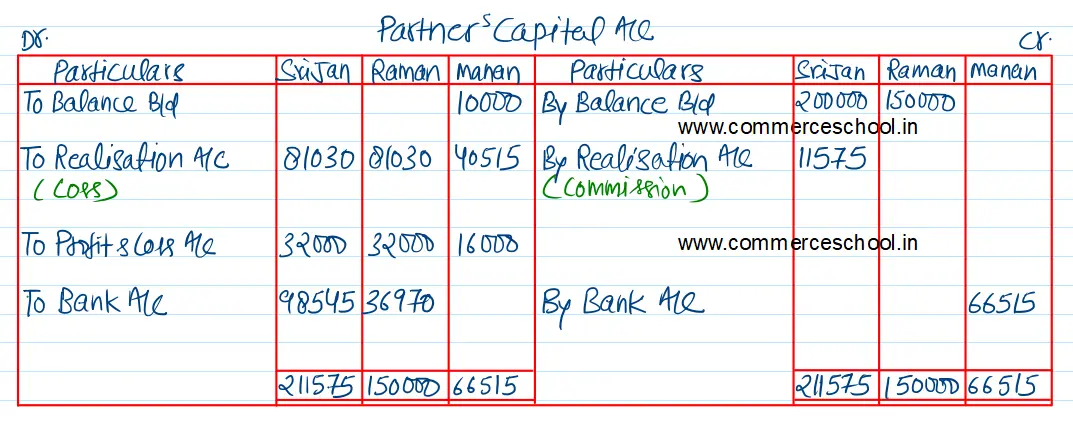

Srijan, Raman and Manan were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. On 31st March, 2017 their Balance Sheet was as follows:

Srijan, Raman and Manan were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. On 31st March, 2017 their Balance Sheet was as follows:

On the above date they decided to dissolve the firm.

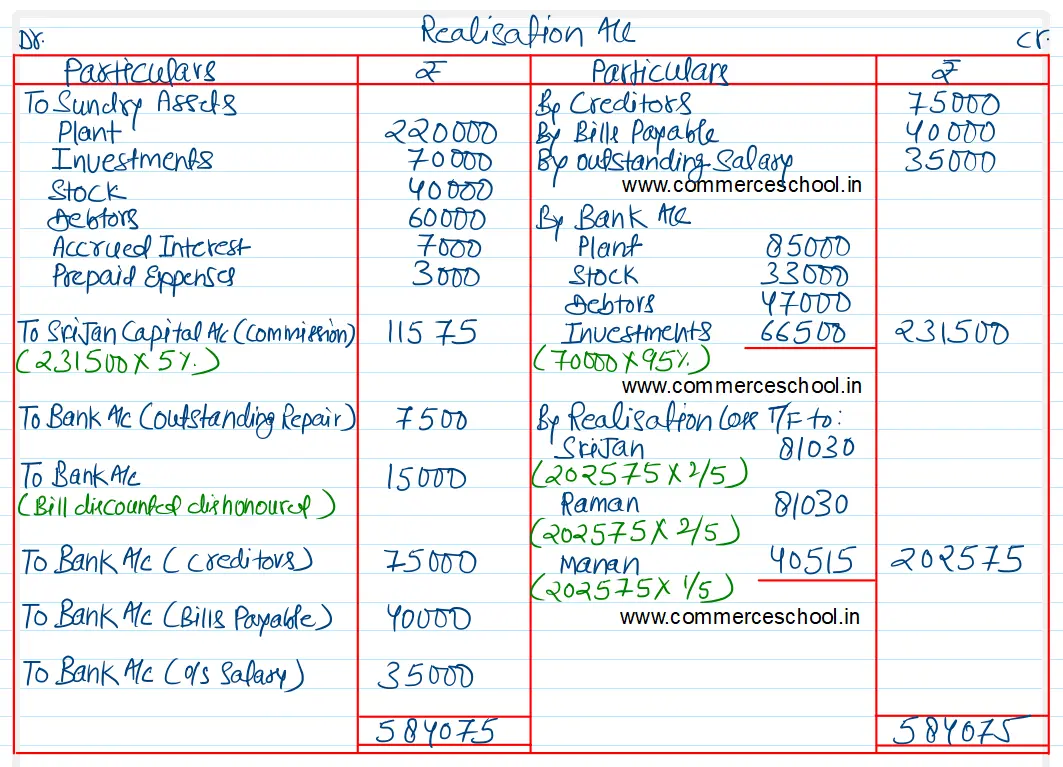

(I) Srijan was appointed to realise the assets and discharge the liabilities. Srijan was to receive 5% commission on sale of assets (except cash) and was to bear all expenses of realisation.

