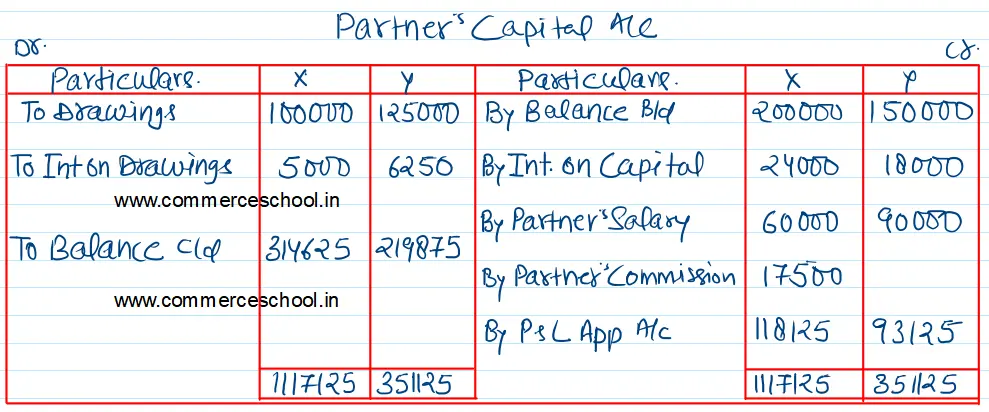

X and Y entered into a partnership on 1st April 2018. Their capitals as on 1st April 2022 were ₹ 2,00,000 and ₹ 1,50,000 respectively

