The following was the Balance Sheet of X, Y and Z as at 28.2.2023:

The following was the Balance Sheet of X, Y and Z as at 28.2.2023:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 30,000 | Bank | 32,000 |

| Bills Payable | 10,000 | Debtors | 48,000 |

| G’s Loan | 18,000 | Stock | 19,000 |

| Y’s Loan | 20,000 | Furniture | 43,000 |

| Workmen Compensation Reserve | 33,000 | Land and Building | 1,09,000 |

|

Capitals: X Y |

75,000 85,000 |

Z’s Capital | 20,000 |

| 2,71,000 | 2,71,000 |

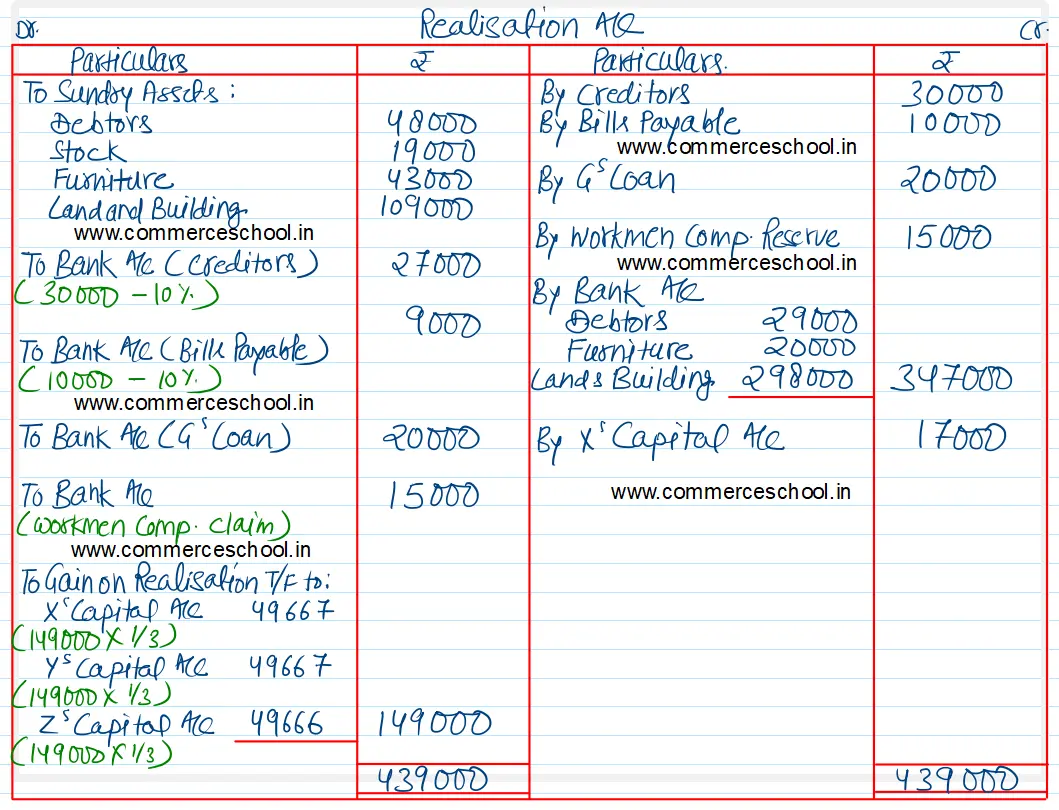

The firm was dissolved on the above date on the following terms:

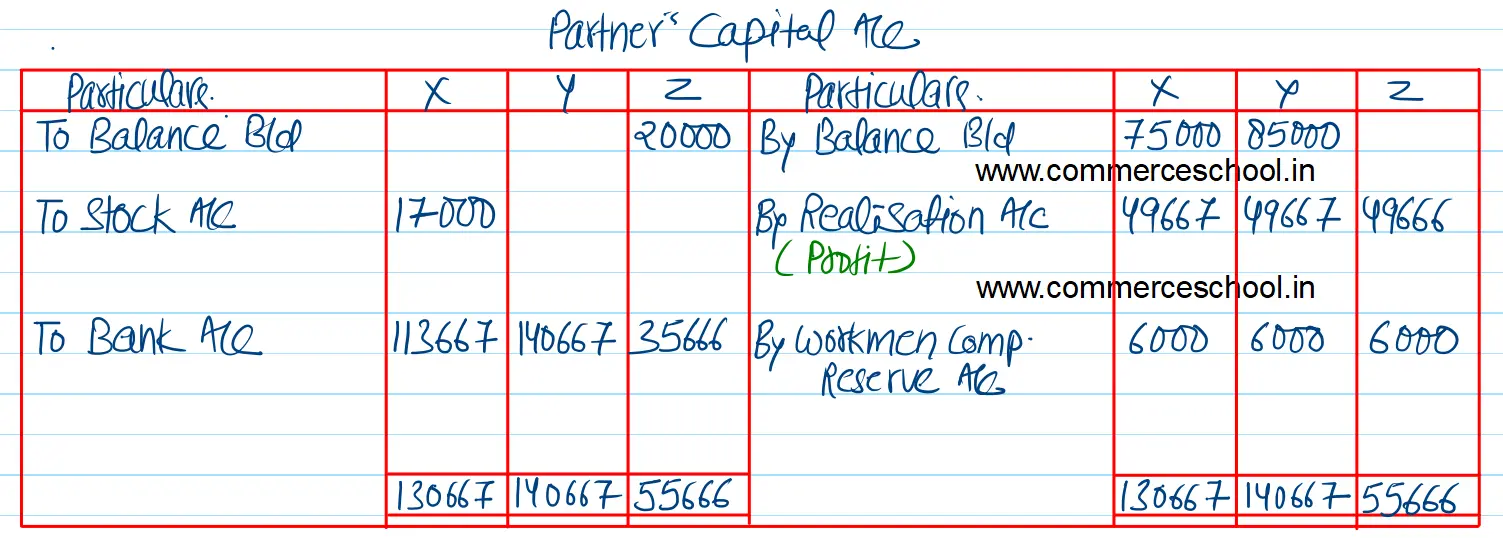

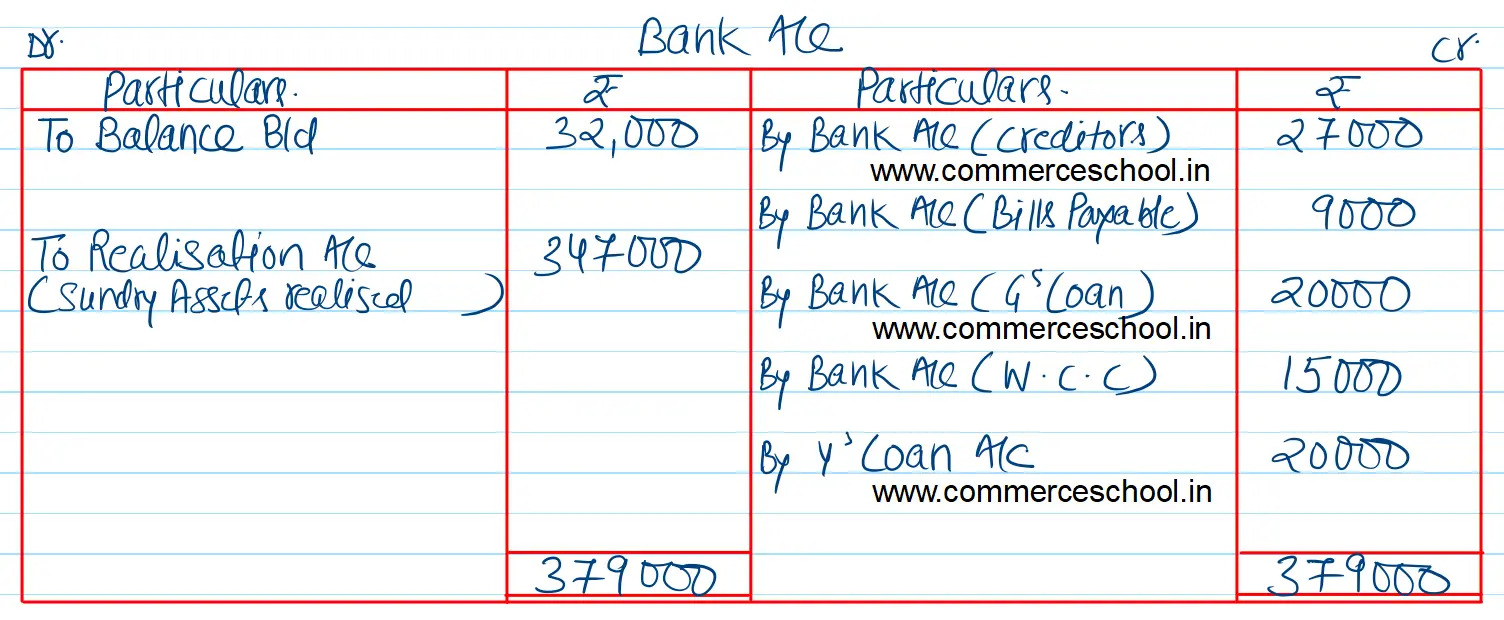

(i) Debtors realized ₹ 29,000 and creditors and bills payable were paid at a discount of 10%.

(ii) Stock was taken over by X for ₹ 17,000 and furniture was sold to K for ₹ 20,000.

(iii) Land and Building was sold for ₹ 2,98,000.

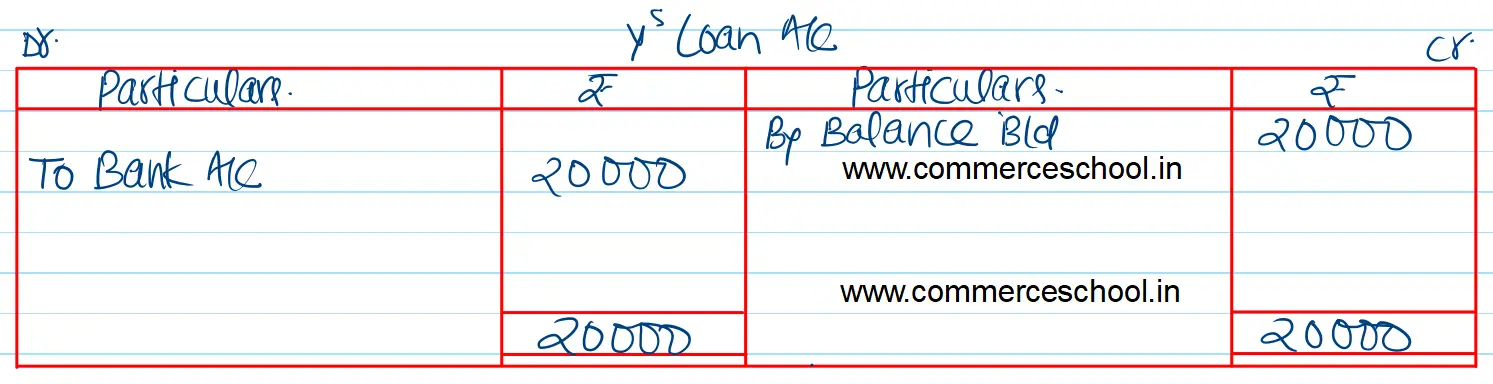

(iv) G’s Loan was paid by a cheque of the same amount.

(v) Compensation to workmen paid by the firm amounted to ₹ 15,000.

Prepare Realisation Account, Capital Accounts and Bank Account.

[Ans. Gain on Realisation ₹ 1,49,000. Final Payments : Y’s Loan ₹ 20,000; Capitals : X ₹ 1,13,667; Y ₹ 1,40,667; and Z ₹ 35,666. Total of Bank A/c ₹ 3,79,000.]