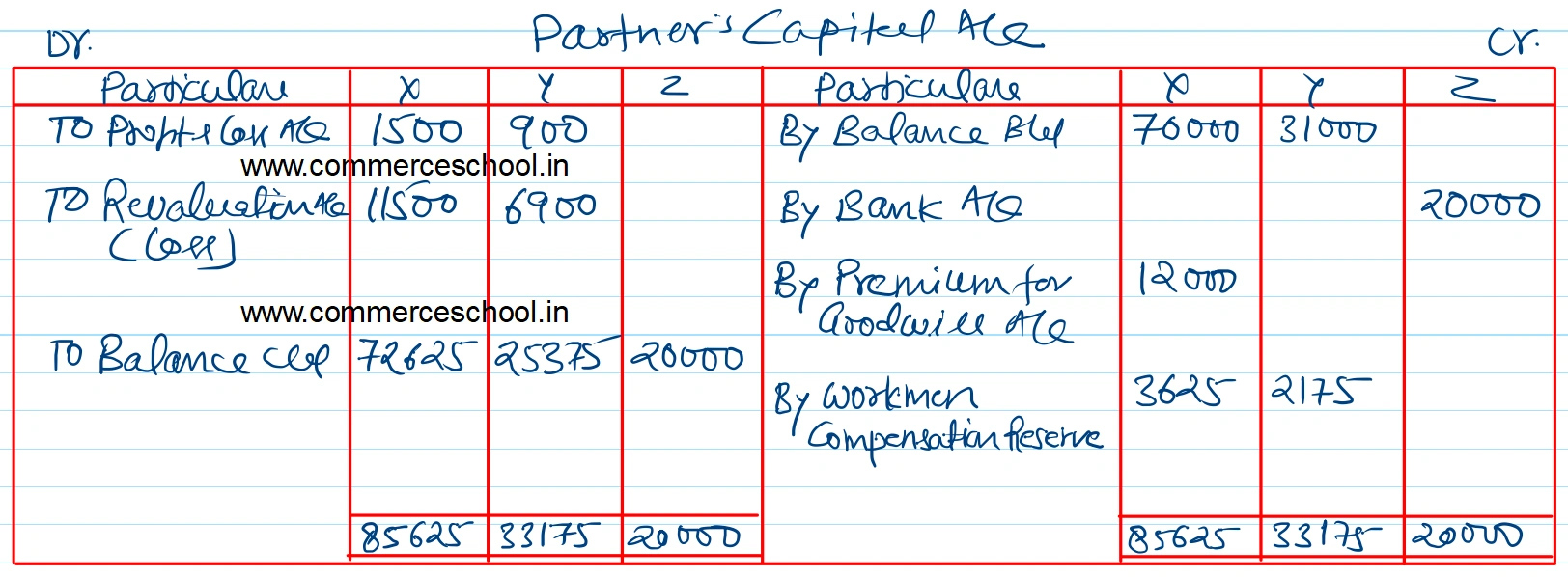

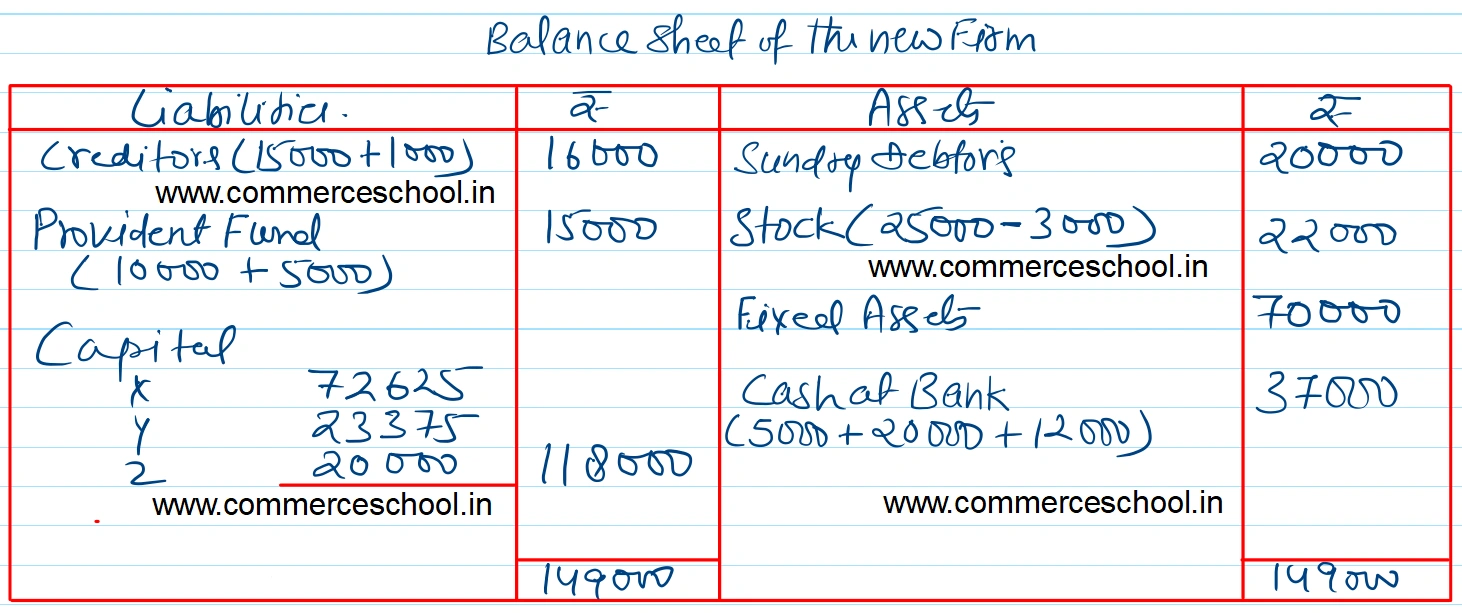

X and Y share profits in the ratio of 5 : 3. Their Balance Sheet as at 31st March, 2023 was:

X and Y share profits in the ratio of 5 : 3. Their Balance Sheet as at 31st March, 2023 was:

