The Balance Sheet of Sadhu, Raja and Karan who were sharing profits in the ratio of 4 : 2 : 4 as at 31st March, 2023 was as follows:

The Balance Sheet of Sadhu, Raja and Karan who were sharing profits in the ratio of 4 : 2 : 4 as at 31st March, 2023 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Bill Payable

Loan General Reserve Capital A/cs: Sadhu Raja karan |

20,000

22,000 10,000 80,000 60,000 1,00,000 |

Cash

Stock Investments Land and Building Sadhu’s Loan |

26,000

64,000 85,000 97,000 20,000 |

| 2,92,000 | 2,92,000 |

Sadhu died on 31st July, 2023. The Partnership Deed provided for the following on the death of a partner.

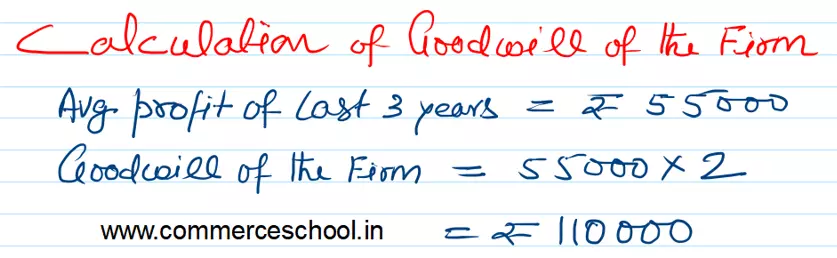

(i) Goodwill of the firm be valued at two year’s purchase of average profits for the last three years.

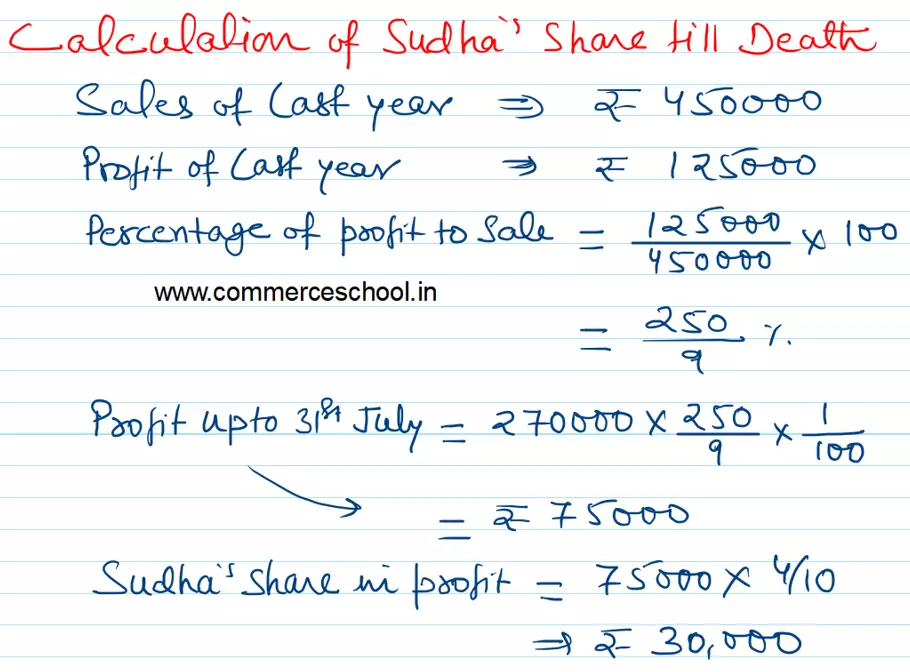

(ii) Sudha’s share of profit or loss till the date of his death was to be calculated on the basis of sales, sales for the year ended 31st March, 2023 amounted to ₹ 4,50,000 and that from 1st April to 31st July, 2023 ₹ 2,70,000. The profit for the year ended 31st March, 2023 was calculated as ₹ 1,25,000.

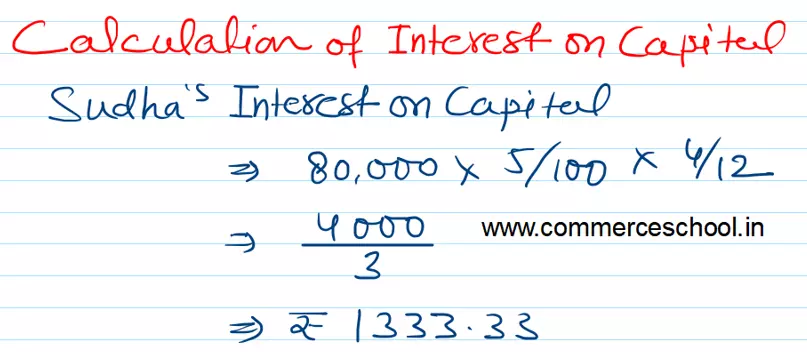

(iii) Interest on capital was to be provided @ 5% p.a.

(iv) The average profits of the last three years were ₹ 55,000.

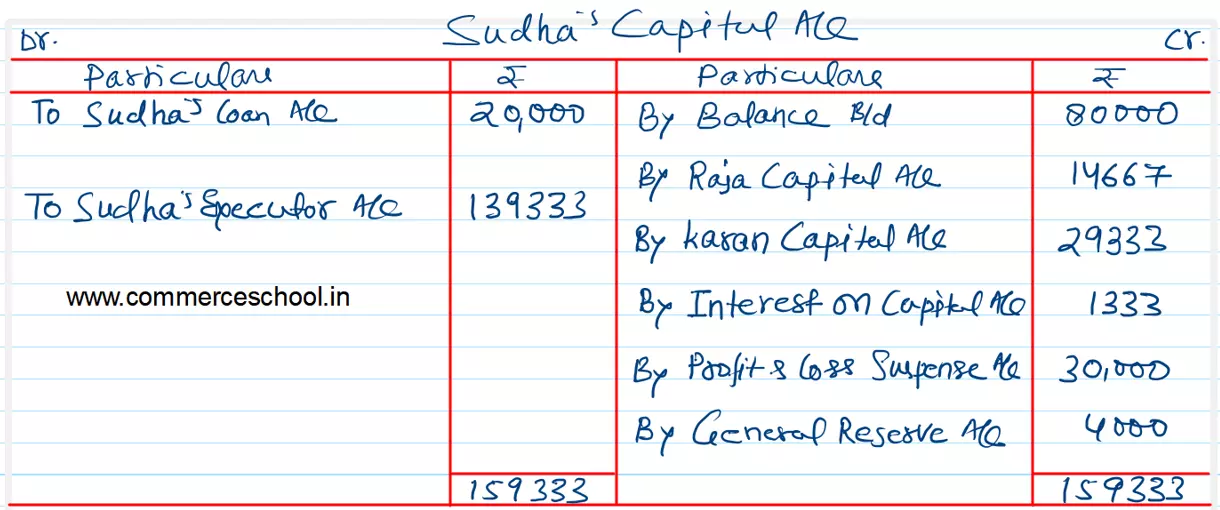

Prepare Sadhu’s Capital Account to be rendered to his executor.

[Ans.: Amount due to Sadhu’s Executors – ₹ 1,39,333.]