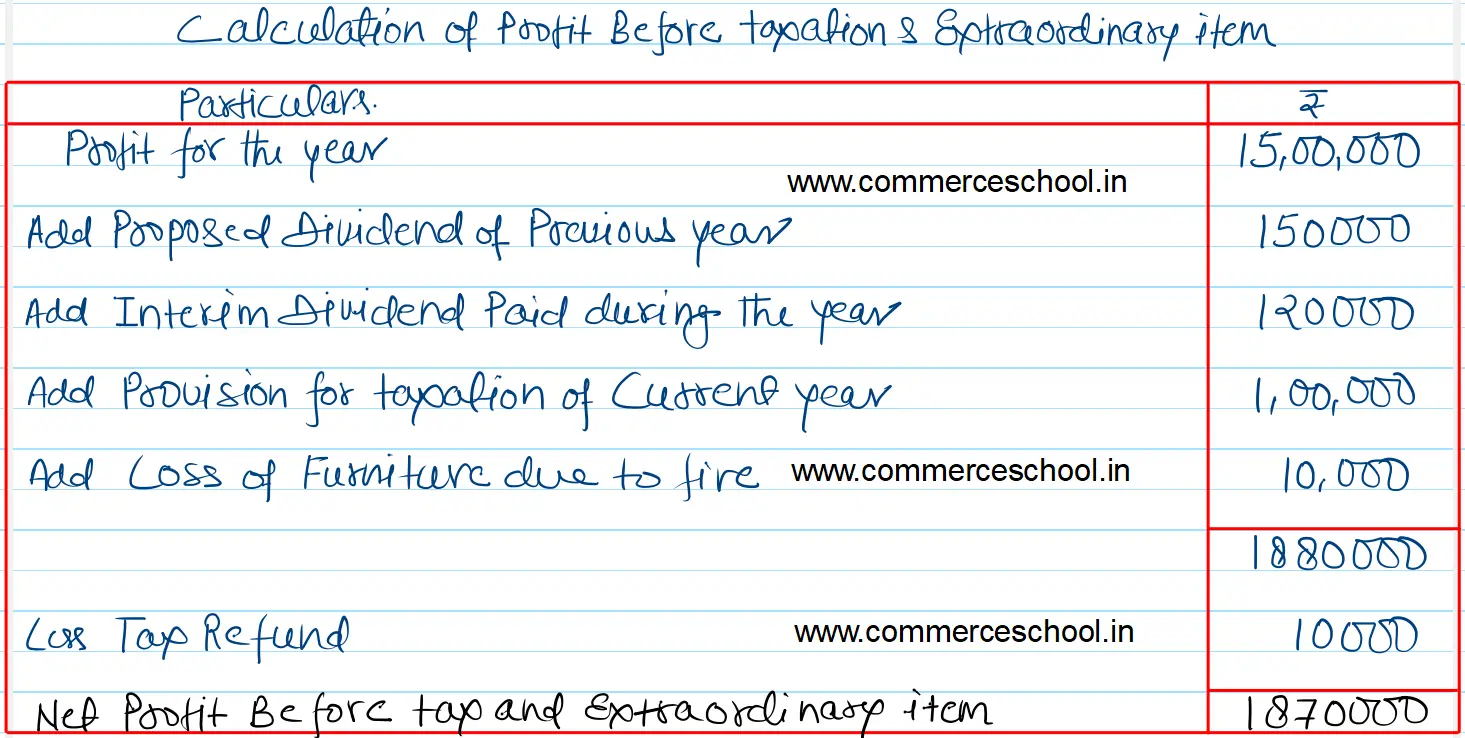

Read the following hypothetical text and answer the given questions on its basis. Profit for the year ended 31st March, 2023 of iPay (a payment processing start up) was ₹ 15,00,000 after accounting the following

Read the following hypothetical text and answer the given questions on its basis. Profit for the year ended 31st March, 2023 of iPay (a payment processing start up) was ₹ 15,00,000 after accounting the following:

