The Balance Sheet of A, B and C who were sharing profits in the ratio of 3 : 3 : 4 as at 31st March, 2019 was as follows:

The Balance Sheet of A, B and C who were sharing profits in the ratio of 3 : 3 : 4 as at 31st March, 2019 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| General Reserve

Bills Payable Loan from Bank Capitals: A B C |

40,000

15,000 30,000 60,000 90,000 40,000 |

Cash

Stock Investments Land and Buildings |

4,000

43,000 70,000 1,58,000 |

| 2,75,000 | 2,75,000 |

A died on 1st October, 2019. The partnership deed provided for the following on the death of a partner.

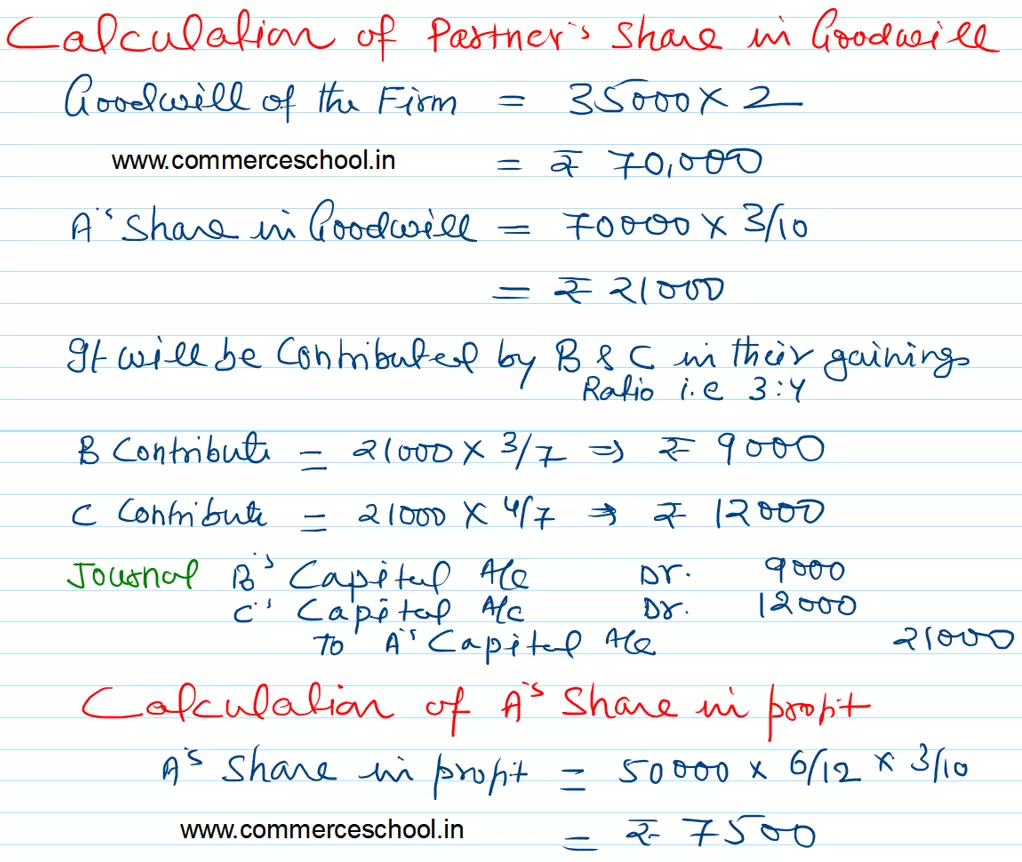

a) Goodwill of the firm be valued at two year’s purchase of average profits for the last three years.

b) The profit for the year ending 31st March, 2019 was ₹ 50,000.

c) Interest on Capital was to be provided @ 6% p.a.

c) The average profits of the last three years were ₹ 35,000.

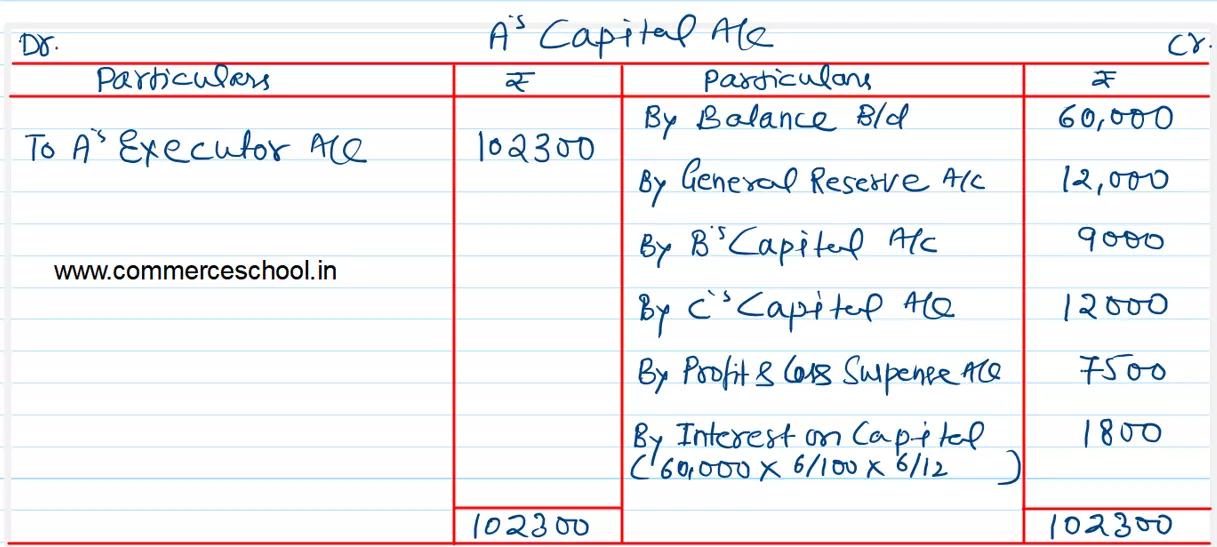

Prepare A’s Capital Account to be rendered to hs executors.

[Ans.: Transferred to A’s Excecutor’s Account – ₹ 1,02,300.]