The Balance Sheet of X, Y and Z as at 31st March, 2023 was:

The Balance Sheet of X, Y and Z as at 31st March, 2023 was:

| Liabilities | ₹ | Assets | ₹ |

| Bills Payable

Employee’s Provident Fund Workmen Compensation Reserve General Reserve Loans Capital A/cs: X Y Z |

2,000

5,000 6,000 6,000 7,100 22,750 15,250 12,000 |

Cash at Bank

Bills Receivable Stock Sundry Debtors Furniture Plant and Machinery Building Advertisement Suspence A/c |

5,800

800 9,000 16,000 2,000 6,500 30,000 6,000 |

| 76,100 | 76,100 |

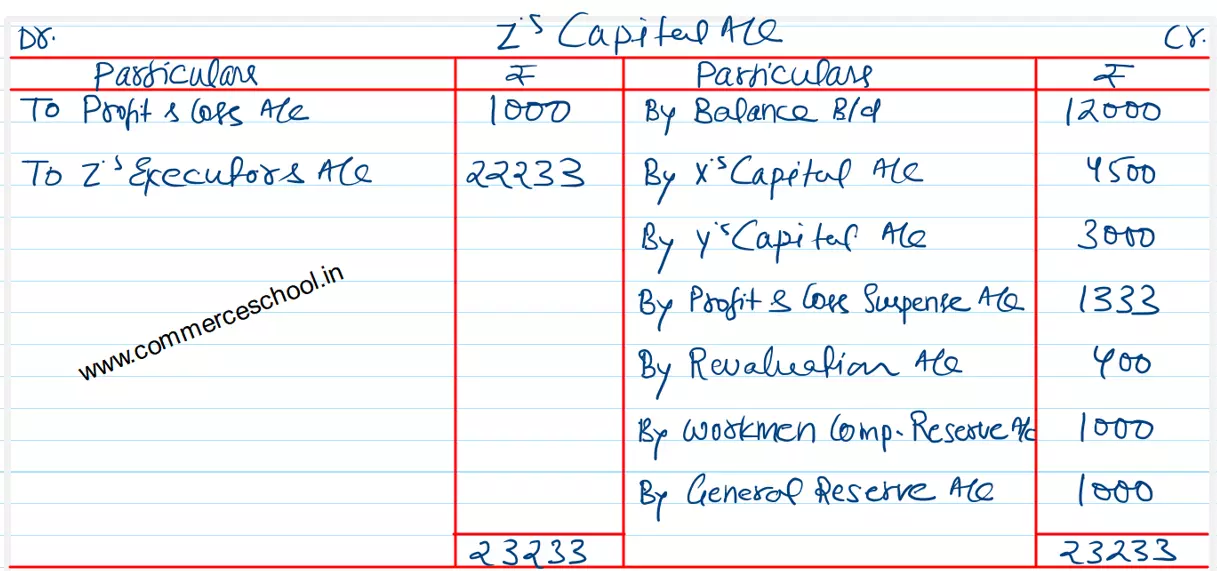

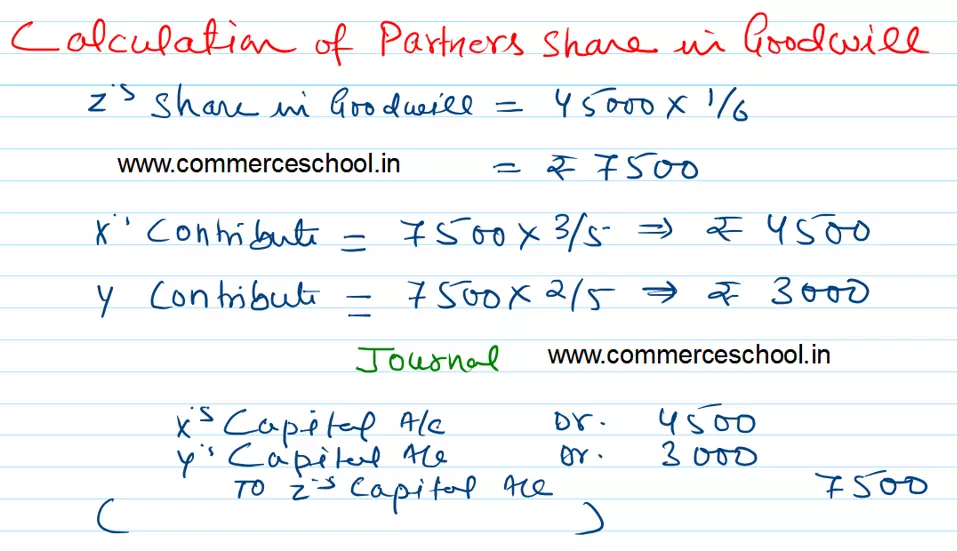

The profit-sharing ratio was 3 : 2 : 1. Z died on 31st July, 2023. The Partnership Deed provided that:

