X and Y are partners. They decided to dissolve their firm. Pass necessary entries assuming that various assets and external liabilities have been transferred to Realisation Account:

X and Y are partners. They decided to dissolve their firm. Pass necessary entries assuming that various assets and external liabilities have been transferred to Realisation Account:

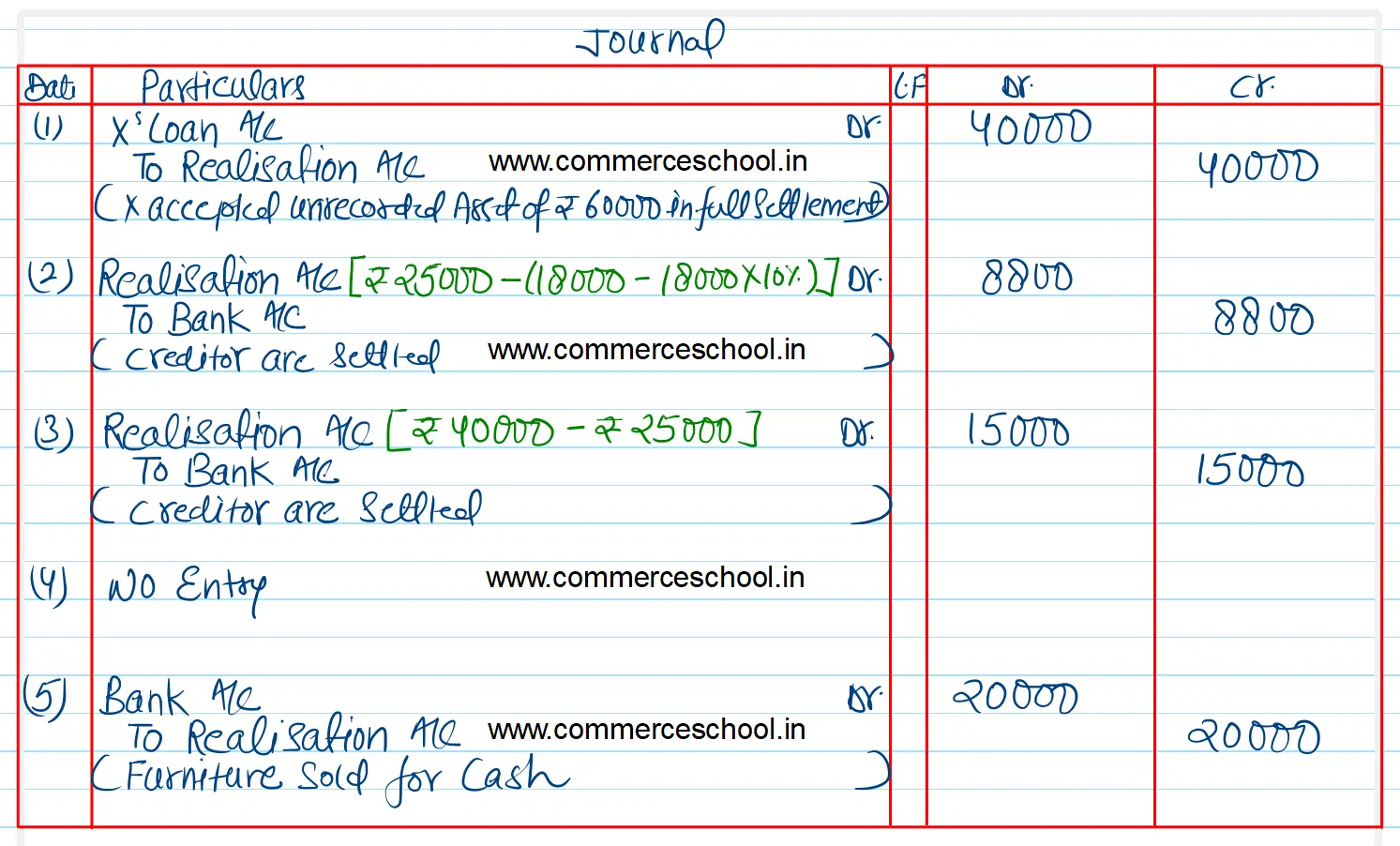

(1) X’s loan was appearing on the liabilities side of Balance Sheet at ₹ 40,000. He accepted an unrecorded asset of ₹ 60,000 in full settlement of his account.

(2) Raman, a Creditor to whom ₹ 25,000 were due to be paid, accepted an unrecorded computer of ₹ 18,000 at a discount of 10% and the balance was paid to him in cash.

(3) Sudhir, an unrecorded creditor of ₹ 40,000 accepted an unrecorded vehicle of ₹ 20,000 at ₹ 25,000 and the balance was paid to him in cash.

(4) There was a Contingent liability in respect of bill discounted but not matured ₹ 20,000.

(5) Furniture of ₹ 20,000 and goodwill of ₹ 30,000 were appearing in the Balance Sheet but no other information was provided regarding these two items.