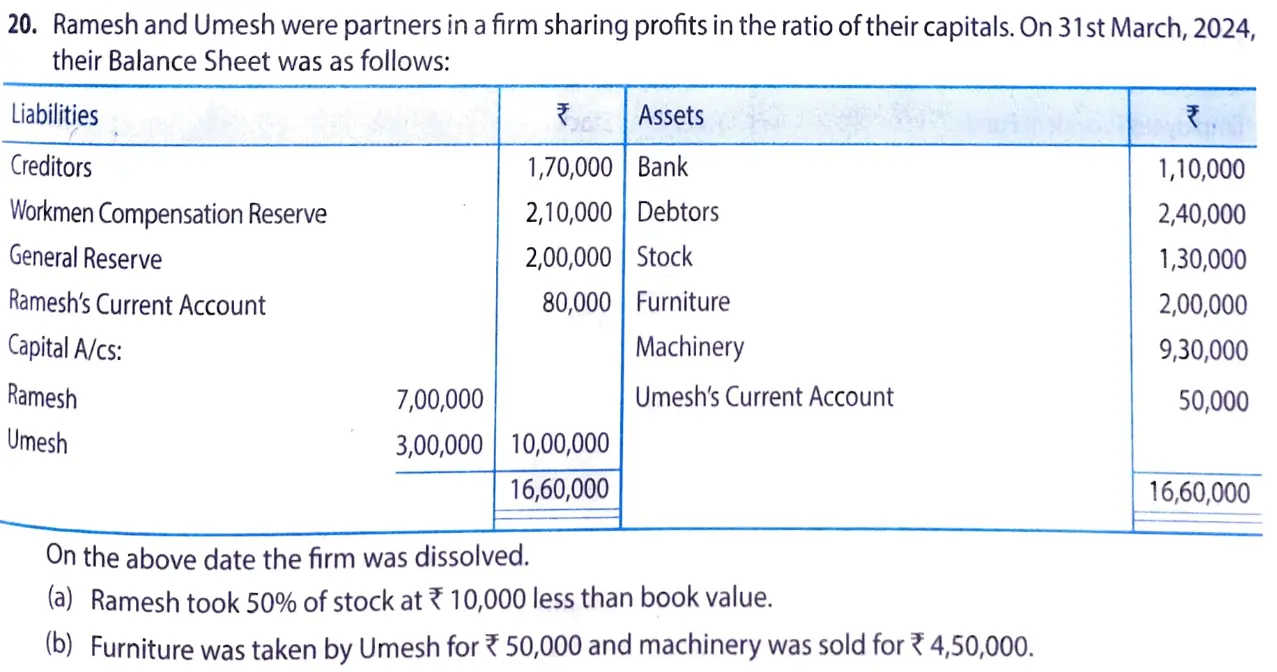

Ramesh and Umesh were partners in a firm sharing profits in the ratio of their capitals. On 31st March, 2023, their Balance Sheet was as follows:

Ramesh and Umesh were partners in a firm sharing profits in the ratio of their capitals. On 31st March, 2023, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors

Workmen Compensation Reserve General Reserve Ramesh’s Current Account Capital A/cs: Ramesh Umesh |

1,70,000

2,10,000 2,00,000 80,000 7,00,000 3,00,000 |

Bank

Debtors Stock Furniture Machinery Umesh’s Current Account |

1,10,000

2,40,000 1,30,000 2,00,000 9,30,000 50,000 |

| 16,60,000 | 16,60,000 |

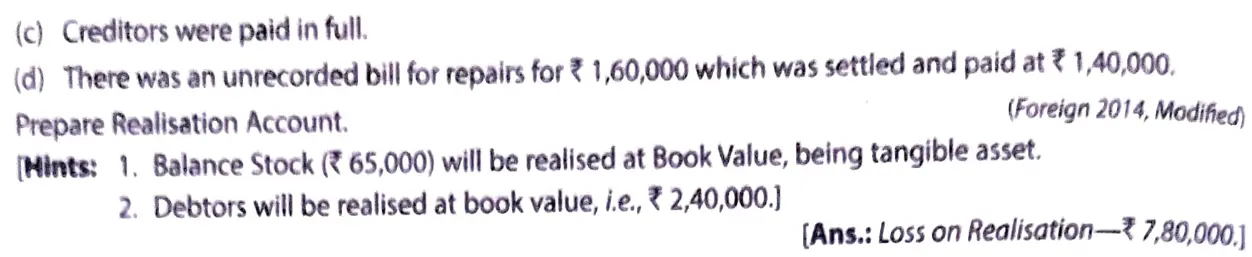

On the above date of the firm was dissolved.

