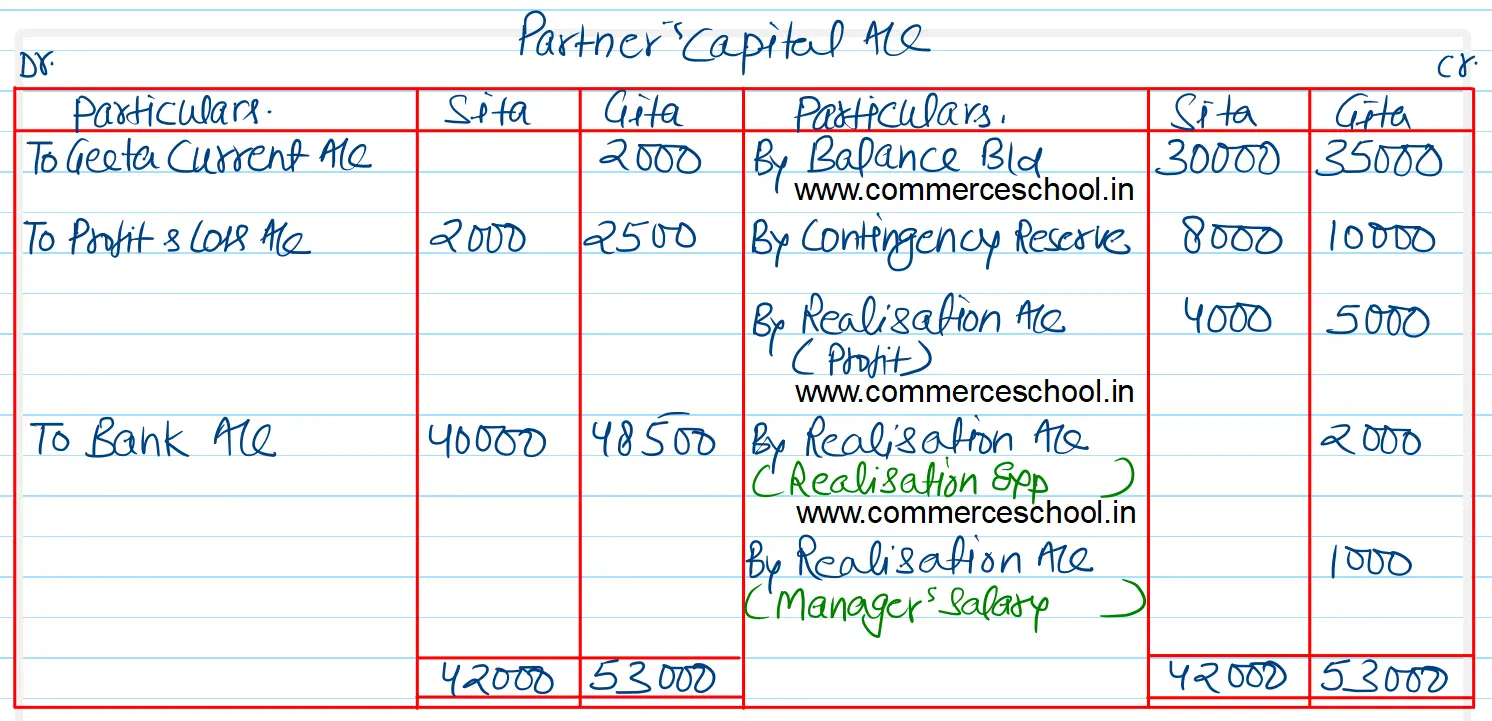

Sita and Gita were partners sharing profits and losses in the ratio of 4 : 5. They dissolved their partnership on 31st March, 2021, when their Balance Sheet showed the following balances

Sita and Gita were partners sharing profits and losses in the ratio of 4 : 5. They dissolved their partnership on 31st March, 2021, when their Balance Sheet showed the following balances:

| Particulars | ₹ |

| Sita’s Capital | 30,000 |

| Gita’s Capital | 35,000 |

| Gita’s Current A/c (Dr.) | 2,000 |

| Contingency Reserve | 18,000 |

| P/L A/c (Dr) | 4,500 |

On the date of dissolution:

(i) The firm, upon realisation of assets and settlement of liabilities, made a profit of ₹ 9,000.

(ii) Gita paid the realisation expenses of ₹ 2,000.

(iii) Gita discharged the outstanding salary of the manager of the firm of ₹ 1,000 which was unrecorded in the books.

You are required to prepare the Partner’s Capital Accounts.

[Ans. Balance of Capital Accounts: Sita ₹ 40,000 and Gita ₹ 48,500.]

Anurag Pathak Changed status to publish