X and Y are partners sharing profits in the ratio of 2 : 1. Their Balance Sheet as at 31st March, 2023 was:

X and Y are partners sharing profits in the ratio of 2 : 1. Their Balance Sheet as at 31st March, 2023 was:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors

General Reserve Capital A/cs: X Y |

25,000 18,000 75,000 62,000 |

Cash/Bank

Sundry Debtors Stock Investments Printer Fixed Assets |

5,000 15,000 10,000 8,000 5,000 1,37,000 |

| 1,80,000 | 1,80,000 |

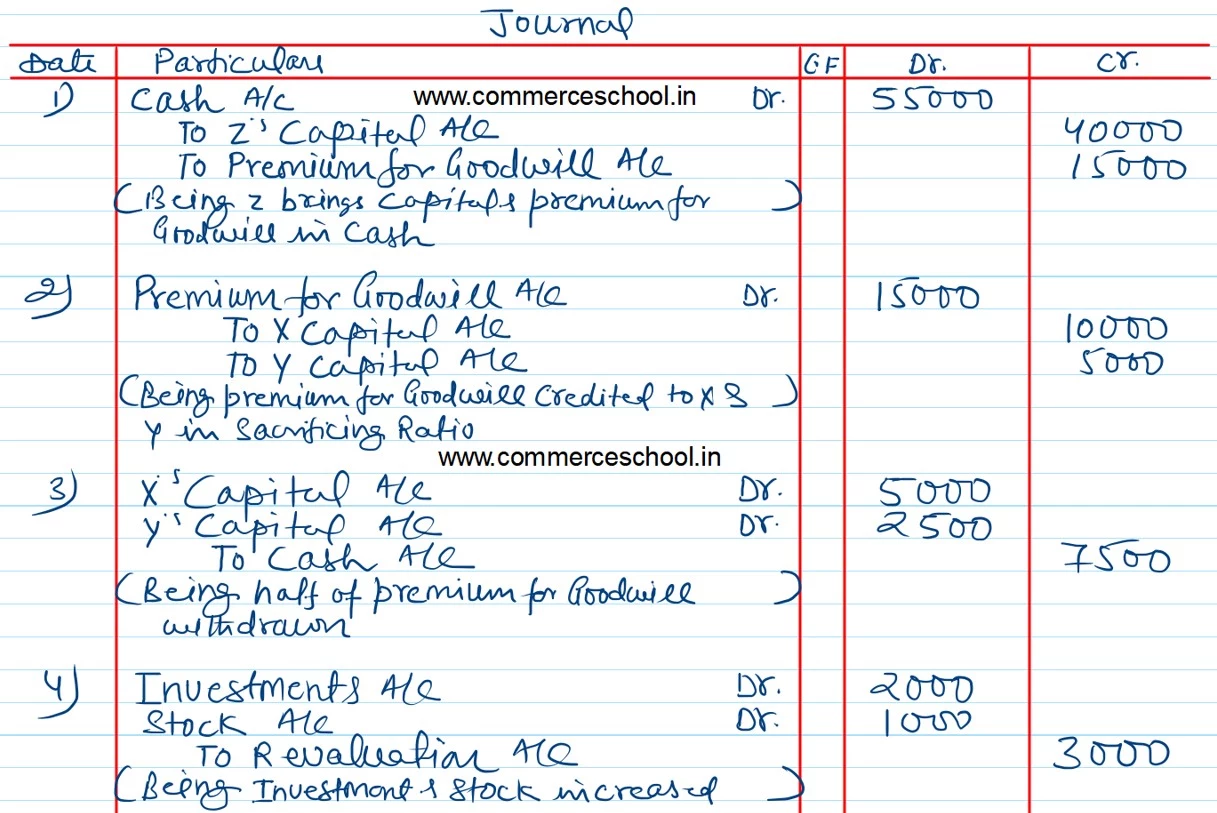

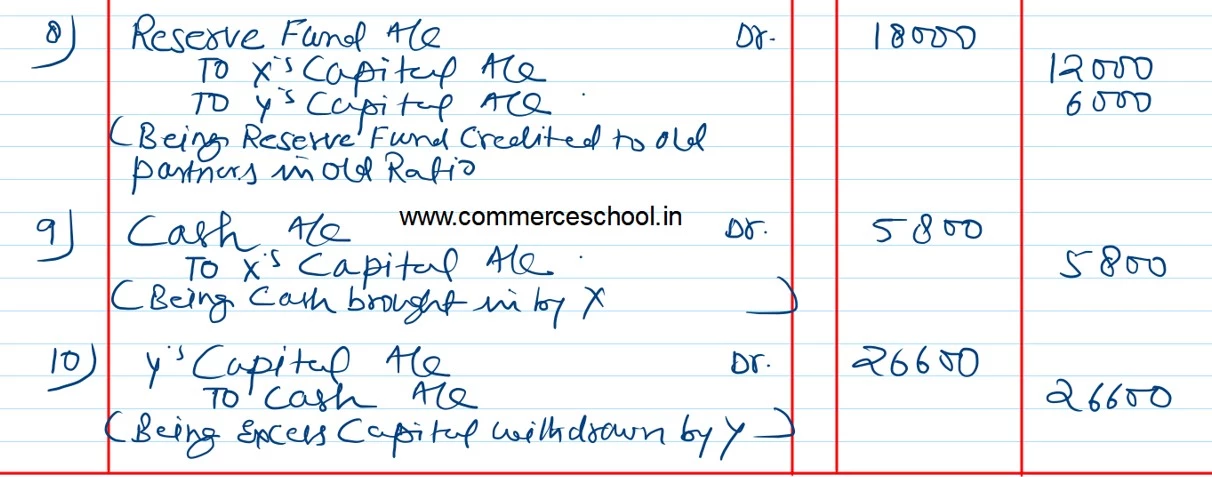

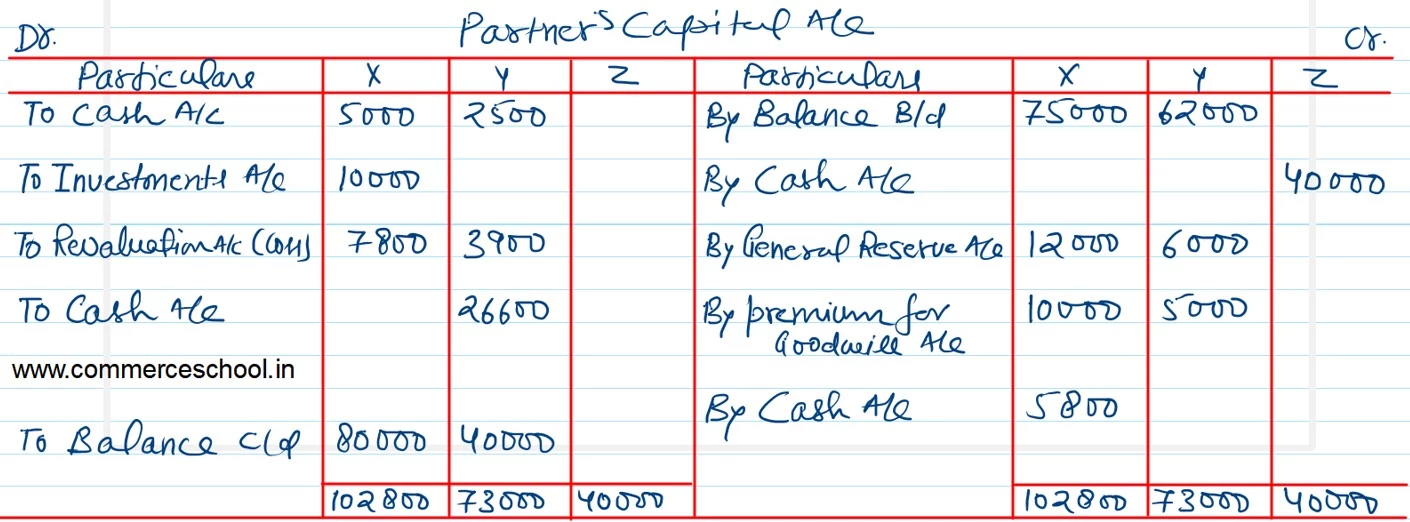

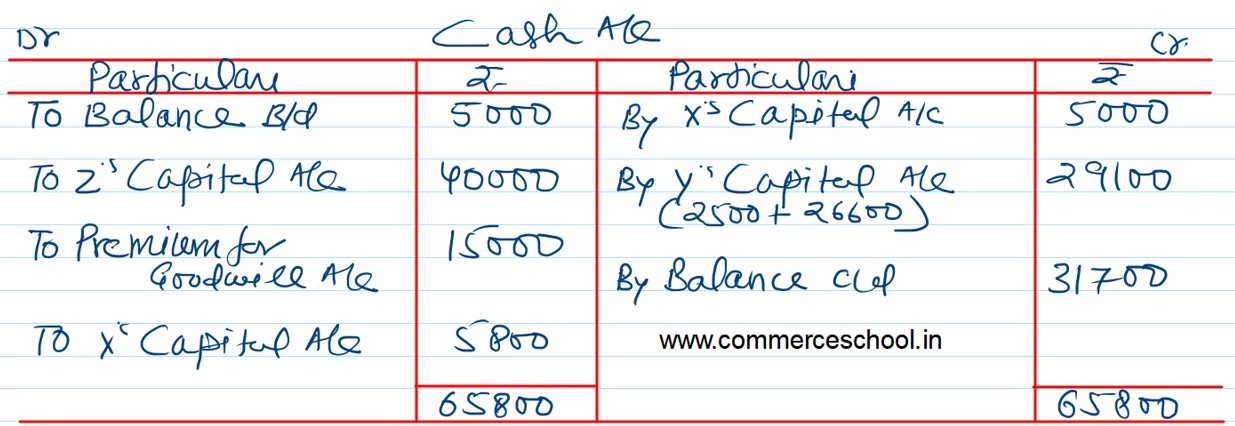