| Liabilities | ₹ | Assets | ₹ | ||

| Creditors

Employee’s Provident Fund Workmen Compensation Reserve X Y |

70,000 31,000 |

15,000

10,000 5,800

1,01,000 |

Cash at Bank

Sundry Debtors Stock Fixed Assets Profit & Loss A/c |

20,000

|

5,000

19,400 25,000 80,000 2,400 |

| 1,31,800 | 1,31,800 |

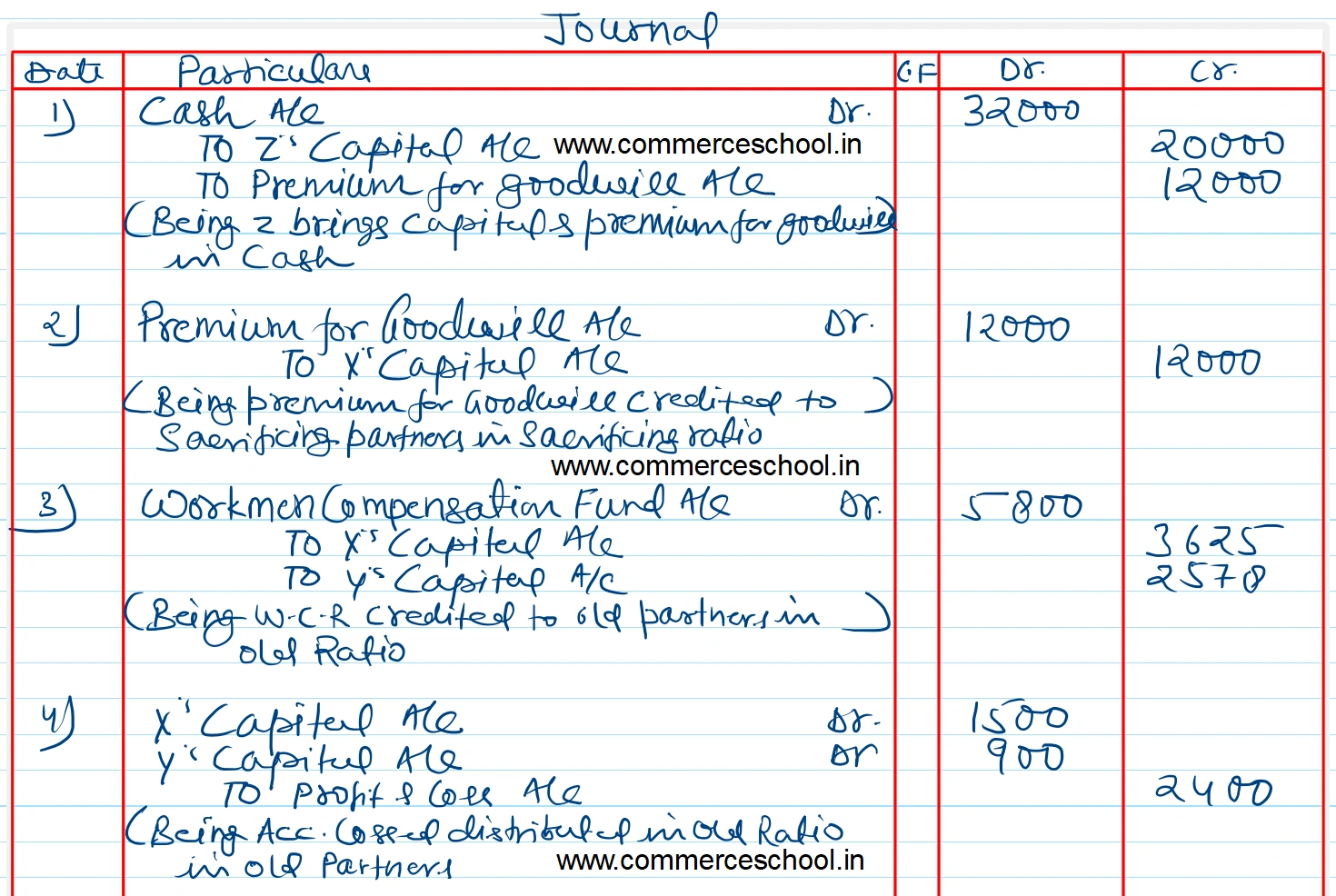

