The Balance Sheet of X, Y and Z who share profits and losses in the ratio of 3 : 2 : 1, as on 1st April, 2023 is as follows:

The Balance Sheet of X, Y and Z who share profits and losses in the ratio of 3 : 2 : 1, as on 1st April, 2023 is as follows:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs:

X Y Z Current A/cs: X Z General Reserve Profit and Loss A/c Creditors |

1,75,000 1,50,000 1,25,000

4,000 6,000 15,000 7,000 1,25,000 |

Y’s Current Account

Land and Building Plant and Machinery Furniture Investment Sundry Debtors Stock Bank |

7,000 1,75,000 67,500 80,000 36,500 60,000 1,37,000 43,500 |

| 6,07,000 | 6,07,000 |

On the above date, W is admitted as a partner on the following terms:

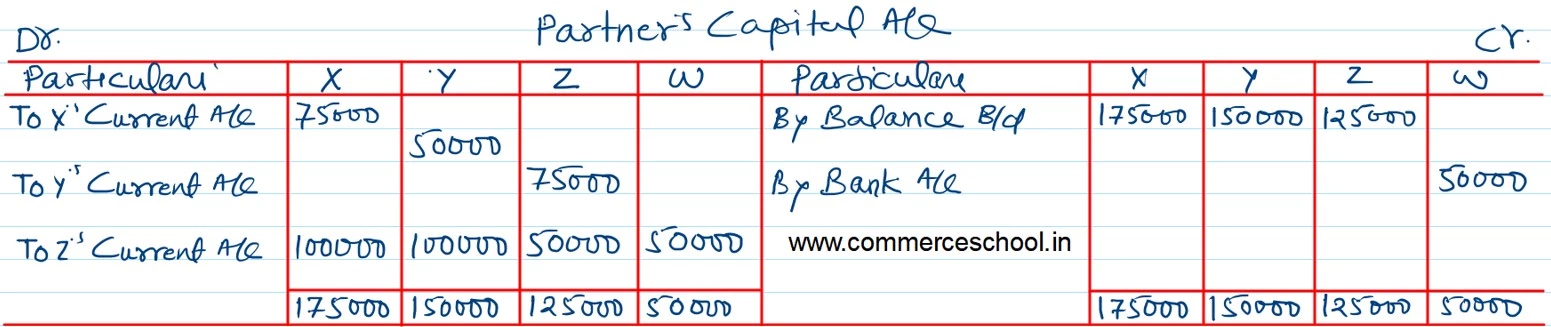

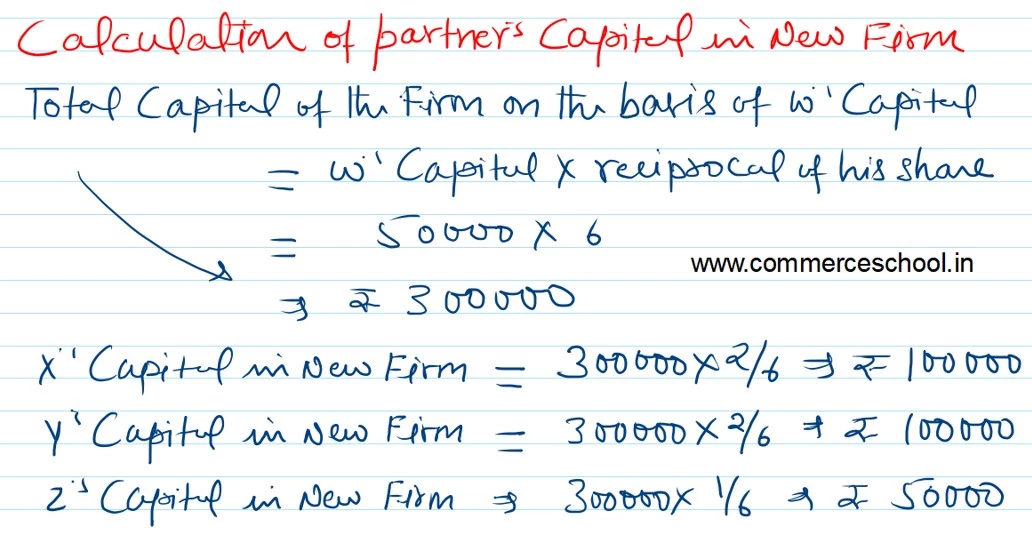

a) W will bring ₹ 50,000 as his capital and get 1/6th share in the profits.