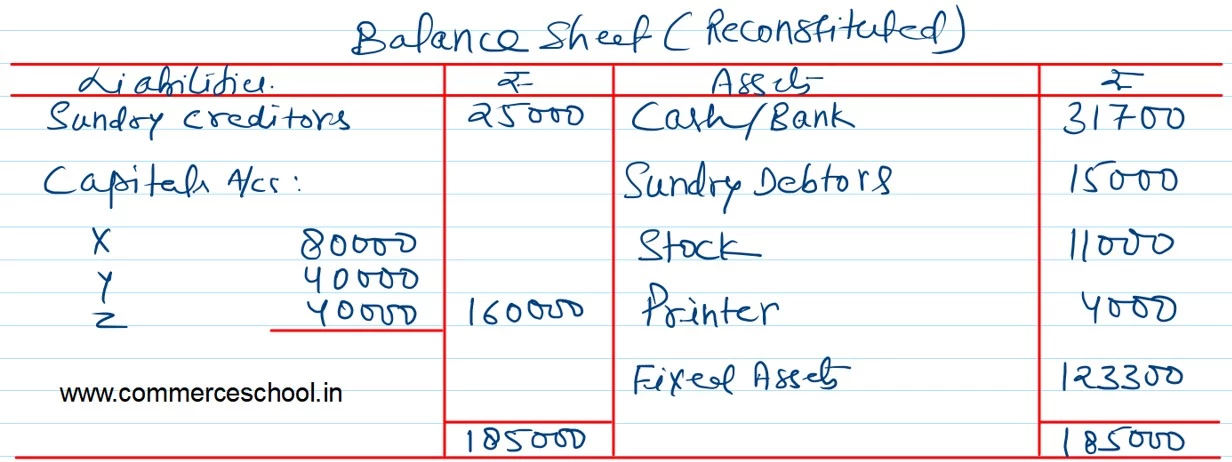

They admit Z into partnership on 1st April, 2023 on the following terms:

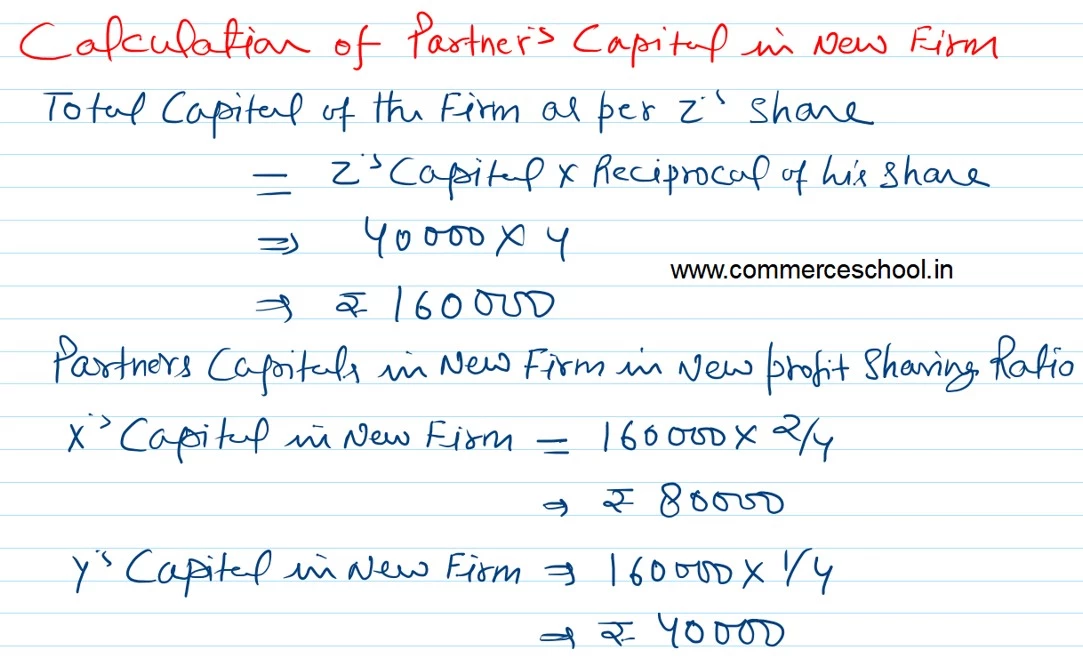

a) Z brings in ₹ 40,000 as his capital and he is given 1/4th share in profits.

b) Z brings in ₹ 15,000 for goodwill, half of which is withdrawn by old partners.