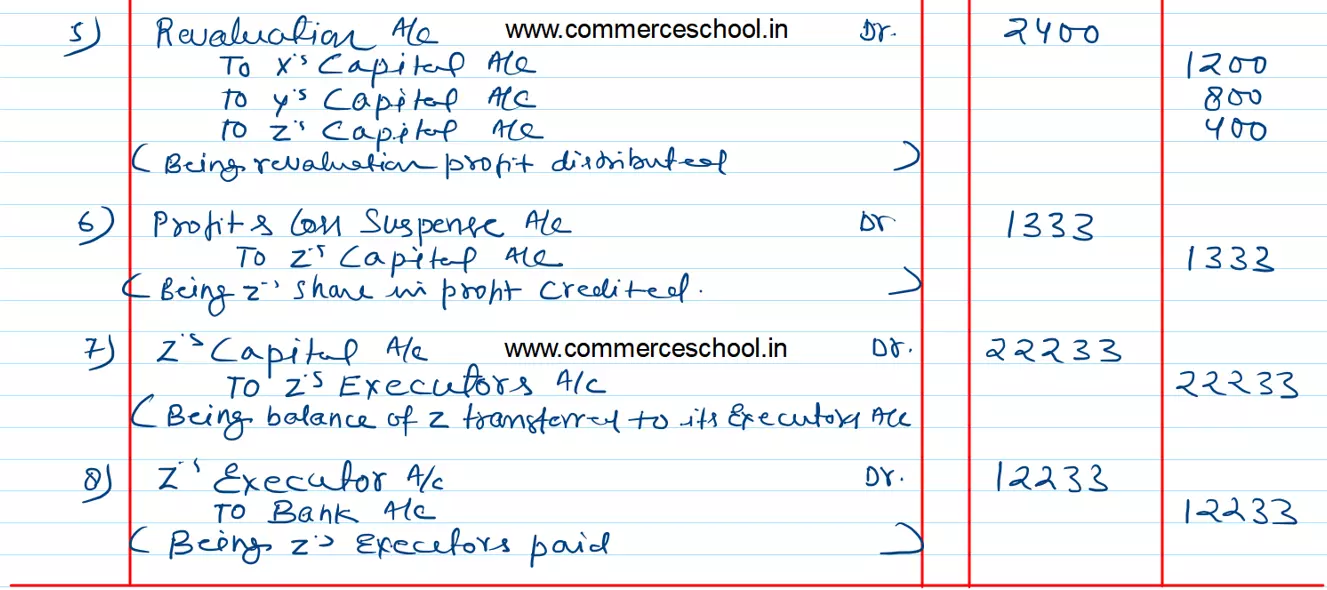

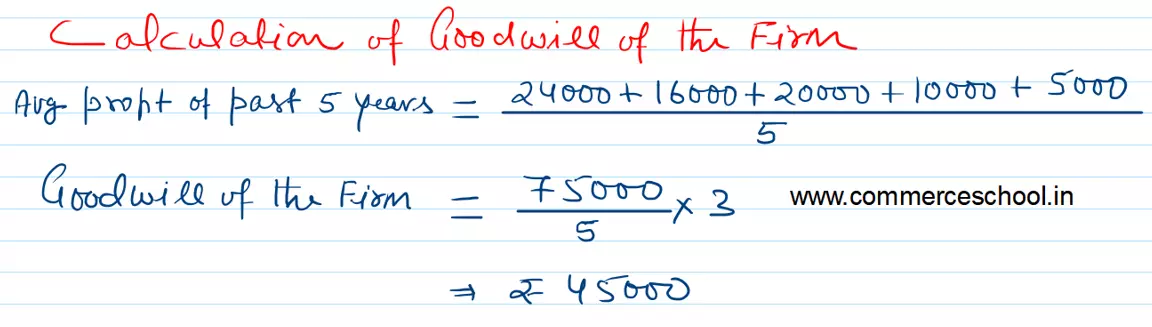

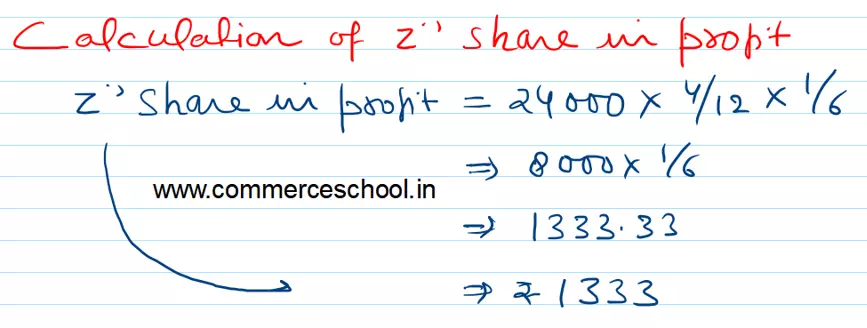

(a) Goodwill is to be calculated on the basis of three year’s purchase of the five year’s average profit. The profits for the years ended 31st March, were: 2023: ₹ 24,000; 2022; ₹ 16,000; 2021: ₹ 20,000; 2020: ₹ 10,000 and 2019: ₹ 5,000.