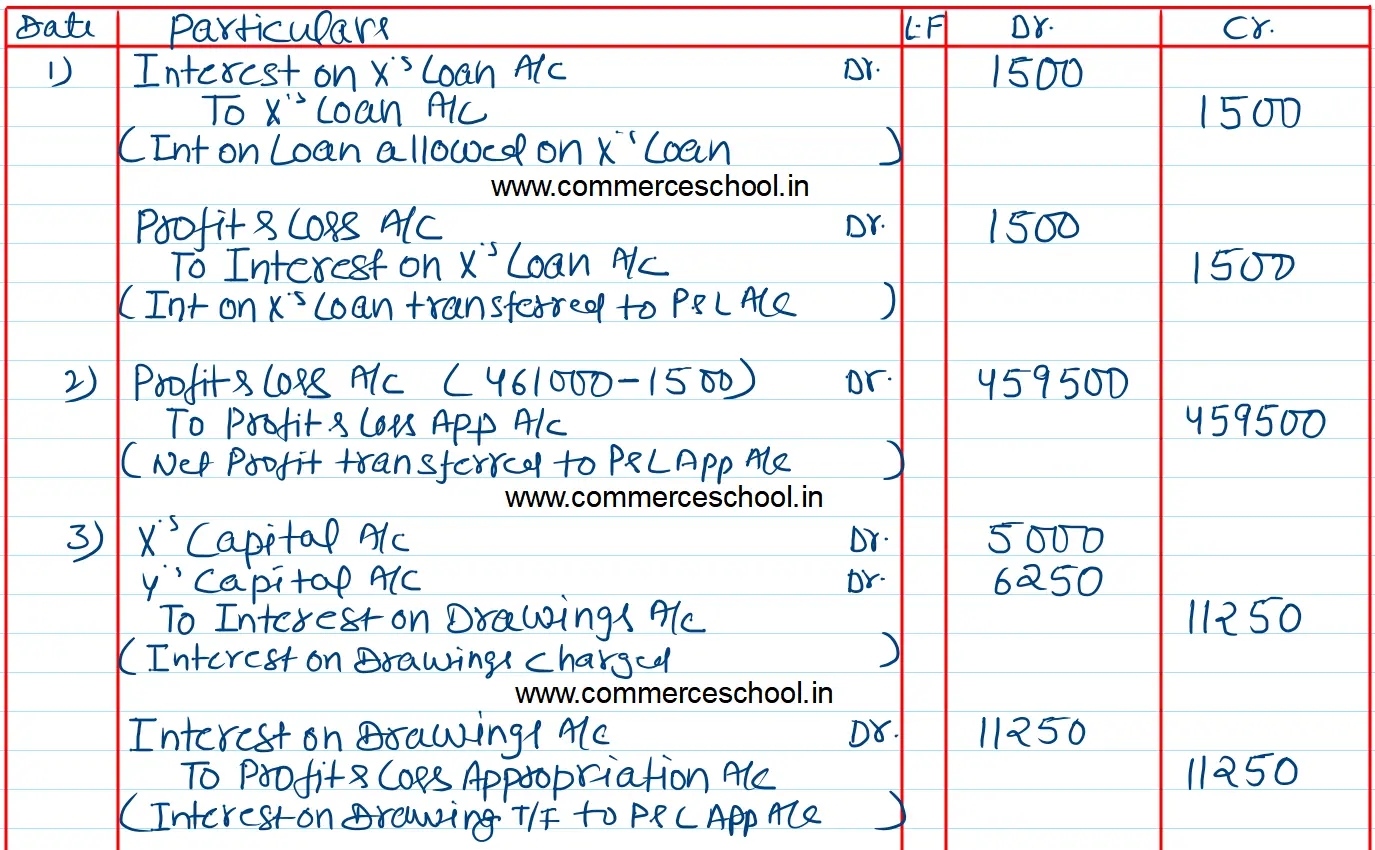

X and Y entered into a partnership on 1st April 2018. Their capitals as on 1st April 2022 were ₹ 2,00,000 and ₹ 1,50,000 respectively. On 1st October 2022, X gave ₹ 50,000 as a loan to the firm. As per the provisions of the Partnership Deed:

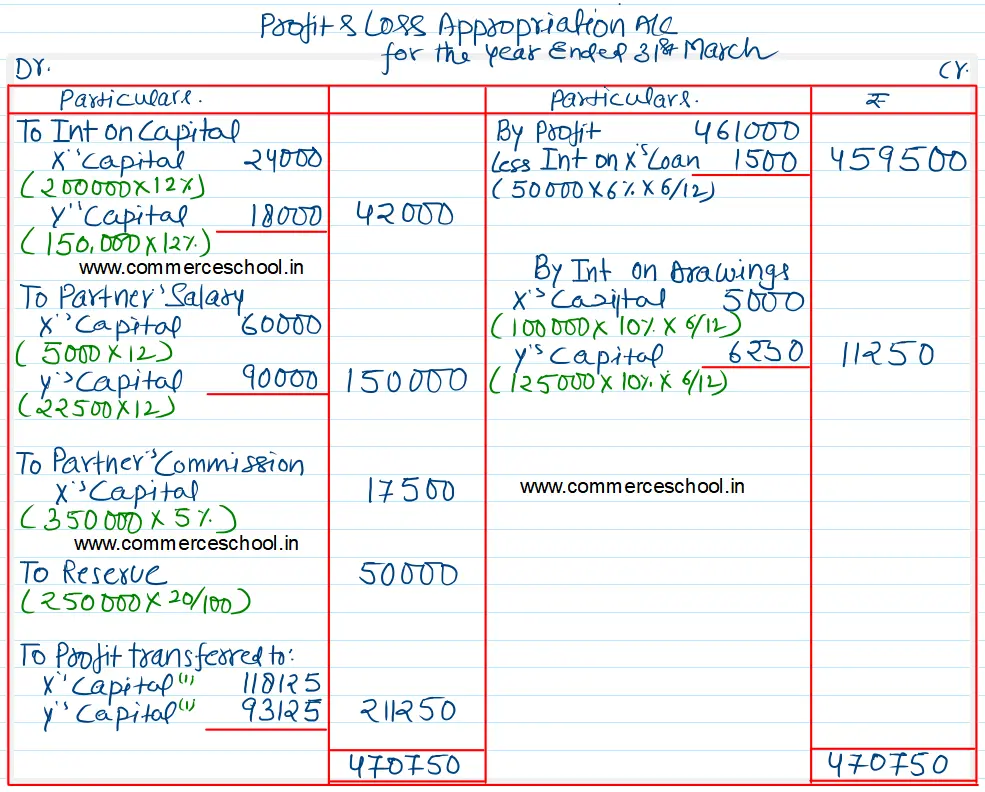

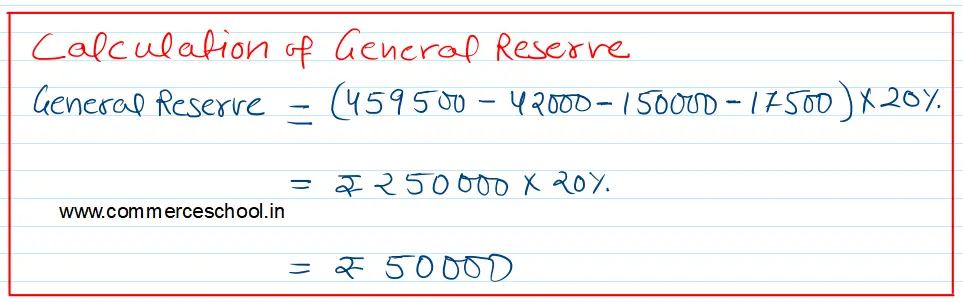

(i) 20% of Profits before charging Interest on Drawings but after making appropriations was to be transferred to General Reserve.

