Susan, Geeta and Rashi are partners sharing profits and losses in the ratio of 5 : 3 : 2. Their Balance Sheet as at 31st March, 2017, is as under:

Susan, Geeta and Rashi are partners sharing profits and losses in the ratio of 5 : 3 : 2. Their Balance Sheet as at 31st March, 2017, is as under:

Balance Sheet of Susan, Geeta and Rashi as at 31st March, 2017

| Sundry Creditors | 50,000 | Cash at Bank | 70,000 |

| Workmen Compensation Reserve | 25,000 |

Sundry Debtors 65,000 Less: Provision for Doubtful Debts (5,000) |

60,000 |

| Employees Provident Fund | 5,000 | Goodwill | 50,000 |

| Bank Loan | 55,000 | Furniture | 1,00,000 |

| Capital A/cs Susan Geeta Rashi | 2,20,000 1,70,000 1,35,000 | Building | 3,80,000 |

| 6,60,000 | 6,60,000 |

The partners decided to dissolve their partnership on 31st March, 2017.

The following transactions took place at the time of dissolution:

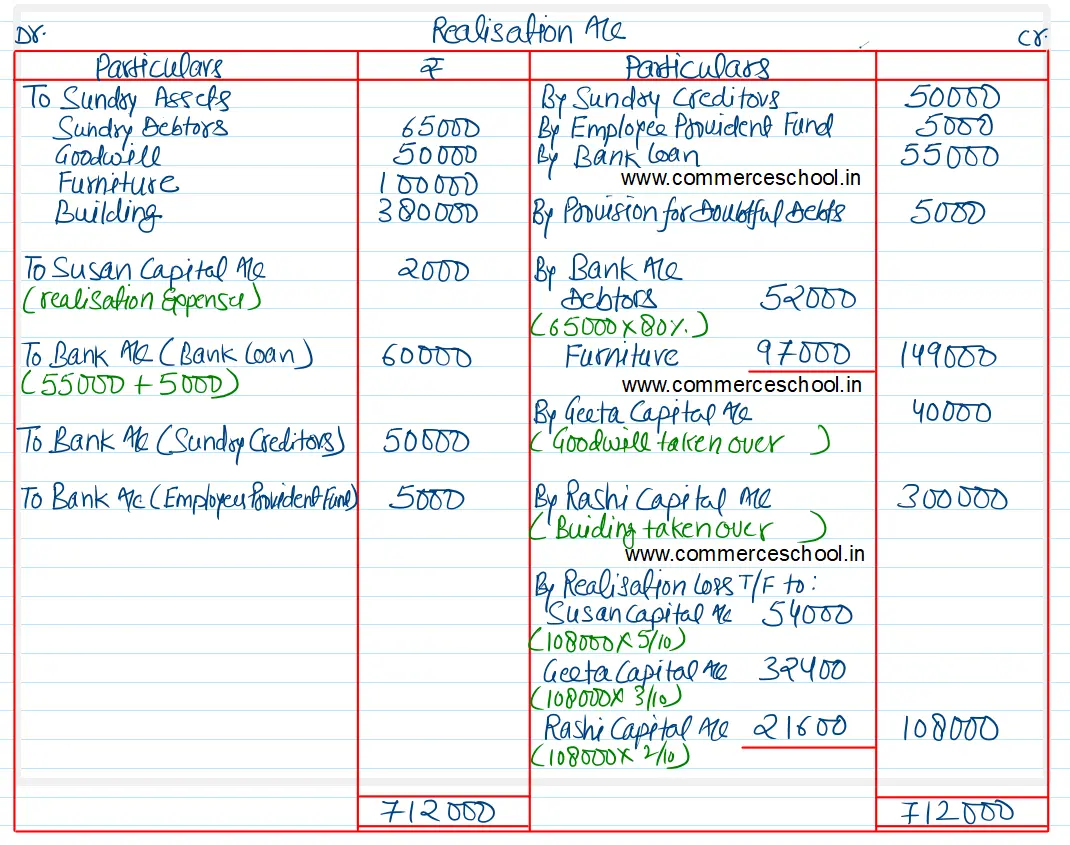

(a) Realization expenses of ₹ 2,000 were paid by Susan on behalf of the firm.

(b) Geeta took over the goodwill for her own business at ₹ 40,000.

(c) Building was taken over by Rashi at ₹ 3,00,000.

(d) Only 80% of the debtors paid their dues.

(e) Furniture was sold for ₹ 97,000.

(f) Bank Loan was settled along with interest of ₹ 5,000.

You are required to prepare the Realization Account.

[Ans. Loss on Realisation ₹ 1,08,000.]