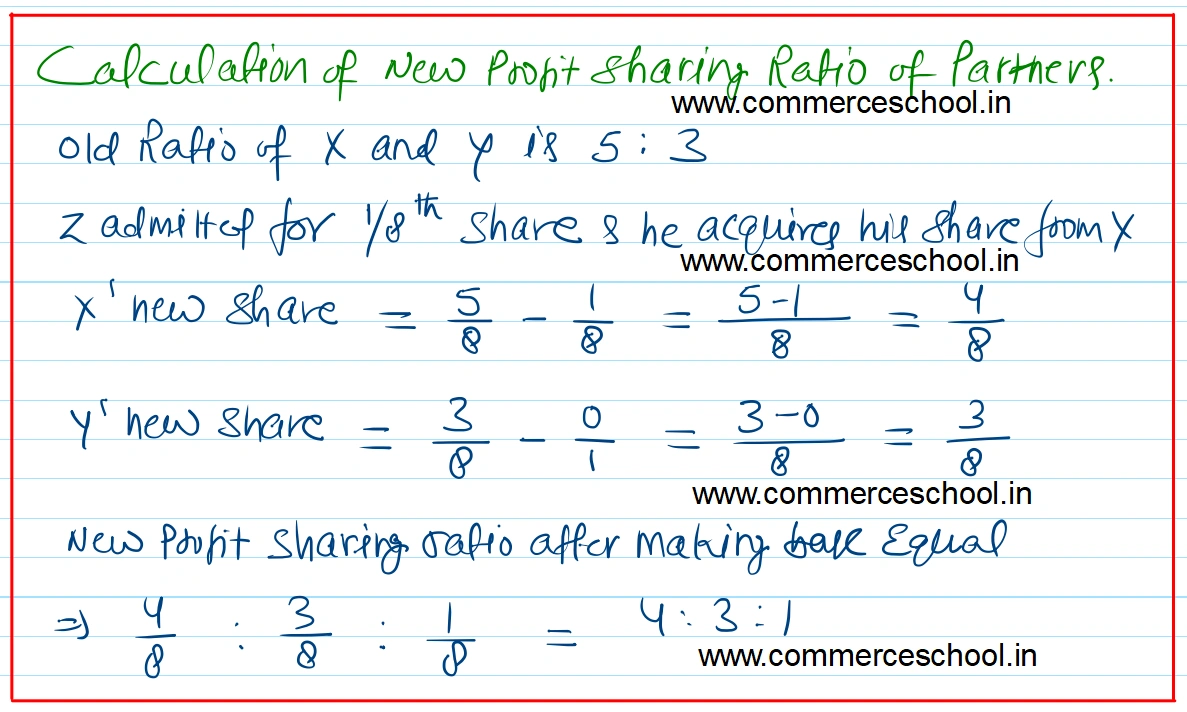

They admit Z into partnership with 1/8th share in profits on 1st April, 2023. Z brings ₹ 20,000 as his capital and ₹ 12,000 for goodwill in cash. Z acquires his share from X. Following revaluations are also made:

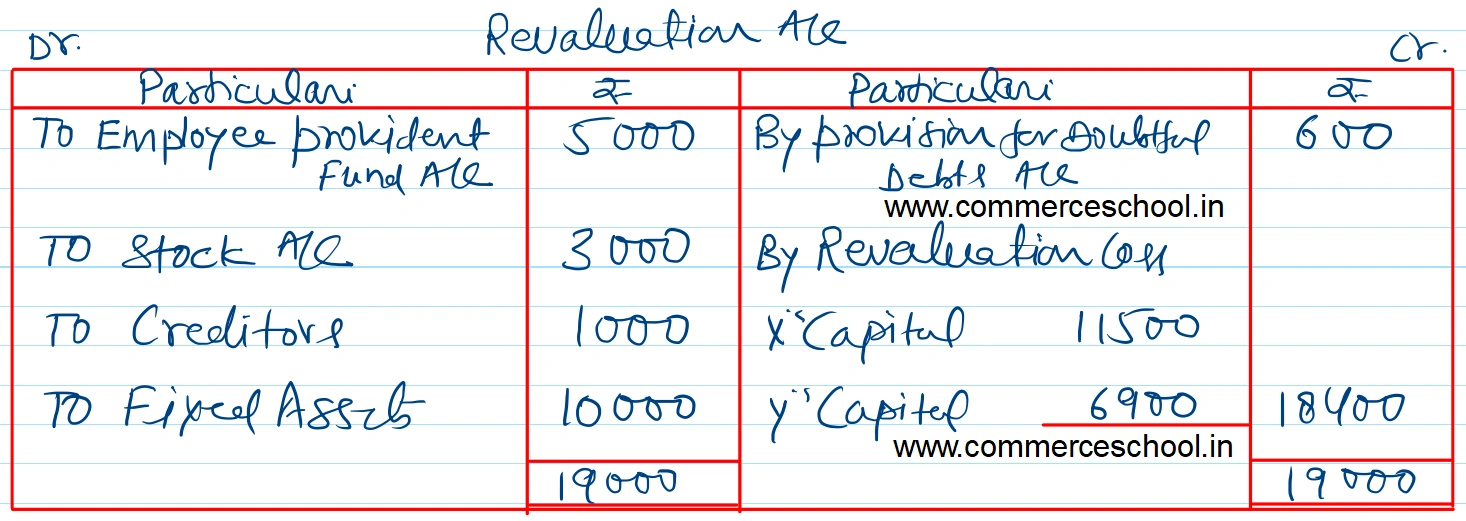

a) Employees’ Provident Fund liability is to be increased by ₹ 5,000.

b) All Debtors are good.

c) Stock includes ₹ 3,000 for obsolete items. Hence, are to be written off.

d) Creditors are to be paid ₹ 1,000 more.

e) Fixed Assets are to be revalued at ₹ 70,000.

Prepare Journal entries, necessary accounts and new Balance Sheet. Also, calculate new profit sharing ratio.