(ii) Assets were realised as follows:

Plant – ₹ 85,000

Stock – ₹ 33,000

Debtors – ₹ 47,000

(iii) Investments were realised at 95% of the book value.

(iv) The firm had to pay ₹ 7,500 for an outstanding repaid bill not provided for earlier.

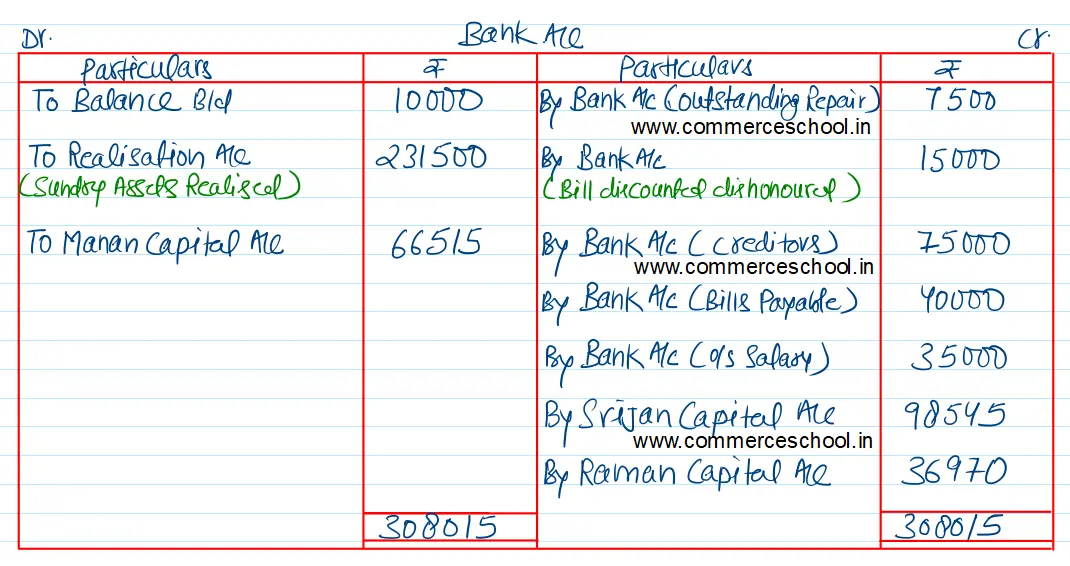

(v) A contingent liability in respect of bills receivable, discounted with the bank had also materialised and had to be discharged for ₹ 15,000.

(vi) Expenses of realisation amounting to ₹ 3,000 were paid by Srijan.

Prepare Realisation Account, Partner’s Capital Accounts and Bank Account.

[Ans. Loss on Realisation ₹ 2,02,575; Cash brought in by Mohan ₹ 66,515; Final Payment to Srijan ₹ 98,545 and Raman ₹ 36,970; Total of Bank Account ₹ 3,08,015.]

Balance Sheet of Srijan, Raman and Manan as at 31.3.2017

| Liabilities | ₹ | Assets | ₹ |

| Capitals: Srijan Raman | 2,00,000 1,50,000 | Capital: Manan | 10,000 |

| Creditors | 75,000 | Plant | 2,20,000 |

| Bills Payable | 40,000 | Investments | 70,000 |

| Outstanding Salary | 35,000 | Stock | 40,000 |

| Debtors | 60,000 | ||

| Accrued Interest | 7,000 | ||

| Prepaid Expenses | 3,000 | ||

| Bank | 10,000 | ||

| Profit and Loss Account | 80,000 | ||

| 5,00,000 | 5,00,000 |

Anurag Pathak Answered question