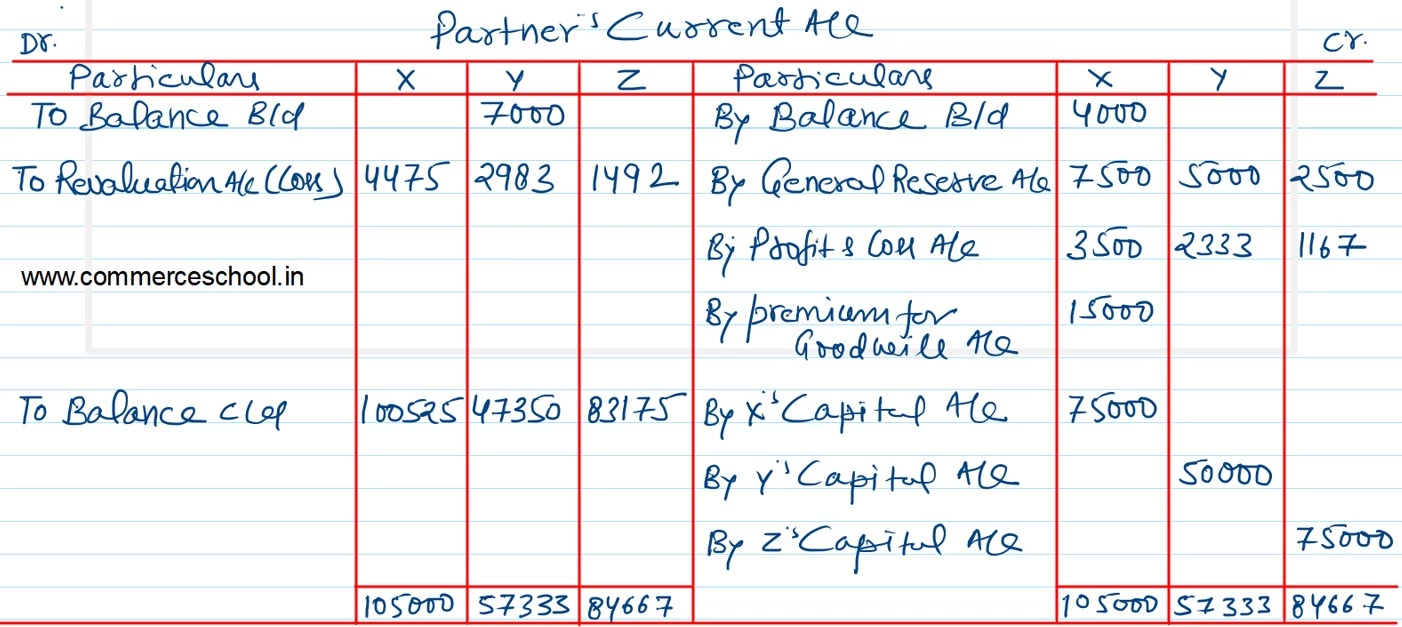

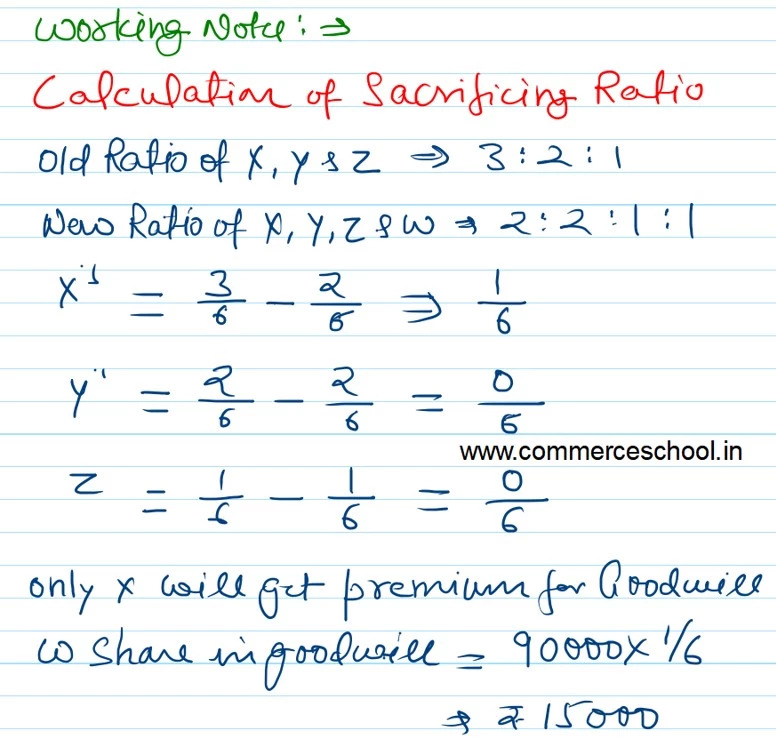

b) He will bring necessary amount for his share of goodwill premium. Goodwill of the firm is valued at ₹ 90,000.

c) New profit sharing ratio will be 2 : 2 : 1 : 1

d) A liability of ₹ 7,004 will be created against bills receivable discounted earlier from another Bank but now dishonoured.

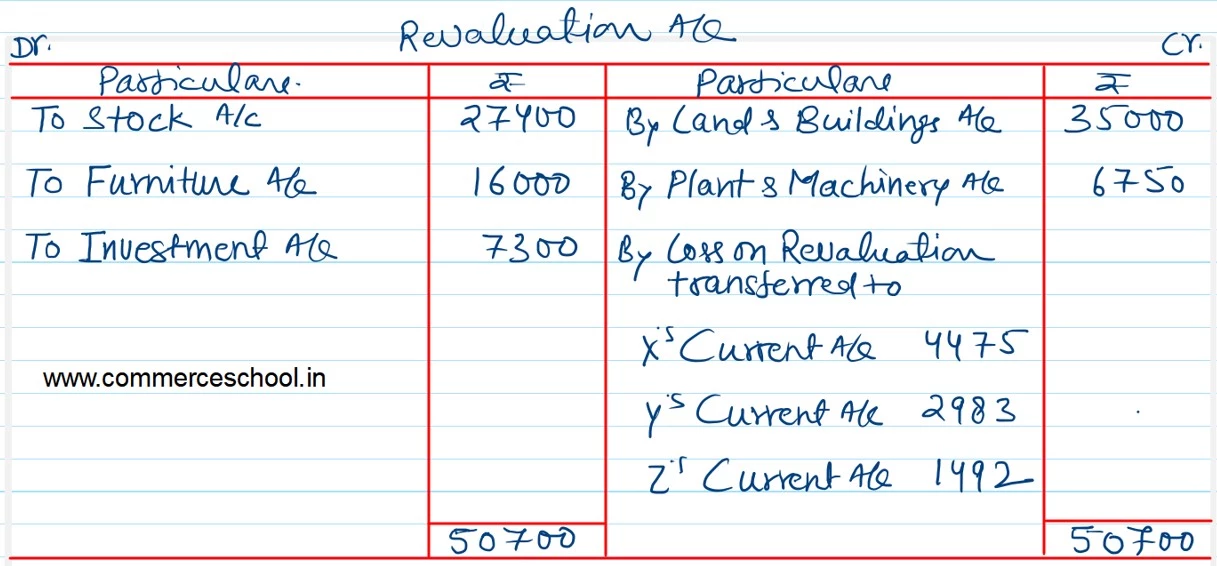

e) The value of stock, furniture and investments is reduced by 20%, whereas the value of Land and Building and Plant and Machinery will be appreciated by 20% and 10% respectively.

f) Capital Accounts of the partners will be adjusted on the basis of W’s Capital through their current accounts.

Prepare Revaluation Account, partner’s Current Accounts and Capital accounts.

[Ans: Loss on Revaluation – ₹ 8,950; partner’s current a/cs: X – ₹ 1,00,525, Y – ₹ 47,350 and Z – ₹ 83,175; partner’s Capital A/cs X – ₹ 1,00,000; Y – ₹ 1,00,000; Z – ₹ 50,000 and W – ₹ 50,000.]