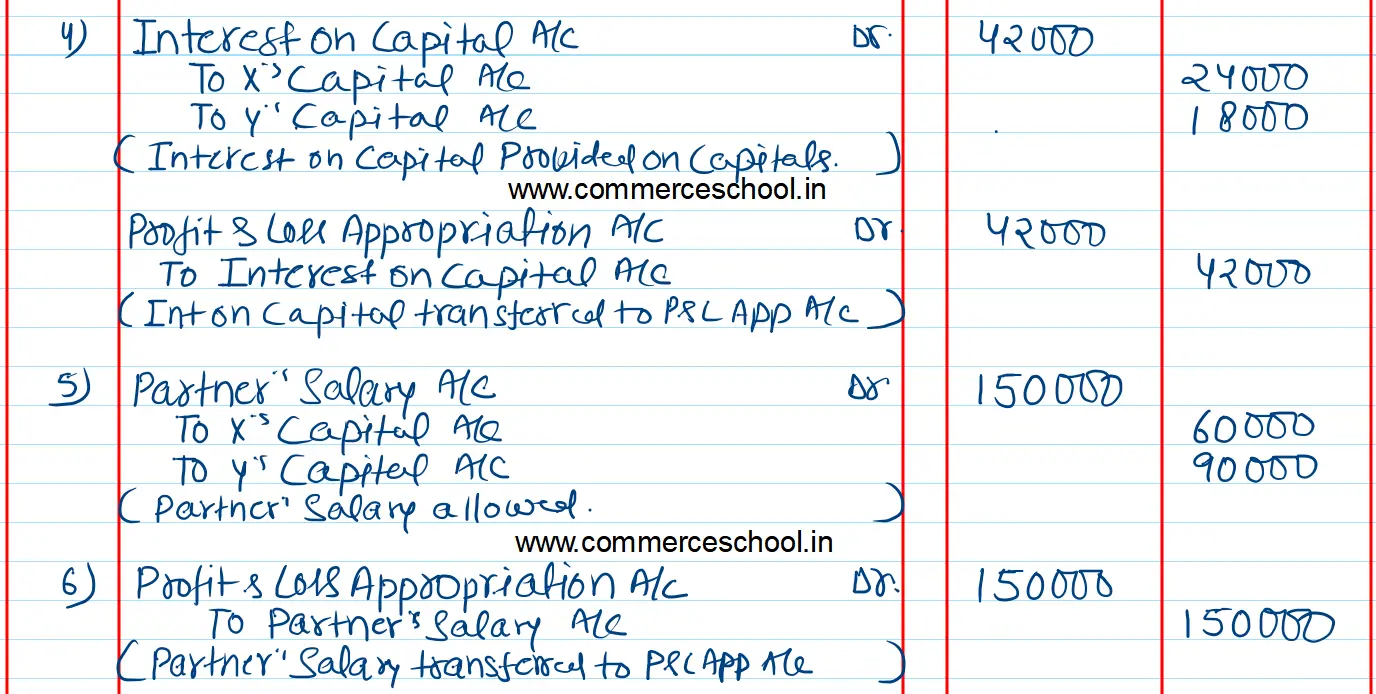

(ii) Interest on capital is to be allowed @ 12% p.a. and Interest on Drawings is to be charged @ 10% p.a.

(iii) X to get a monthly salary of ₹ 5,000 and Y to get a salary of ₹ 22,500 per quarter.

(iv) X is entitled to a commission of 5% on sales. Sales for the year were ₹ 3,50,000.

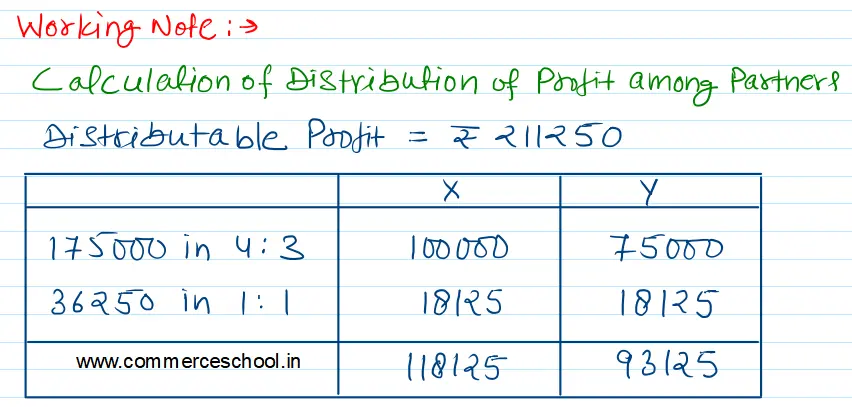

(v) Profit to be shared in the ratio of their capitals up to ₹ 1,75,000 and balance equally.

