Sunaina and Tamanna are partners in a firm sharing profits and losses in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2020 stood as follows:

Sunaina and Tamanna are partners in a firm sharing profits and losses in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2020 stood as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Capital A/cs:

Sunaina Tamanna Current A/cs: Sunaina Tamanna General Reserve Workmen Compensation Reserve Creditors |

60,000 80,000 10,000 30,000 1,20,000 50,000 1,50,000 |

Plant and Machinery

Land and Building Debtors Stock Cash Cash Goodwill |

1,90,000

|

1,20,000 1,40,000 1,50,000 40,000 30,000 20,000 |

| 5,00,000 | 5,00,000 |

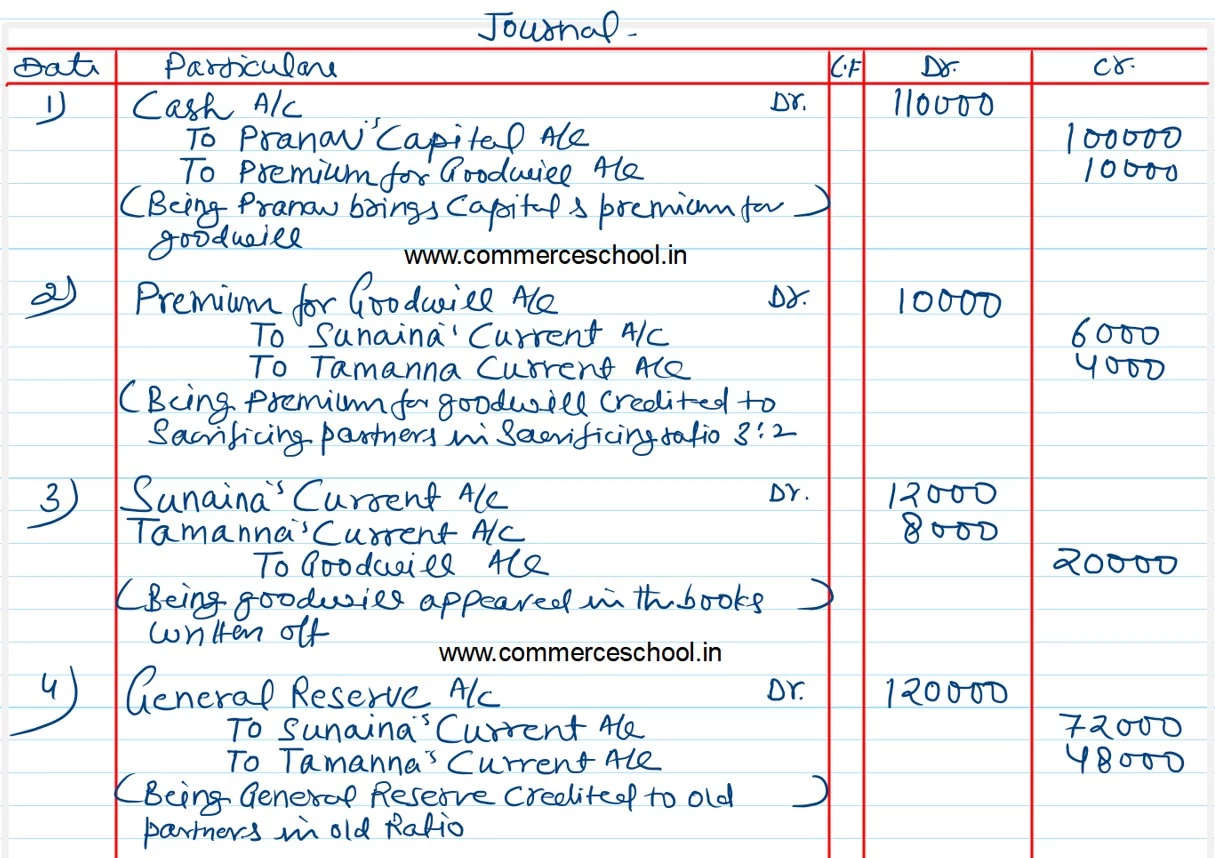

They agreed to admit Pranav into partnership for 1/5th share of profits on 1st April, 2020 on the following terms:

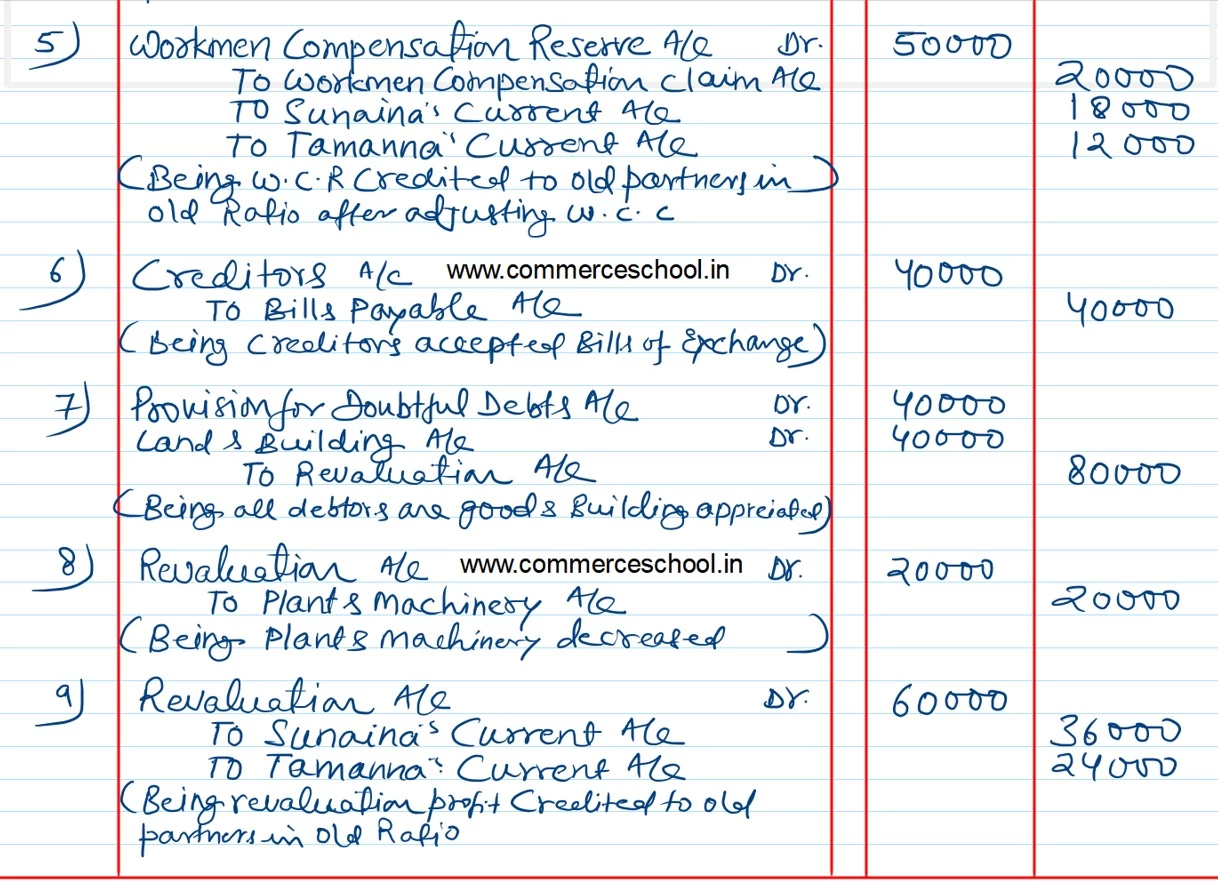

a) All Debtors are good.

b) Value of Land and Building to be increased to ₹ 1,80,000.

c) Value of Plant and Machinery to be reduced by ₹ 20,000.

d) The liability against workmen’s Compensation Fund is determined at ₹ 20,000 which is to be paid later in the year.

e) Anil, to whom ₹ 40,000 were payable (already included in above creditors), drew a bill of exchange for 3 months which was duly accepted.

f) Pranav to bring in capital of ₹ 1,00,000 and ₹ 10,000 as premium for goodwill in cash.

Journalise.

[Ans: Gain on Revaluation – ₹ 60,000; Sacrificing Ratio – 3 : 2.]