| Particulars | ₹ |

|

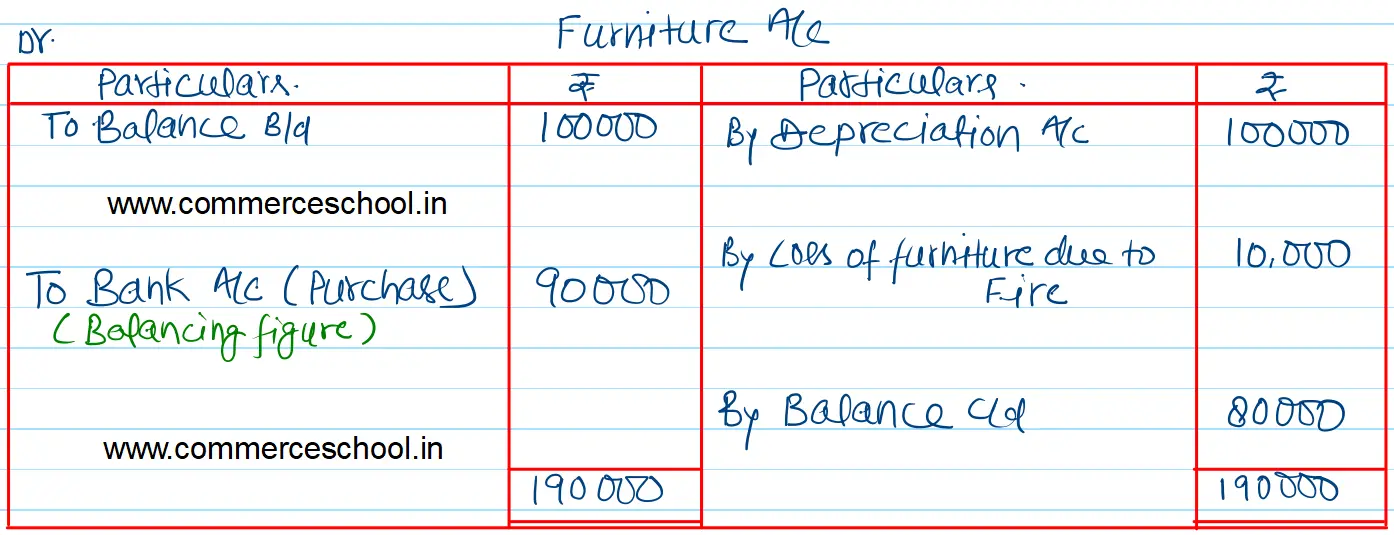

Depreciation Loss of Furniture due to Fire Interest on Investment (Long-term) Tax Refund |

1,00,000 10,000 25,000 10,000 |

Additional Information:-

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

|

Share Capital Securities Premium General Reserve Machinery Furniture Marketable Securities 10% Non-Current Investment Patents Cash in Hand and at Bank Bank overdraft Provision for Tax |

20,00,000 15,00,000 2,50,000 5,00,000 80,000 1,00,000 3,00,000 50,000 50,000 5,00,000 1,00,000 |

15,00,000 20,00,000 2,50,000 3,00,000 1,00,000 – 2,00,000 80,000 1,00,000 7,00,000 75,000 |