(b) The deceased partner to be given share of profits till the date of death on the basis of profits for the previous year.

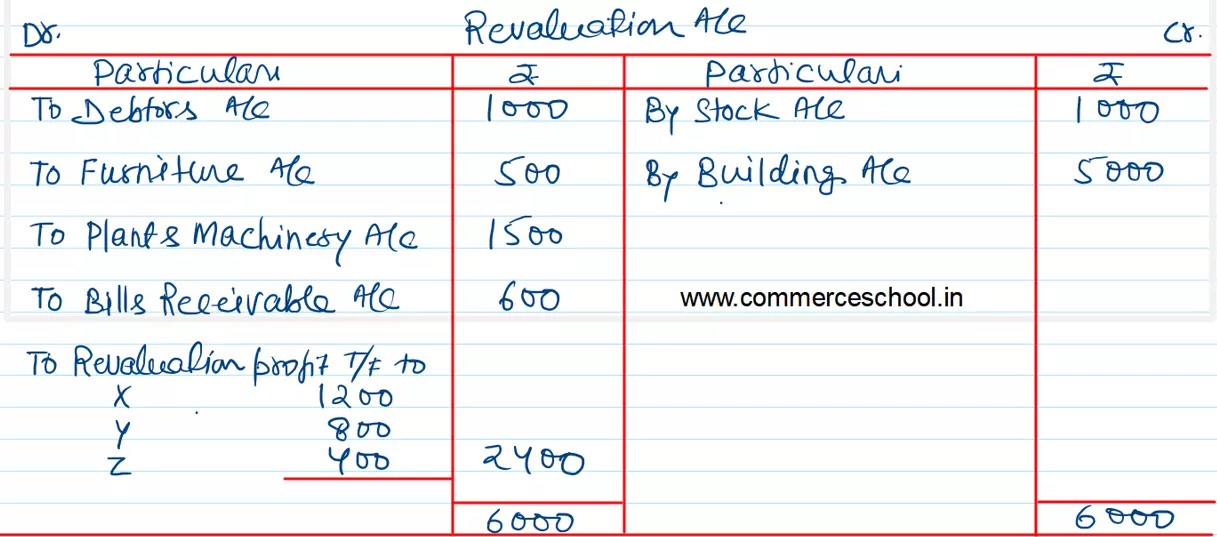

(c) The assets have been revalued as: Stock ₹ 10,000; Debtors ₹ 15,000; Furniture ₹ 15,00; Plant and Machinery ₹ 5,000; Building ₹ 35,000. A Bill Receivable for ₹ 600 was found worthless.