Profit for the year ended 31st March 2023, before allowing or charging interest was ₹ 4,61,000. The drawings of X and Y were ₹ 1,00,000 and ₹ 1,25,000 respectively.

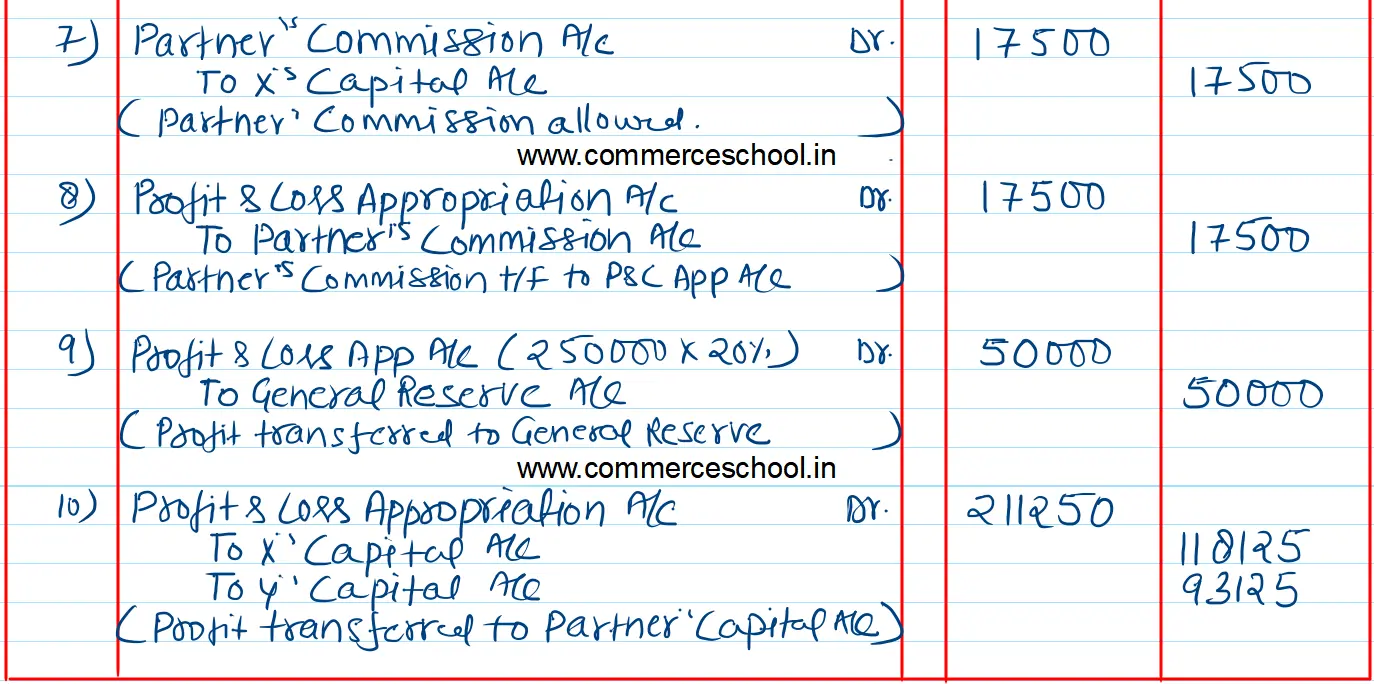

Pass the necessary Journal entries relating to the appropriation of profit. Prepare the Profit and Loss Appropriation Account and the Partner’s Capital Accounts.

[Ans: Interest on Capital: X – ₹ 24,000; Y – ₹ 18,000; Salary: X – ₹ 60,000; Y – ₹ 90,000; Commission X – ₹ 17,500; Interest on Drawings: X – ₹ 5,000; Y – ₹ 6,250; Share of Profit: X – ₹ 1,18,125; Y – ₹ 93,125; Capital Balance: X – ₹ 3,14,625; Y – ₹ 2,19,875; Interest on Loan by X: ₹ 1,500; Transfer to General Reserve – ₹ 50,000]