Shirish, Harit and Asha were partners in a firm sharing profits in the ratio of 5 : 4 : 1. Shirish died on 30th June, 2018. On this date, their Balance Sheet was follows:

Shirish, Harit and Asha were partners in a firm sharing profits in the ratio of 5 : 4 : 1. Shirish died on 30th June, 2018. On this date, their Balance Sheet was follows:

| Liabilities | ₹ | Assets | ₹ |

| Capitals:

Shirish Harit Asha Profit for the year 2017-18 Bills Payable |

1,00,000 2,00,000 3,00,000 80,000 20,000 |

Plant and Machinery

Stock Debtors Cash |

5,60,000 90,000 10,000 40,000 |

| 7,00,000 | 7,00,000 |

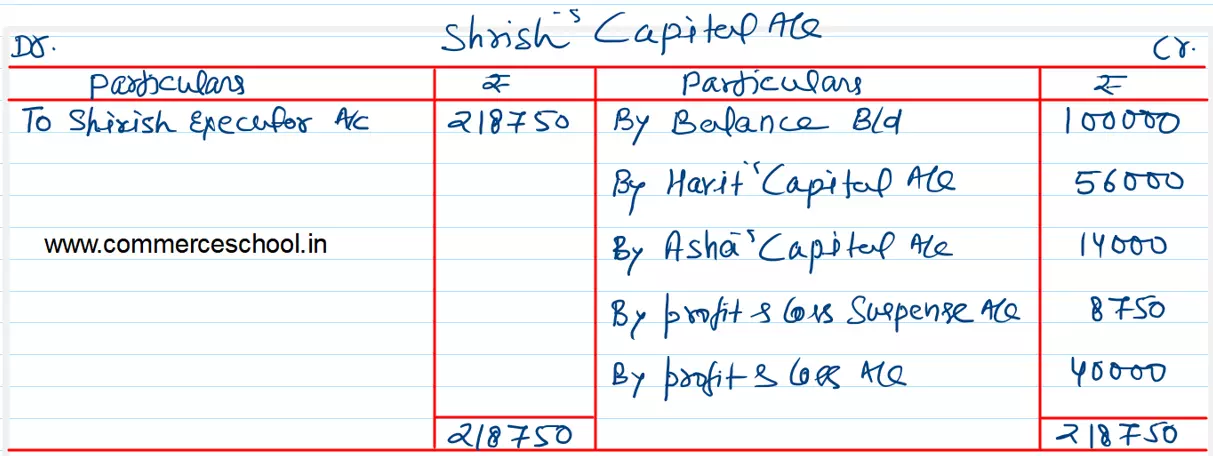

According to the Partnership Deed, in addition to deceased partner’s capital, his executor is entitled to:

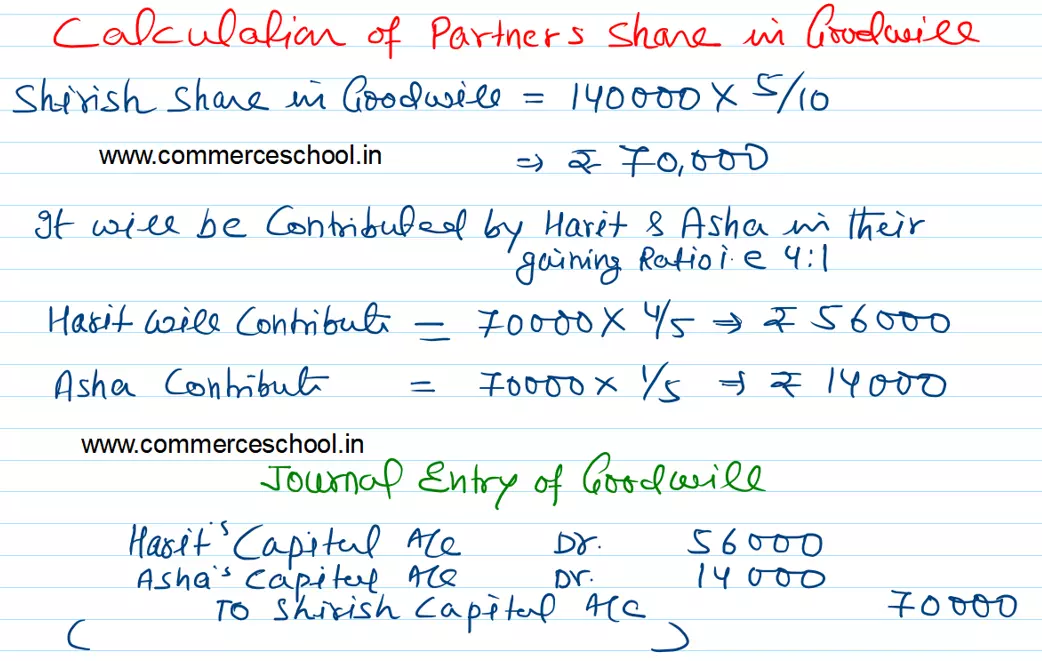

(i) Share in profits in the year of death on the basis of average of last two year’s profit. Profit for the year 2016-17 was ₹ 60,000.

(ii) Goodwill of the firm was to be valued at 2 year’s purchase of average of last two year’s profits.

Prepare Shirish’s Capital Account to be presented to his executor.

[Ans.: Amount due to Shirish’s Executors – ₹ 2,18,750.]