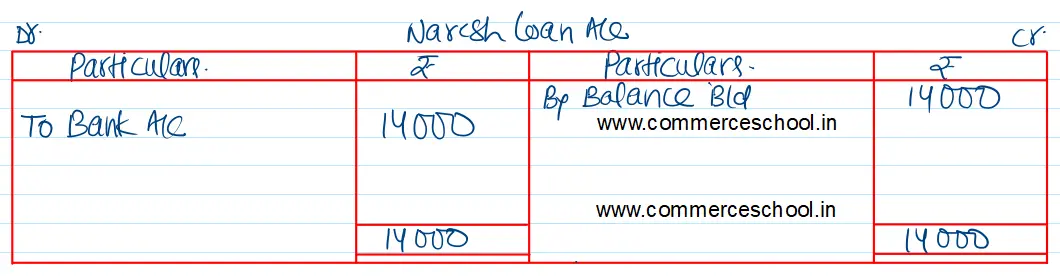

Loan Accounts: Naresh Mrs. Pritam |

14,000 10,000 |

Stock-in-Trade | 21,500 |

| Sundry Creditors | 36,000 | Bills Receivable | 8,800 |

| Outstanding Rent | 500 | Sundry Debtors 45,000 Less: Provision for Bad Debts 1,500 | 43,500 |

| Furniture | 3,000 | ||

| Plant & Machinery | 23,000 | ||

| Goodwill | 20,000 | ||

| Prepaid Insurance | 300 | ||

| 1,20,500 | 1,20,500 |

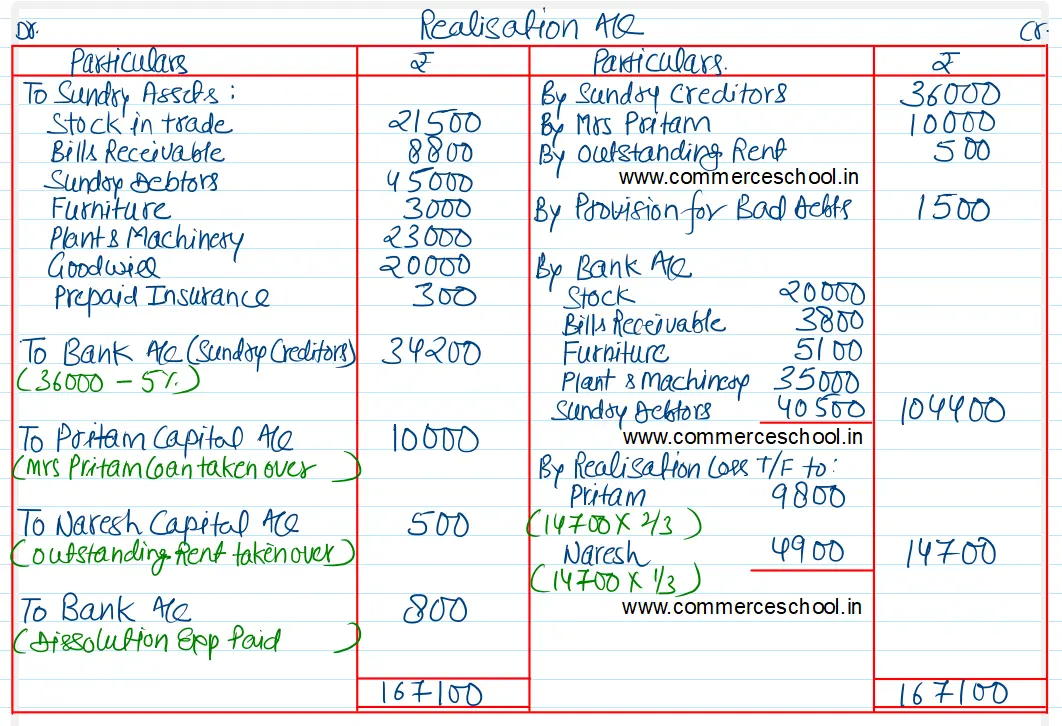

The assets were realised as follows: Stock ₹ 20,000; Bills Receivable ₹ 3,800; Furniture ₹ 5,100; Plant & Machinery ₹ 35,000; Sundry Debtors at 10% less than book value.

Sundry Creditors allowed a discount of 5%. Pritam agreed to pay his wife’s loan. Naresh agreed to pay outstanding rent. Expenses on dissolution came to ₹ 800.

Pritam and Naresh shared profits and losses in the ratio of their capitals. Accounts were finally settled.