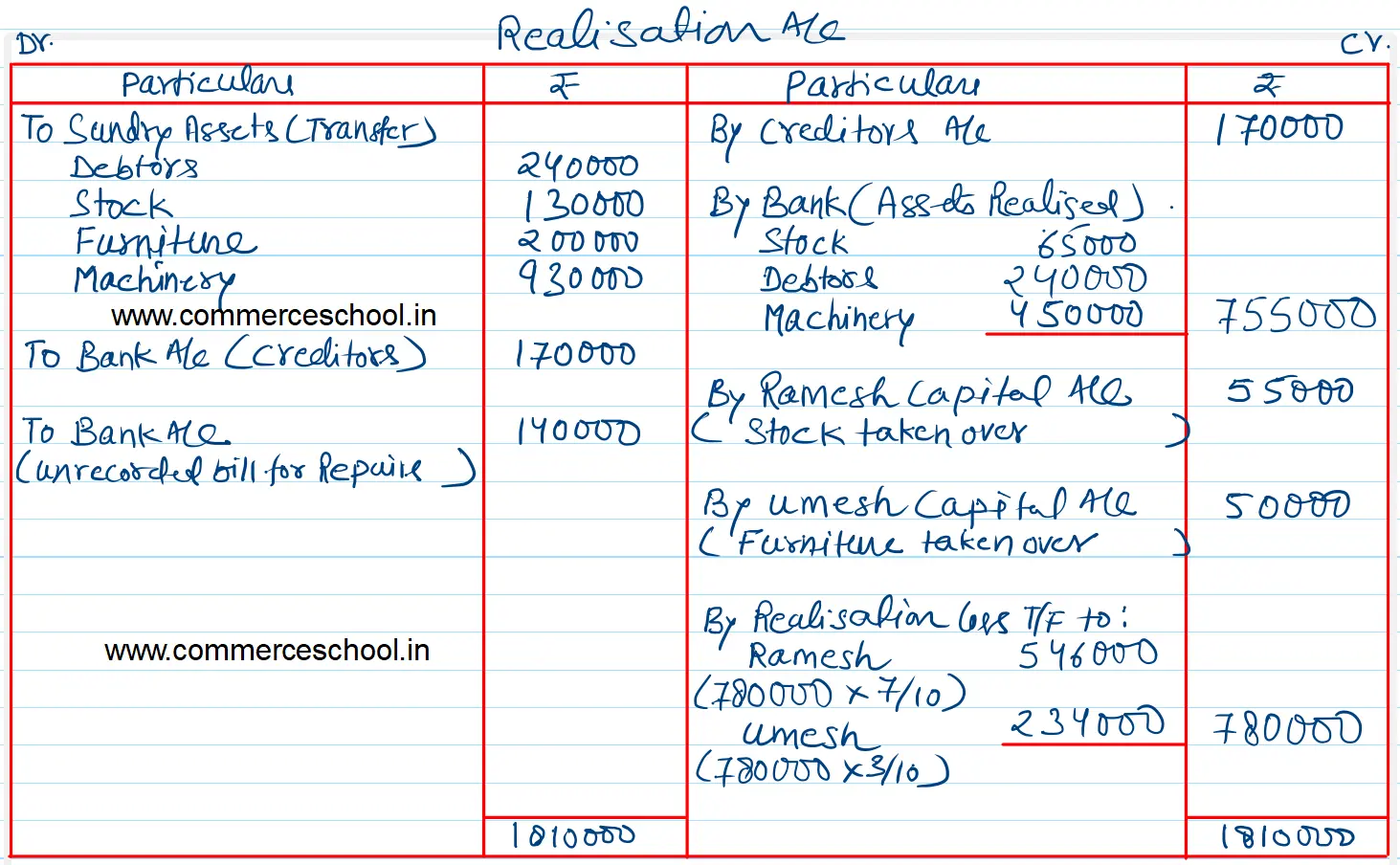

(a) Ramesh took 50% of stock at ₹ 10,000 less than book value.

(b) Furniture was taken by Umesh for ₹ 50,000 and machinery was sold for ₹ 4,50,000.

(c) Creditors were paid in full.

(d) There was an unrecorded bill for repairs for ₹ 1,60,000 which was settled and paid at ₹ 1,40,000.

Prepare Realisation Account.

[Hint: Balance Stock (₹ 65,000) will be realised at Book Value, being tangible asset.]

[Ans.: Loss on Realisation – ₹ 7,80,000.]

Please correct the question add

Debtors was realised at 5%

Corrected

debtors are realised at 5% discount. It was misprinted in the questions.

Sir debtors meh 228000 kasie aya