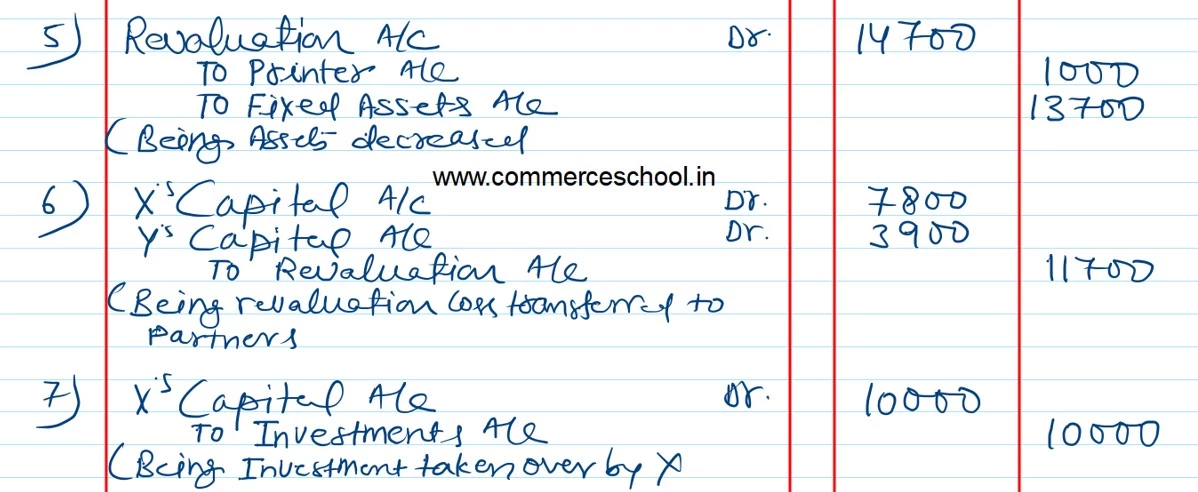

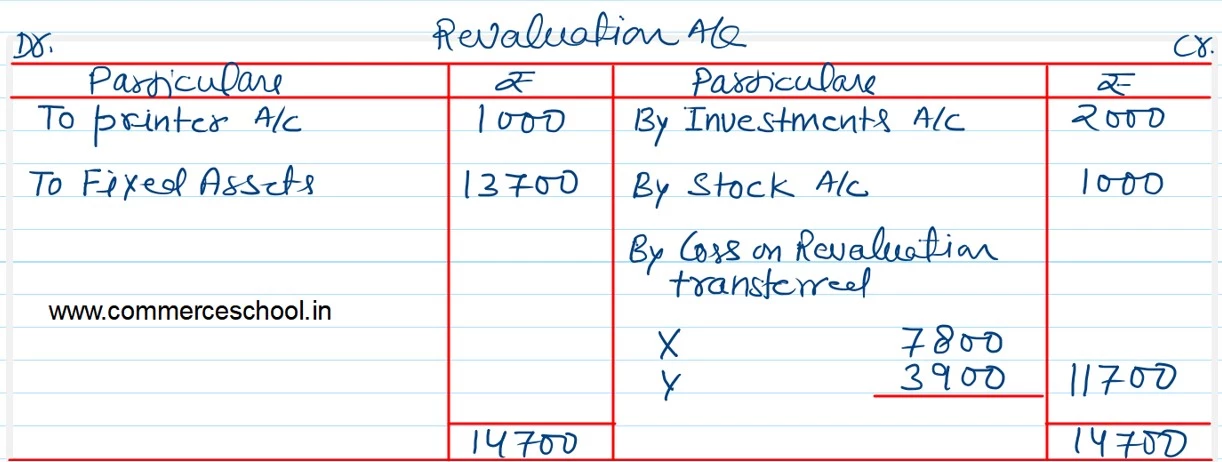

c) Investments are valued at ₹ 10,000. X takes over Investments at this value.

d) Printer is to be reduced (depreciated) by 20% and Fixed Assets by 10%.

e) An unrecorded stock on 31st March, 2023 is ₹ 1,000.

f) By bringing in or withdrawn cash, the Capitals of X and Y are to be made proportionate to that of Z on their profit sharing ratio.

Pass Journal entries, prepare Revaluation Account, Capital Accounts and new Balance Sheet of the firm.