Ravi and Mukesh were partners in a firm sharing profit and losses equally. On 31st March, 2019 their firm was dissolved. On the date of dissolution their Balance Sheet showed stock of ₹ 60,000 and Creditors of ₹ 70,000

Ravi and Mukesh were partners in a firm sharing profit and losses equally. On 31st March, 2019 their firm was dissolved. On the date of dissolution their Balance Sheet showed stock of ₹ 60,000 and Creditors of ₹ 70,000. After transferring stock and creditors to realisation account the following transactions took place:

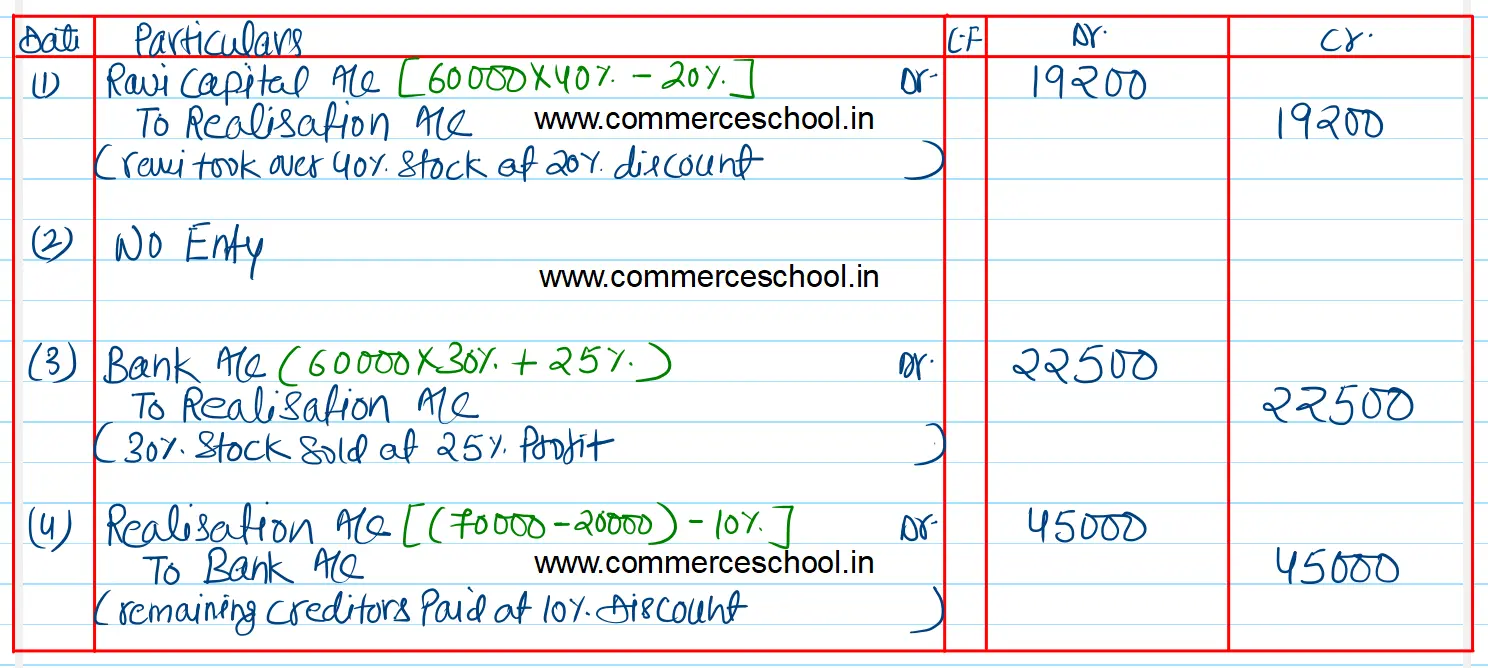

(i) Ravi took over 40% of total stock at 20% discount.

(ii) 30% of total stock was taken over by creditors of ₹ 20,000 in full settlement.

(iii) Remaining stock was sold for cash at a profit of 25%.

(iv) Remaining creditors were paid in cash at a discount of 10%.

Pass necessary journal entries for the above transactions in the books of the firm.

Anurag Pathak Answered question