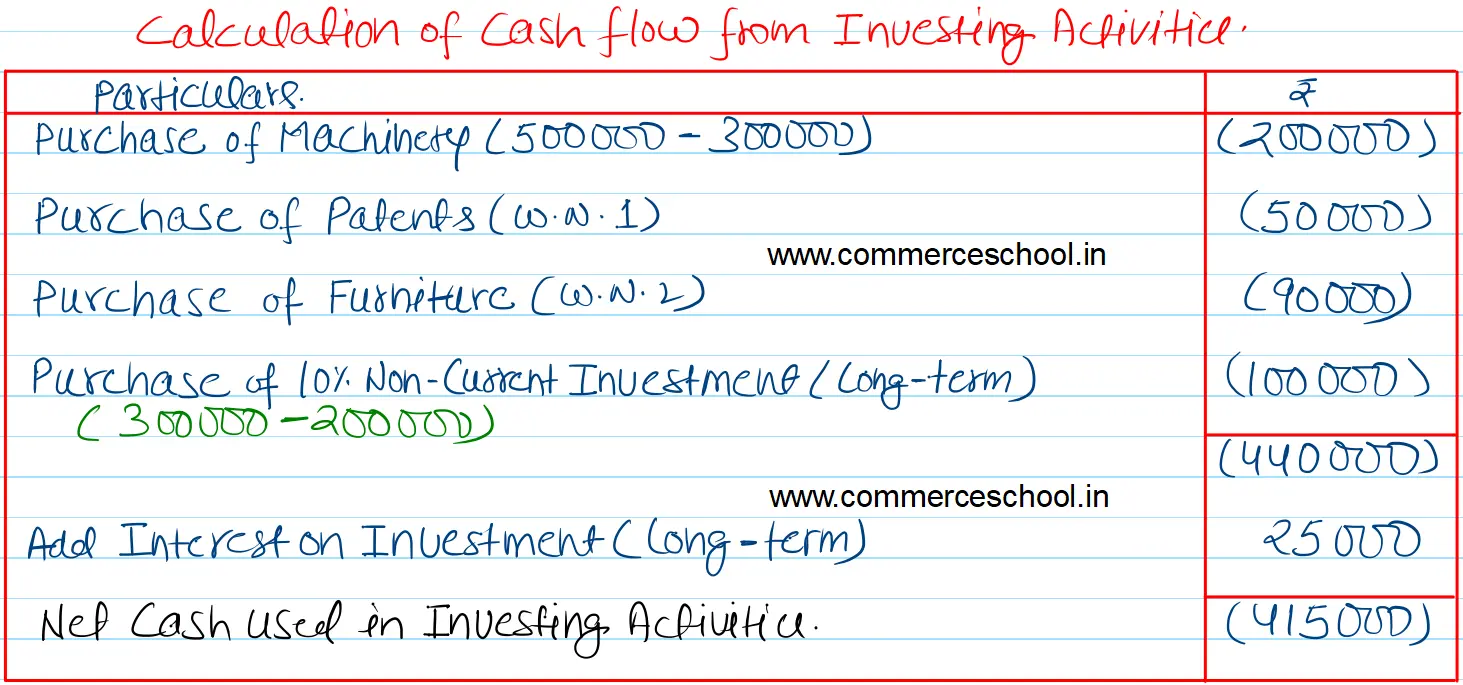

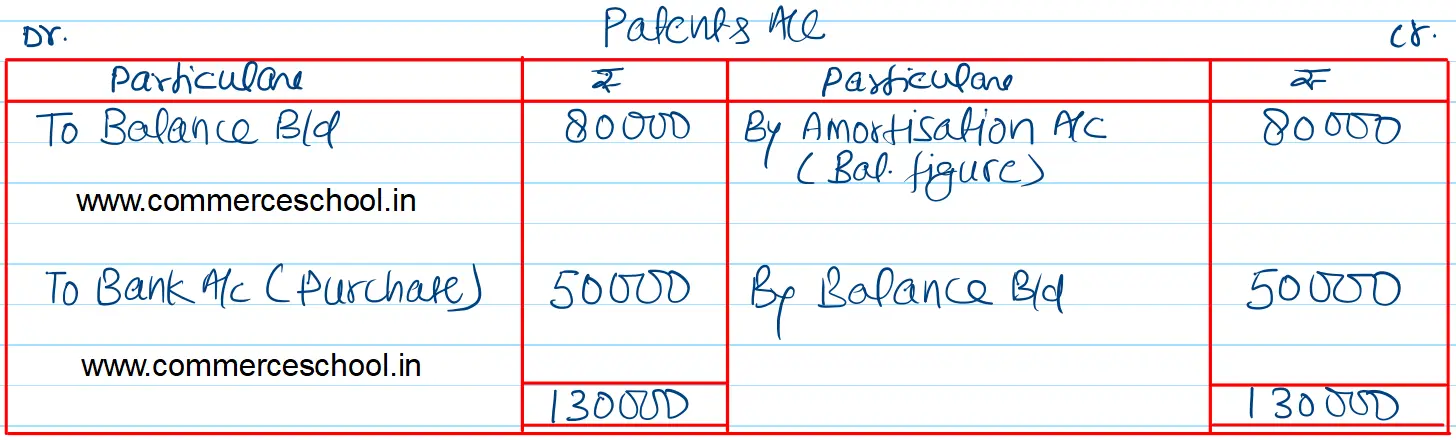

(i) Patents purchased during the year was ₹ 50,000.