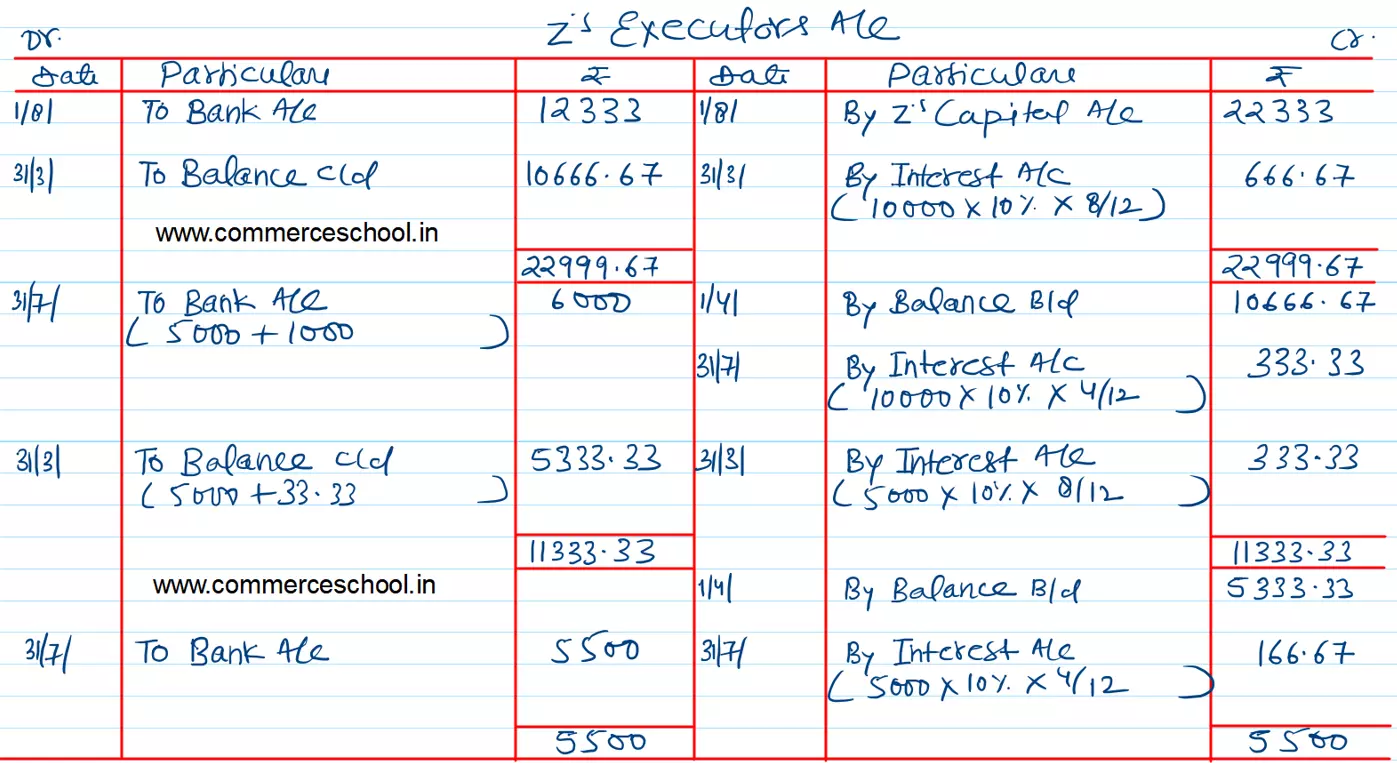

(d) A sum of ₹ 12,233 was paid immediately to Z’s Executors and the balance to be paid in two equal annual instalments together with interest @ 10% p.a. on the amount outstanding.

Give Journal entreis and show the Z’s Executor’s Account till it finally settled.

[Ans.: Gain (Profit) on Revaluation – ₹ 2,400; Amount transferred to Z’s Executor’s Loan A/c – ₹ 10,000.]