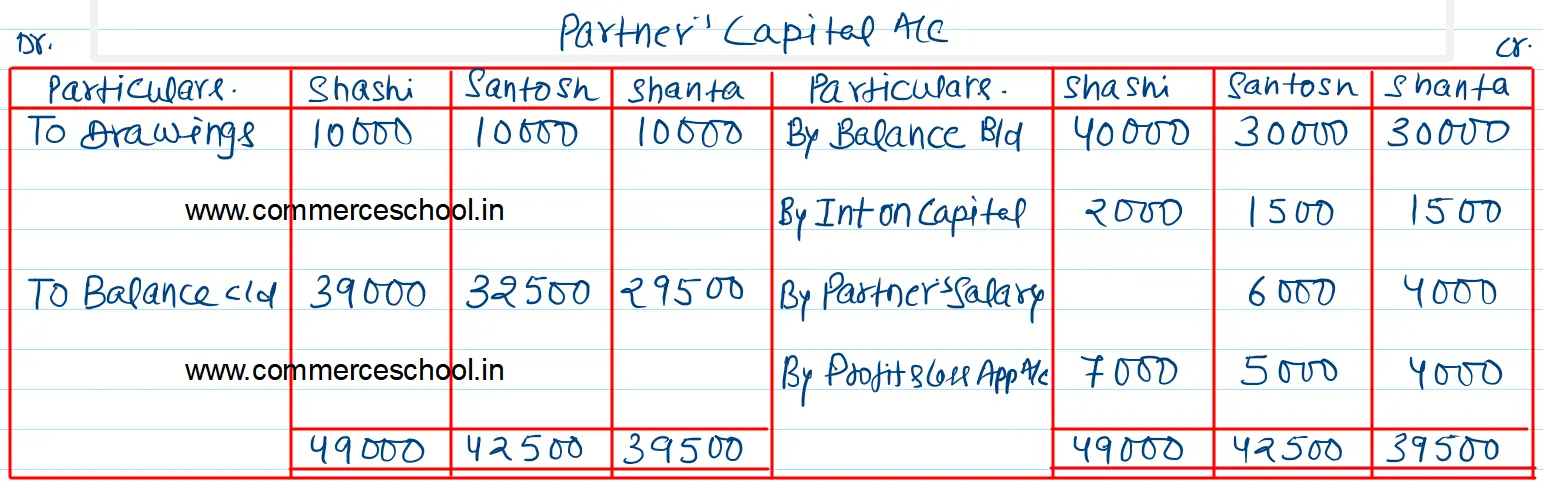

Shashi, Santosh, and Shanta are in partnership, and as at 1st April 2022, their respective capitals were: ₹ 40,000, ₹ 30,000, and ₹ 30,000