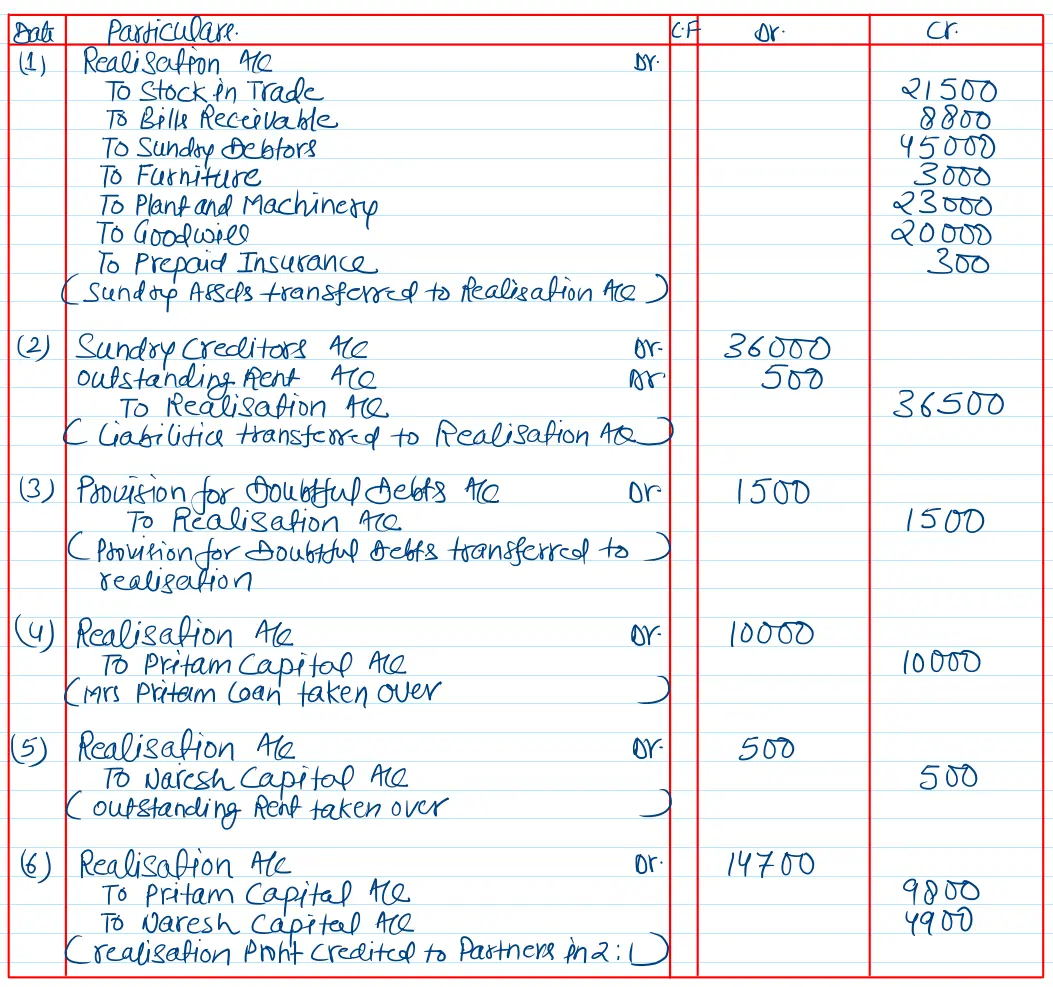

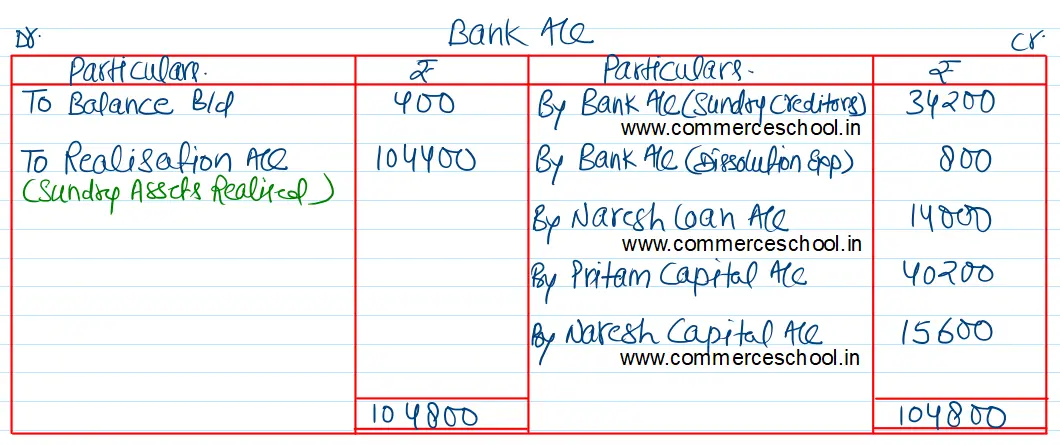

Prepare Journal Realisation Account, Capital Accounts and Bank Account.

[Ans. Loss on Realisation ₹ 14,700; Cash paid to Pritam ₹ 40,200 and Naresh ₹ 15,600; Total of Bank A/c ₹ 1,04,800.]