Suraj, Pawan and Kamal are partners in a firm sharing profits and losses in the ratio of 3 : 2 : 1. Their Balance Sheet as at 31st March, 2023 is:

Suraj, Pawan and Kamal are partners in a firm sharing profits and losses in the ratio of 3 : 2 : 1. Their Balance Sheet as at 31st March, 2023 is:

| Liabilities | ₹ | Assets | ₹ | |

| Creditors

General Reserve Capital A/cs: Suraj Pawan kamal |

46,000 12,000 40,000 40,000 30,000 |

Cash in Hand

Debtors Stock Furniture Machinery Goodwill |

25,000

|

18,000 22,000 18,000 30,000 70,000 10,000 |

| 1,68,000 | 1,68,000 |

Pawan retired on 1st April, 2023 on the following terms:

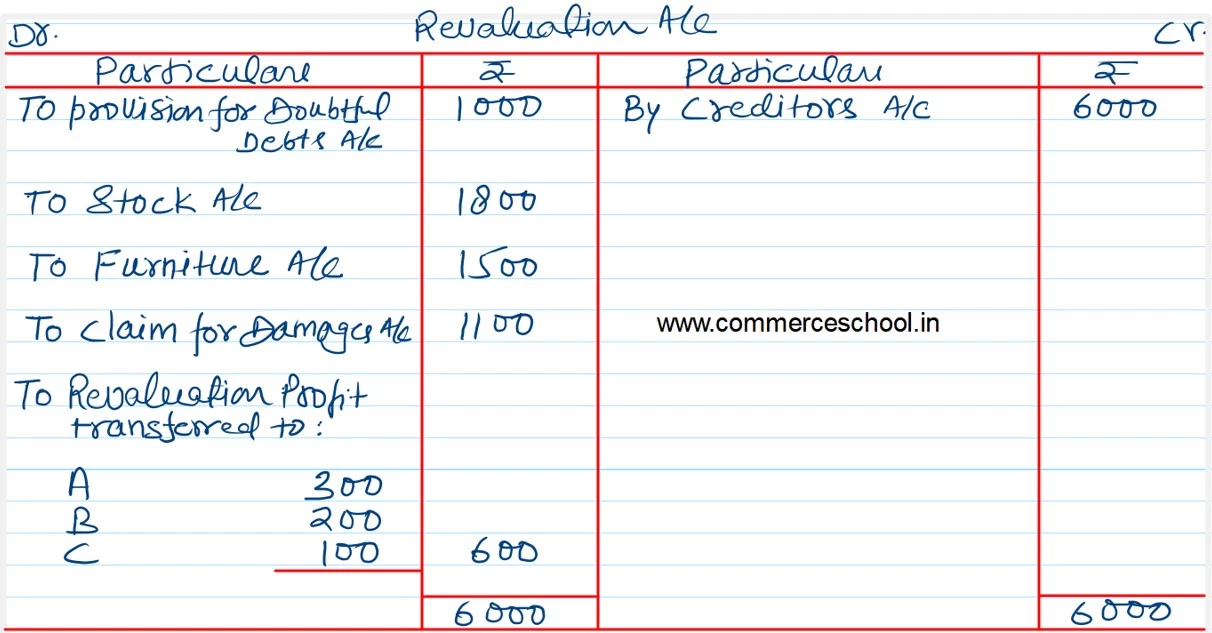

a) Provision for Doubtful Debts be raised by ₹ 1,000.

b) Stock to be reduced by 10% and Furniture by 5%.

c) There is an outstanding claim of damages of ₹ 1,100 and it is to be provided for.

d) Creditors will be written back by ₹ 6,000.

