Rita Geeta and Ashish were partners sharing profits and losses equally. Their Balance Sheet as at 31st March, 2023 is given below:

Rita Geeta and Ashish were partners sharing profits and losses equally. Their Balance Sheet as at 31st March, 2023 is given below:

| Liabilities | ₹ | Assets | ₹ | |

|

Capital A/cs: Rita Geeta Ashish General Reserve Creditors |

50,000 50,000 50,000 15,000 500 |

Machinery Furniture Bills Receivable Stock Debtors Less: PDD Cash at Bank |

45,000 3,000 |

50,000 28,000 21,000 9,500

42,000 15,000 |

| 1,65,500 | 165,500 |

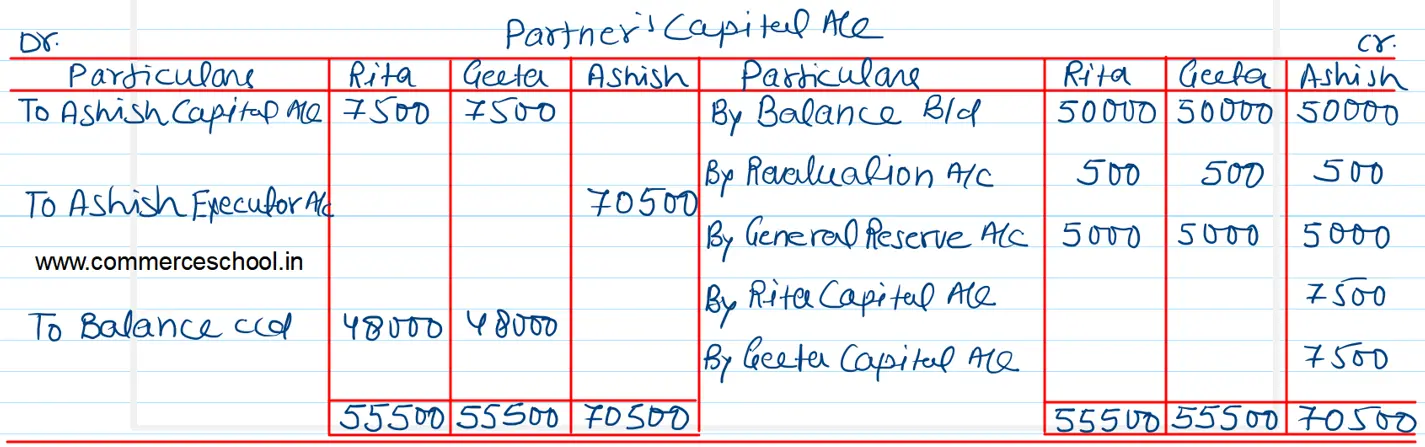

Ashish died on 1st April 2023 and the following agreement was to be put into effect:

(i) Assets were to be revalued: Machinery to ₹ 56,500; Furniture to ₹ 25,000; Stock to ₹ 7,500.

(ii) Goodwill of the firm was to be valued at two year’s purchase of average profit for the last three years which was ₹ 22,500.

(iii) ₹ 10,000 were to be paid to the executor of the deceased partner on 1st April, 2023.

You are required to prepare:

(a) Revaluation Account, (b) Capital Accounts of the partners, and (c) Balance Sheet of the new firm.