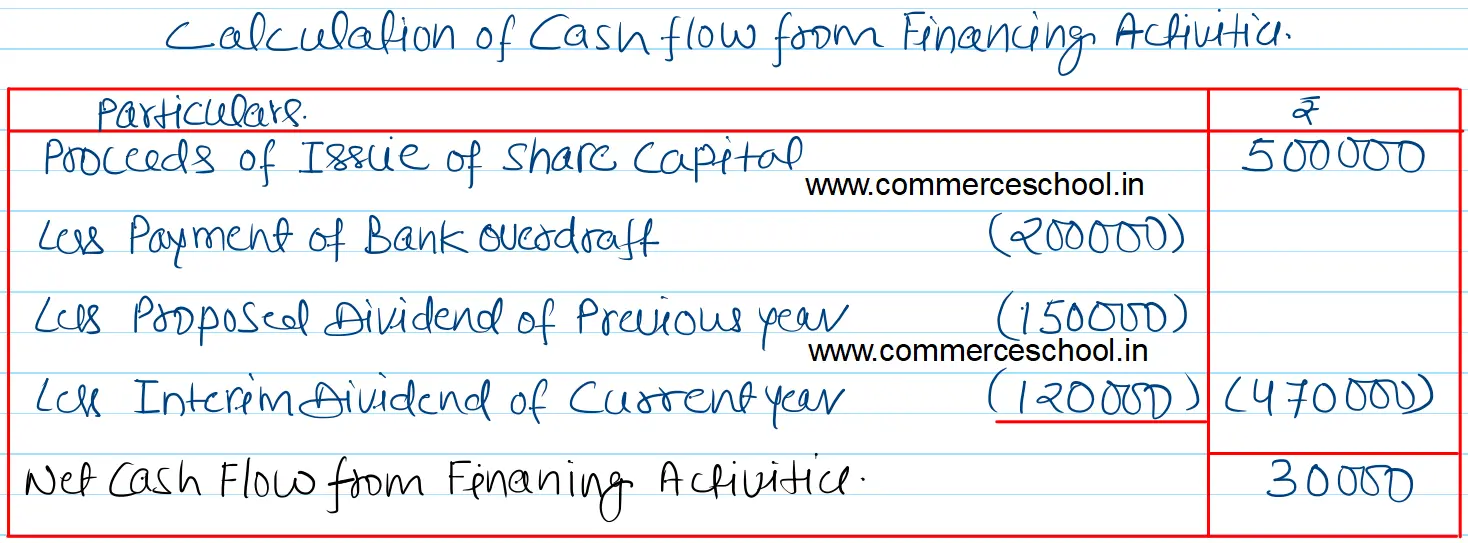

(ii) Proposed Dividend for the year ended 31st March, 2022 and 2023 was ₹ 1,50,000 and ₹ 2,00,000 respectively.

(iii) Interim Dividend during the year ended 31st March, 2022 and 2023 was ₹ 50,000 and ₹ 1,20,000 respectively.

You are required to:

- Determine Net Profit before Tax and Extraordinary Items.

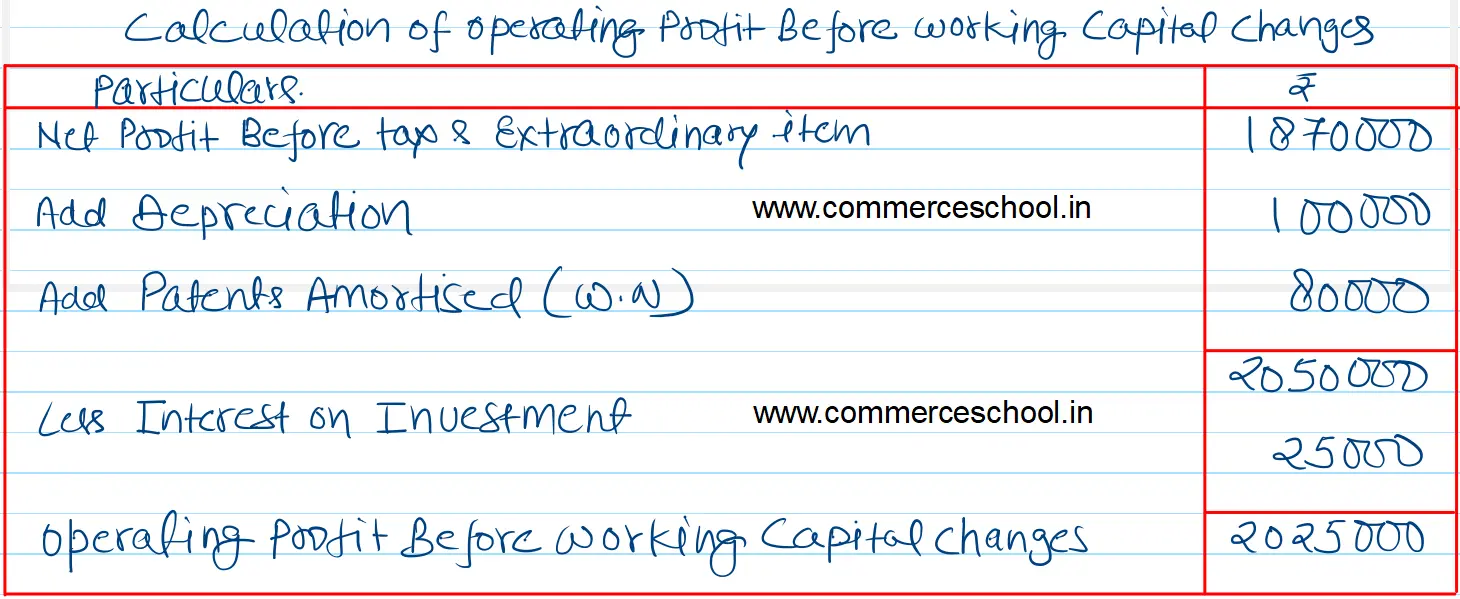

- Determine Operating Profit before Working Capital Changes

- Determine Cash Flow from Investing Activities.

- Determine Cash Flow from Financing Activities

- Determine Cash and Cash Equivalents.

[Ans.: 1. Net Profit before Tax and Extraordinary Items = ₹ 18,70,000; 2. Operating Profit before Working Capital Changes = ₹ 20,25,000; 3. Cash Used in Investing Activities = ₹ 3,25,000; 4. Cash Flow from Financing Activities = ₹ 30,000; 5. Cash and Cash Equivalents = ₹ 1,50,000.]