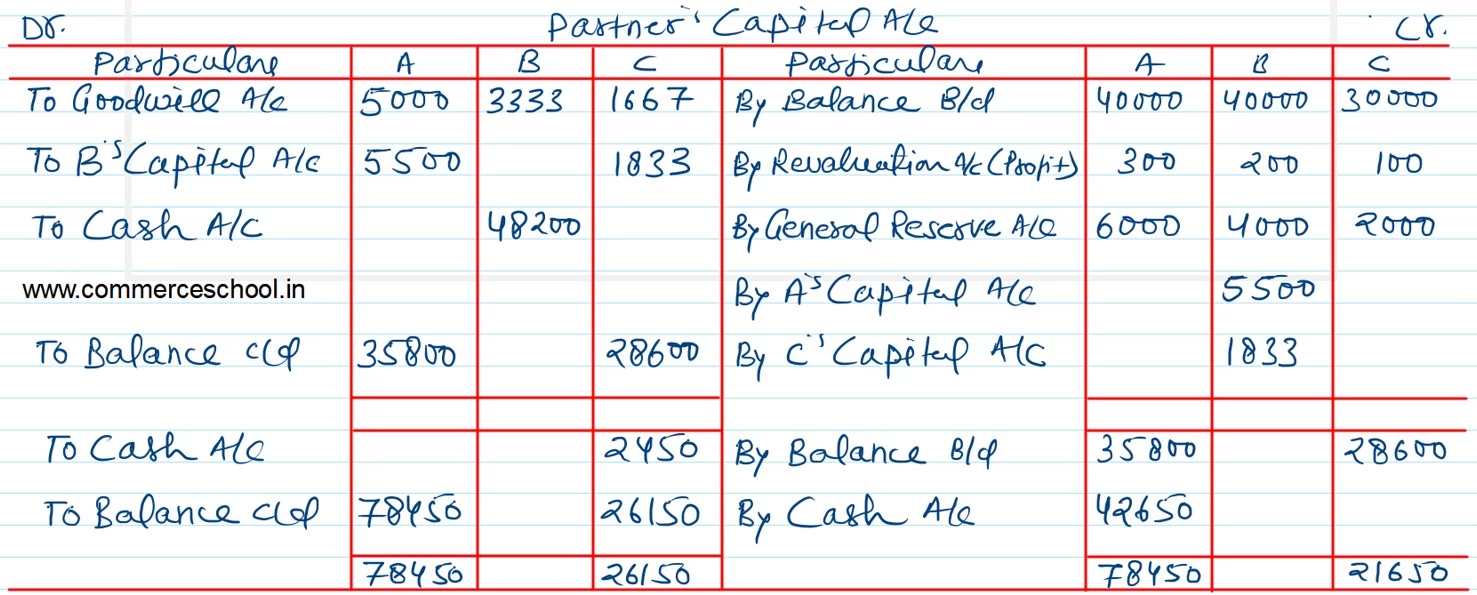

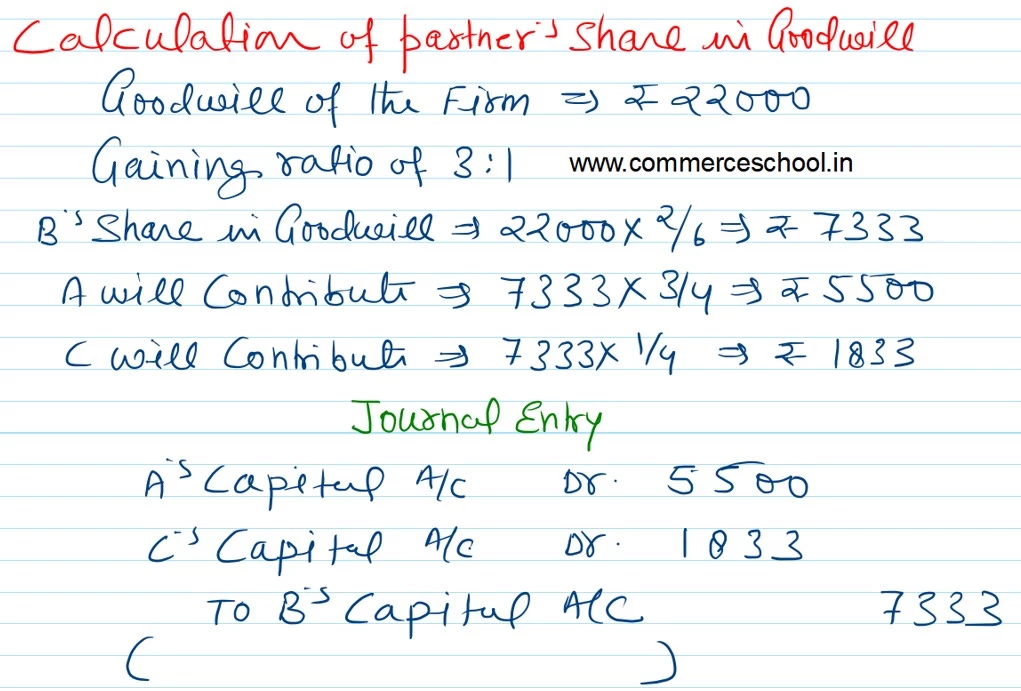

e) Goodwill of the firm is valued at ₹ 22,000.

f) Pawan is paid in full with the cash brought in by Suraj and Kamal in such a manner that their capitals are in proportion to their profit sharing ratio and Cash in Hand remains at ₹ 10,000.

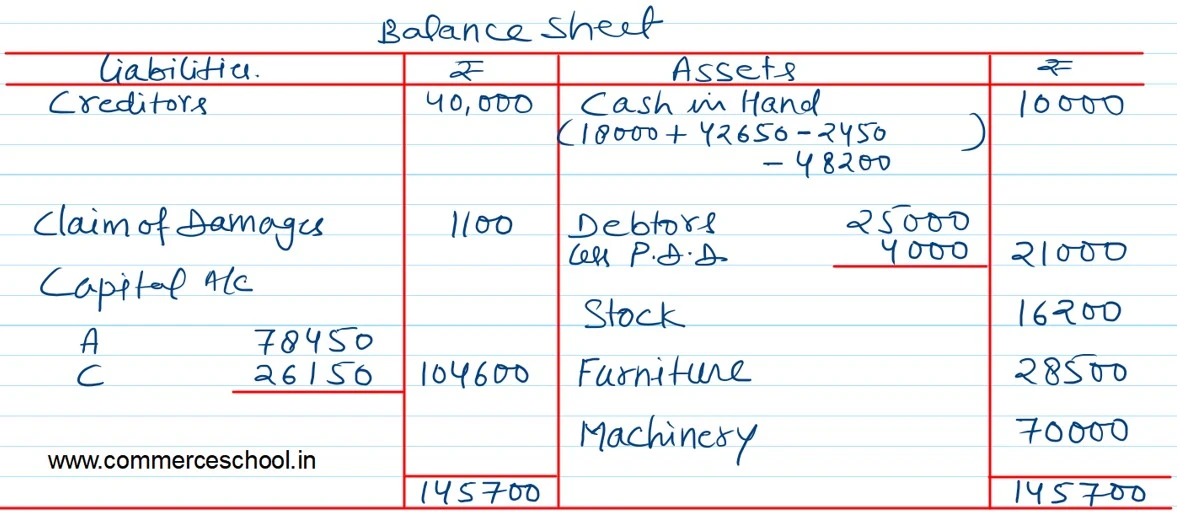

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of Suraj and Kamal.

How creditors are valued 24000 in balance sheet. Why it isn’t 40000.