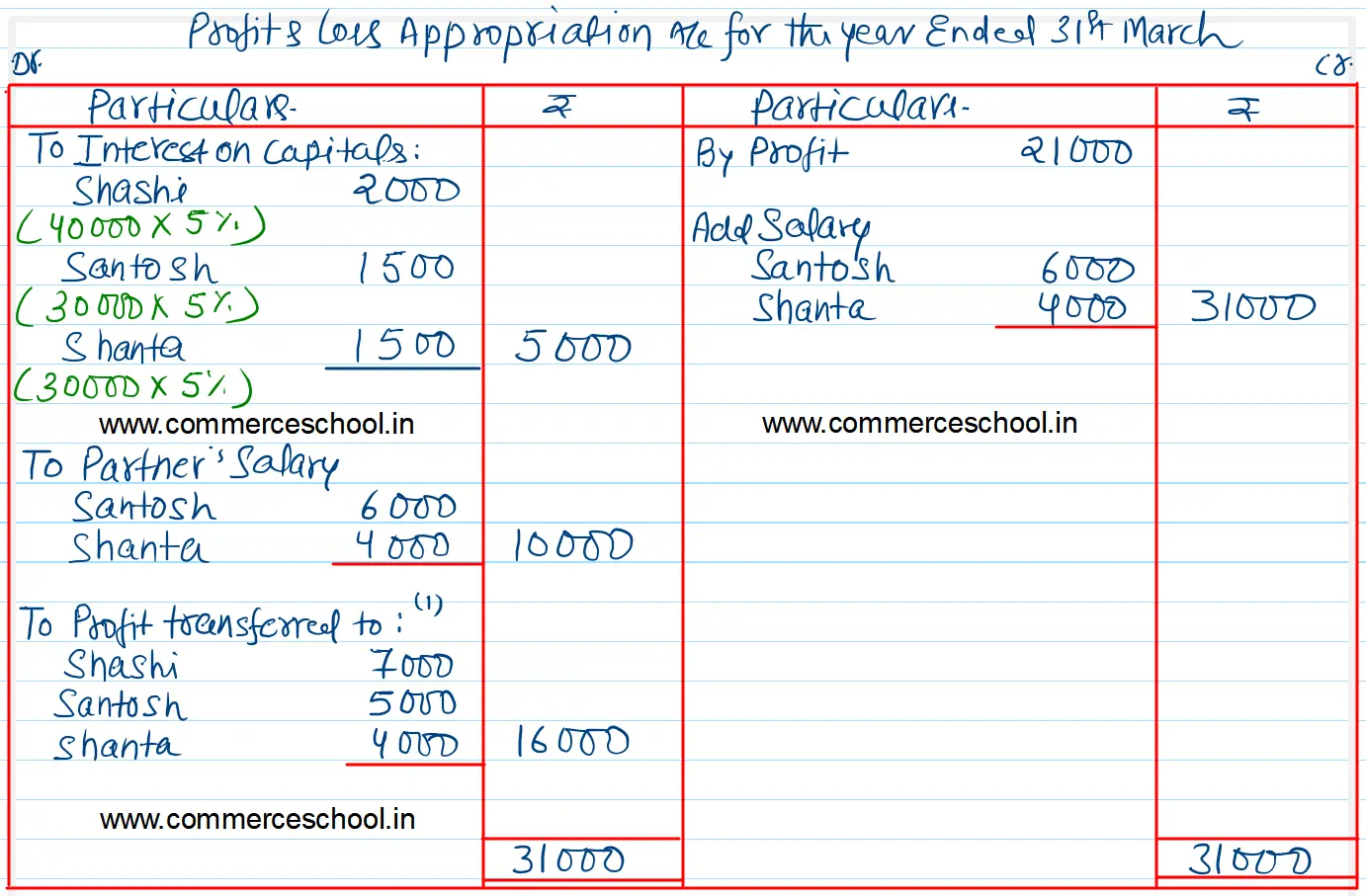

Shashi, Santosh, and Shanta are in partnership, and as at 1st April 2022, their respective capitals were: ₹ 40,000, ₹ 30,000, and ₹ 30,000. Santosh is entitled to a salary of ₹ 6,000 p.a. and Shanta ₹ 4,000 p.a. payable before the division of profit.

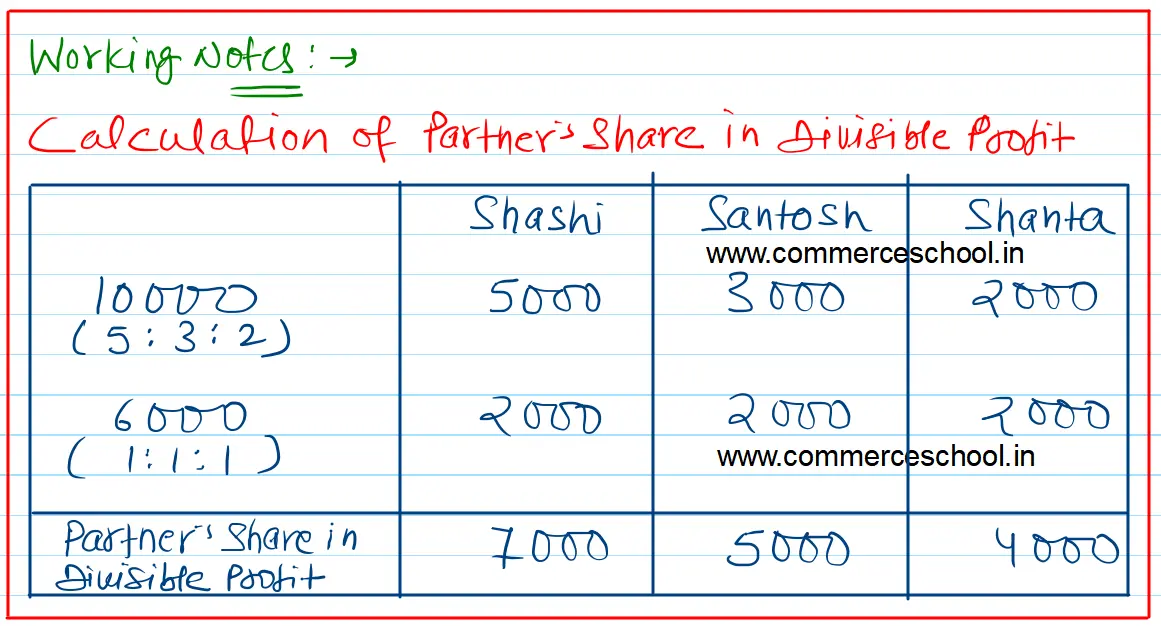

Interest is allowed on capitals @ 5% p.a. and is not charged on drawings. of the divisible profits, Shashi is entitled to 50% of the first ₹ 10,000, Santosh to 30%, and Shanta to 20% over the amount profits are shared equally.

Profit for the year ended 31st March 2023, after debiting partner’s salaries but before charging interest on capital was ₹ 21,000 and the partners had drawn ₹ 10,000 each on account of salaries, interest, and profit.

Prepare a Profit and Loss Appropriation Account showing the distribution of profit and Capital Accounts of the partners.