Shiv and Mohan are two partners sharing profits and losses in the ratio of 3:2. On 31st March 2023, their capital Accounts stood at ₹ 55,000 and ₹ 45,000 after distribution of net profit of ₹ 15,000 and due consideration of drawings of the partners for ₹ 6,000 and ₹ 4,000 respectively.

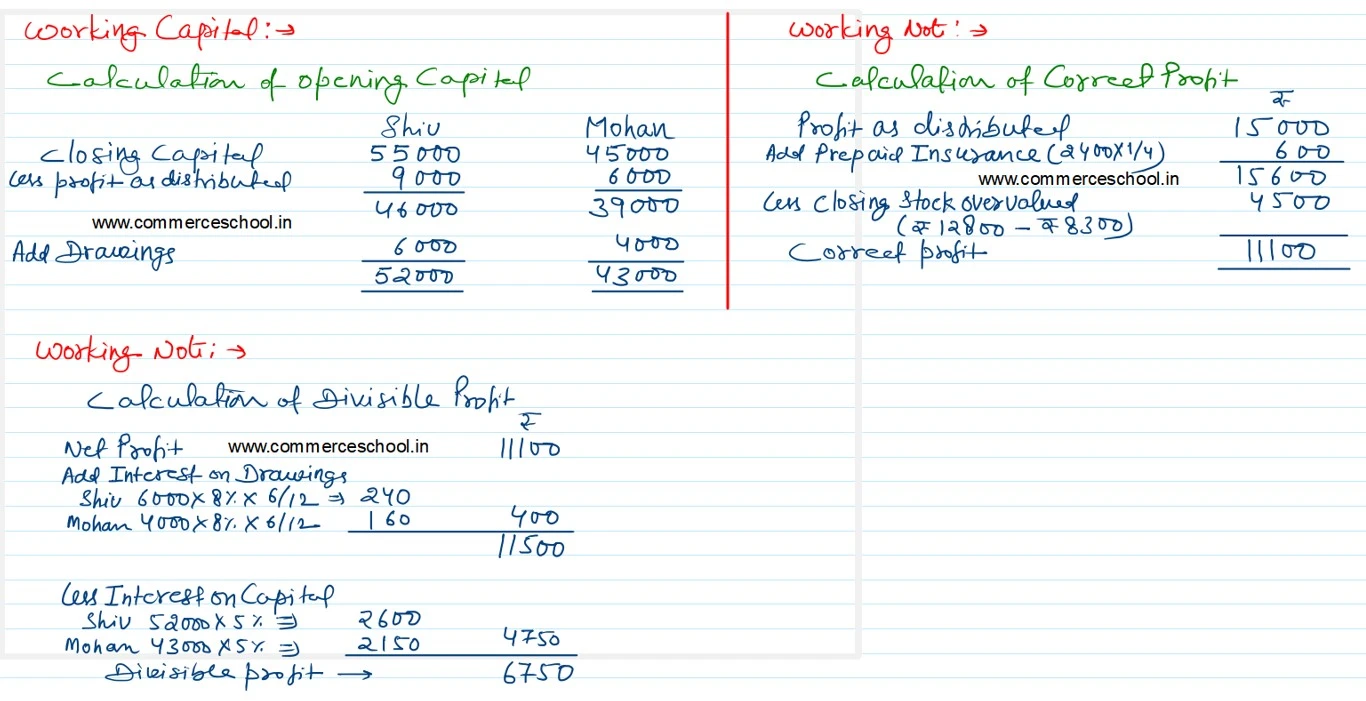

Shiv and Mohan are two partners sharing profits and losses in the ratio of 3:2. On 31st March 2023, their capital Accounts stood at ₹ 55,000 and ₹ 45,000 after distribution of net profit of ₹ 15,000 and due consideration of drawings of the partners for ₹ 6,000 and ₹ 4,000 respectively. After closing the books, the following discrepancies were noticed.

i) An item in the inventory was valued at ₹ 12,800 but had a realizable value of ₹ 8,300.

ii) ₹ 2400 paid for insurance premium for the year ending on 30th June 2023 had been debited to the Profit and Loss Account.

iii) Interest on Capital at 5% on partner’s capital as at the beginning of the year and interest on drawings of partners at 8% p.a. were left out of consideration.

Q. 1 Balance of Opening capital on 1st April 2022

a) ₹ 40,000 (Shiv), ₹ 35,000 (Mohan)

b) ₹ 46,000 (Shiv), ₹ 39,000 (Mohan)

c) ₹ 52,000 (Shiv), ₹ 43,000 (Mohan)

d) ₹ 64,000 (Shiv), ₹ 51,000 (Mohan)

Q. 2 Correct Profit is

a) ₹ 15,500

b) ₹ 11,100

c) ₹ 10,500

d) None of these

Q. 3 Divisible Profit is

a) ₹ 6,350

b) ₹ 6,750

c) ₹ 7,100

d) ₹ 1.15,000