The Trial Balance of Shyam for the year ended 31st March, 2023 is given below:

The Trial Balance of Shyam for the year ended 31st March, 2023 is given below:

| Heads of Accounts | Dr. (₹) | Cr. (₹) |

|

Furniture Building Machinery Cash Debtors Creditors Sales Purchase Return Bad Debts Provision for Doubtful Debts Opening Stock Bank Overdraft Capital Purchases Sales Return Advertisement Interest Commission Insurance General Expenses Salary |

64,000 7,50,000 6,25,000 65,000 3,80,000 – – – 12,500 – 3,46,000 – – 5,47,500 20,000 45,000 11,800 – 1,25,000 78,200 3,30,000 |

– – – – – 2,50,000 15,45,000 12,500 – 20,000 – 2,85,000 12,50,000 – – – – 37,500 – – – |

| Total | 34,00,000 | 34,00,000 |

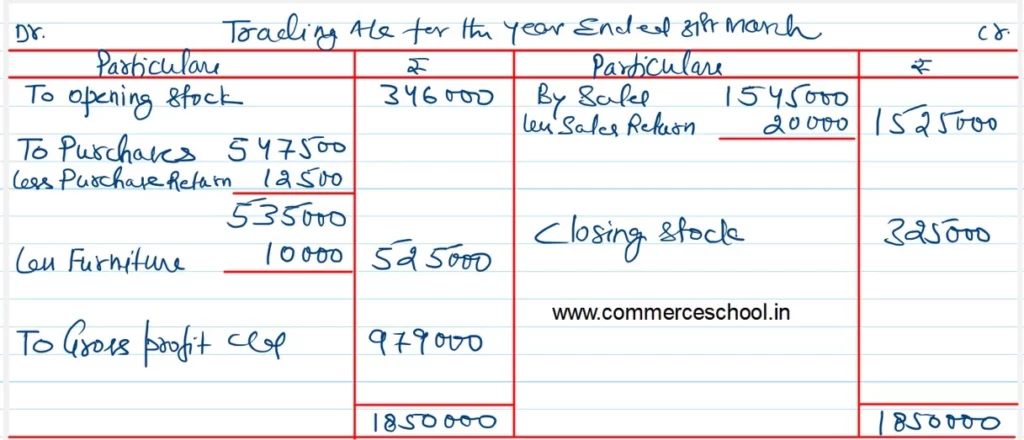

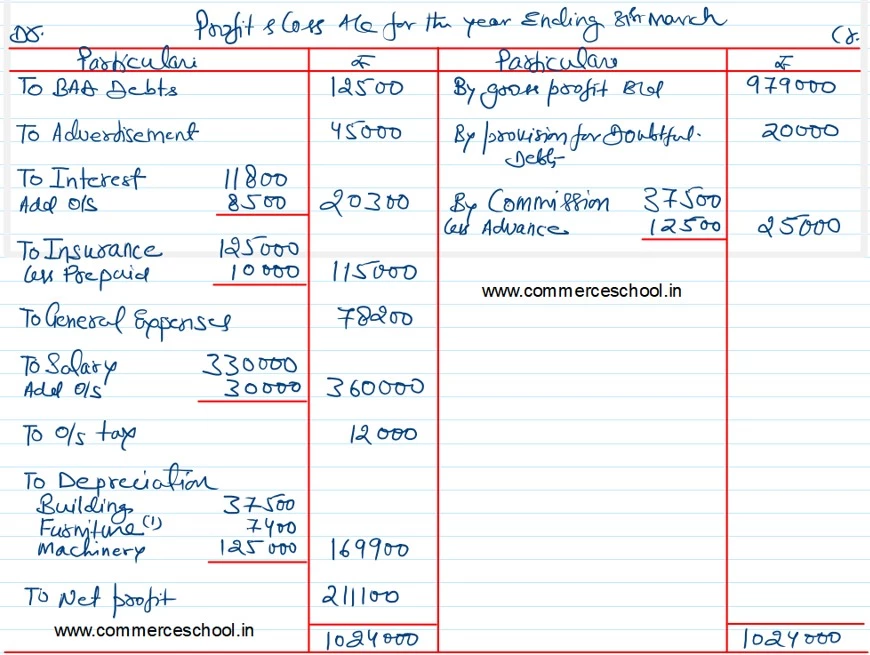

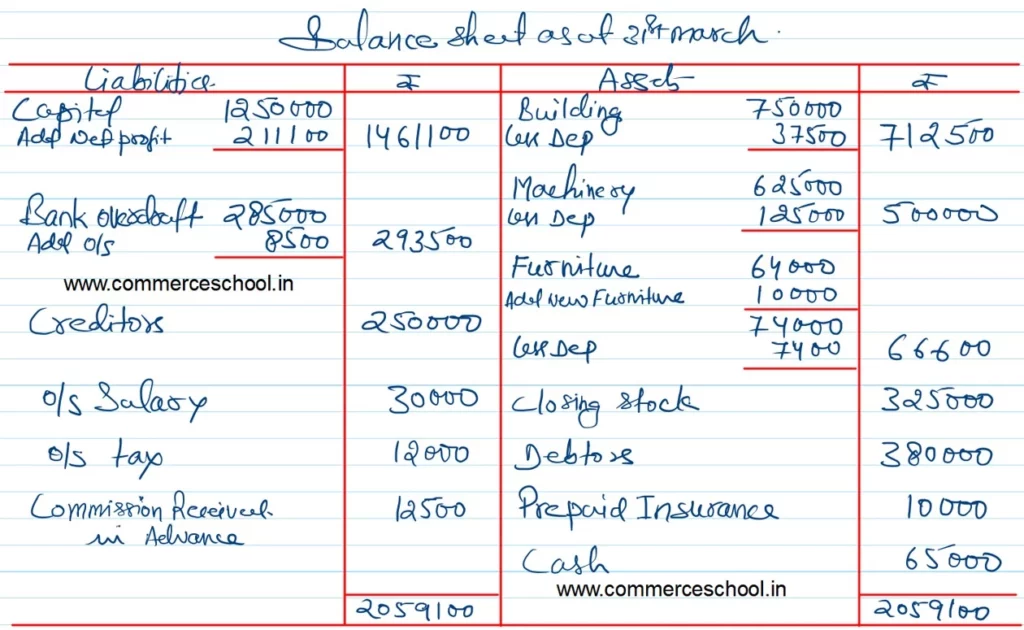

Adjustments to be taken into account:

(i) Closing stock is valued at ₹ 3,25,000 against its purchase cost of ₹ 3,35,000.

(ii) Interest of ₹ 8,500 is due on bank overdraft.

(iii) Depreciation on building is to be provided @ 5%, furniture @ 10% and machinery @ 20%.

(iv) Salary Outstanding is ₹ 30,000 and tax outstanding is ₹ 12,000.

(v) Prepare insurance is ₹ 10,000 and one-third of commission has been received in advance.

(vi) Purchase include furniture of ₹ 10,000.

(vii) Remaining debtors are goods.

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and a Balance Sheet as on that date.