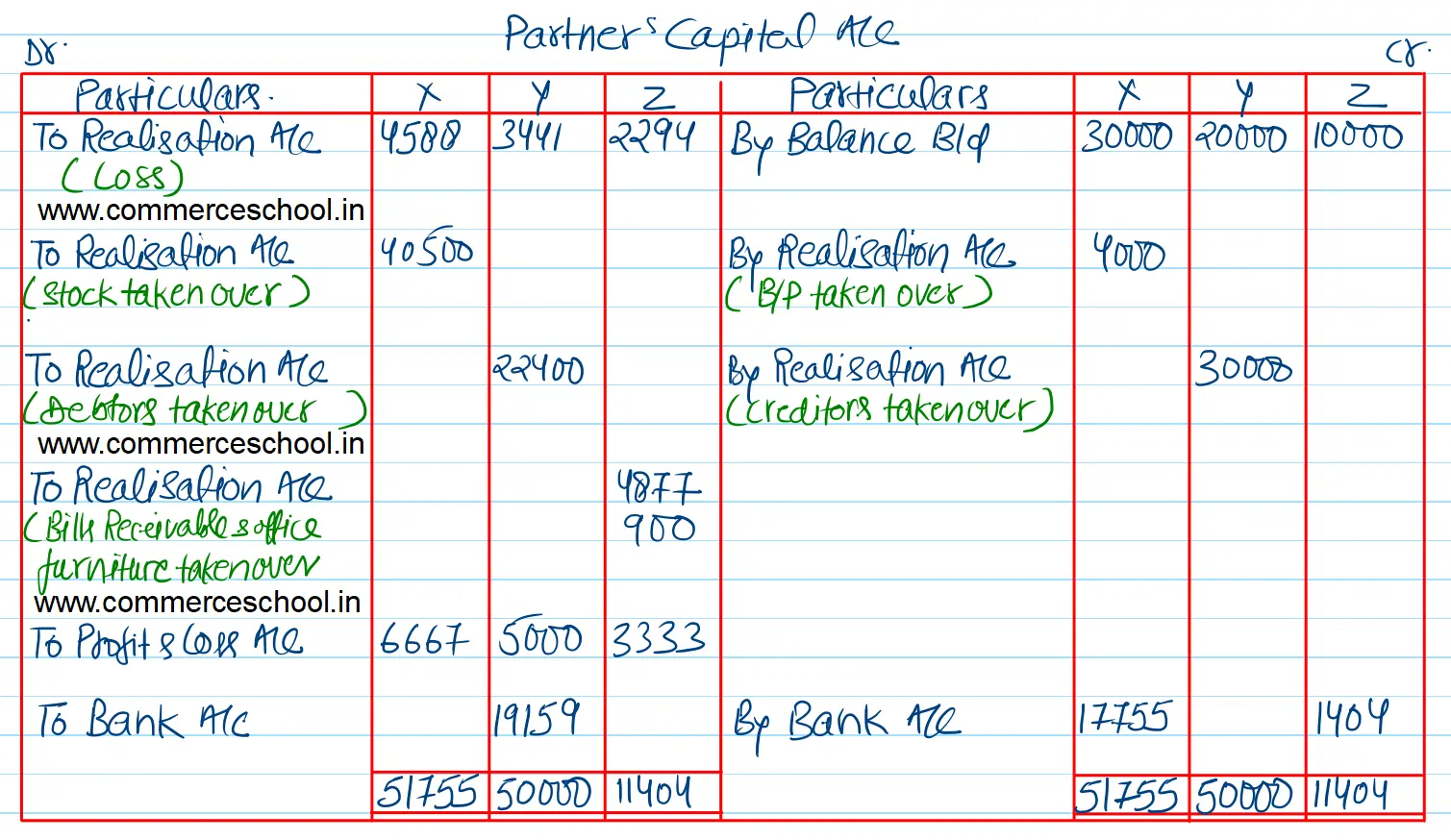

X, Y and Z entered into partnership on 1st October 2021 sharing profits and losses in the proportions of 4 : 3 : 2, respectively, and with capitals of ₹ 30,000, ₹ 20,000 and ₹ 10,000

X, Y and Z entered into partnership on 1st October 2021 sharing profits and losses in the proportions of 4 : 3 : 2, respectively, and with capitals of ₹ 30,000, ₹ 20,000 and ₹ 10,000.

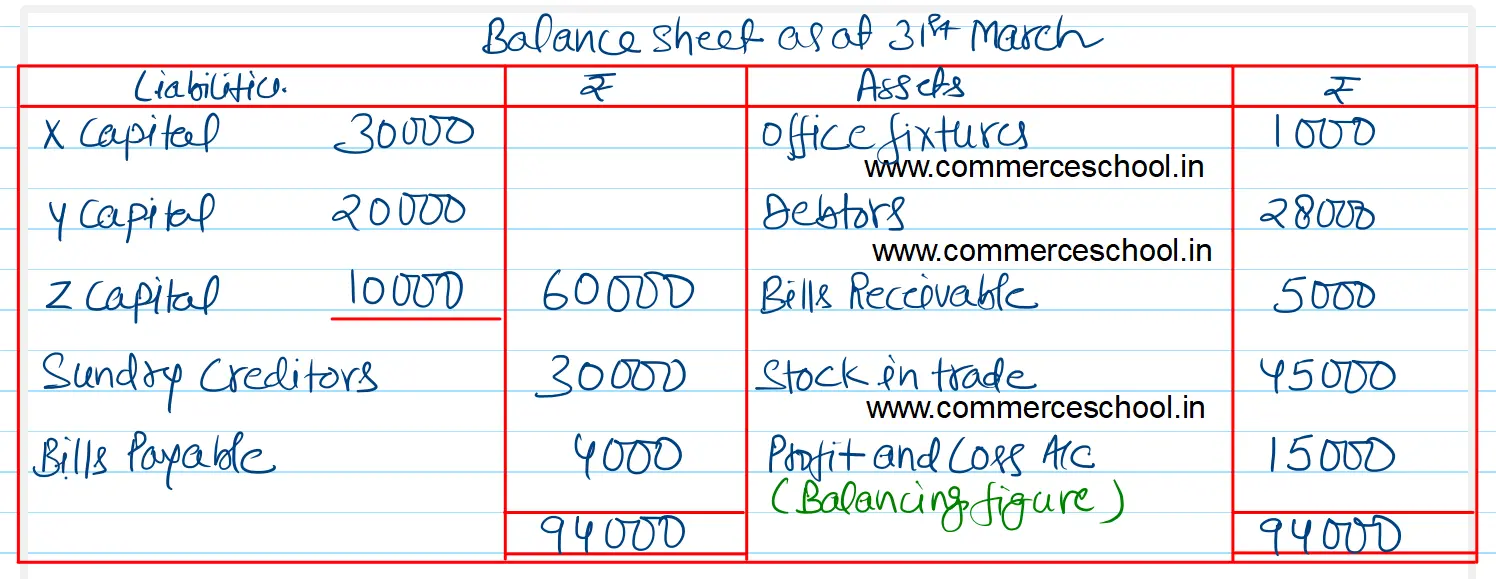

Their assets and liabilities on 1st October 2022, the date on which they decided to wind up their affairs, were as follows:

Office Fixtures ₹ 1,000; Debtors ₹ 28,000; Bills Receivable ₹ 5,000; and Stock-in-trade ₹ 45,000. Sundry Creditors were ₹ 30,000; Bills Payable ₹ 4,000.

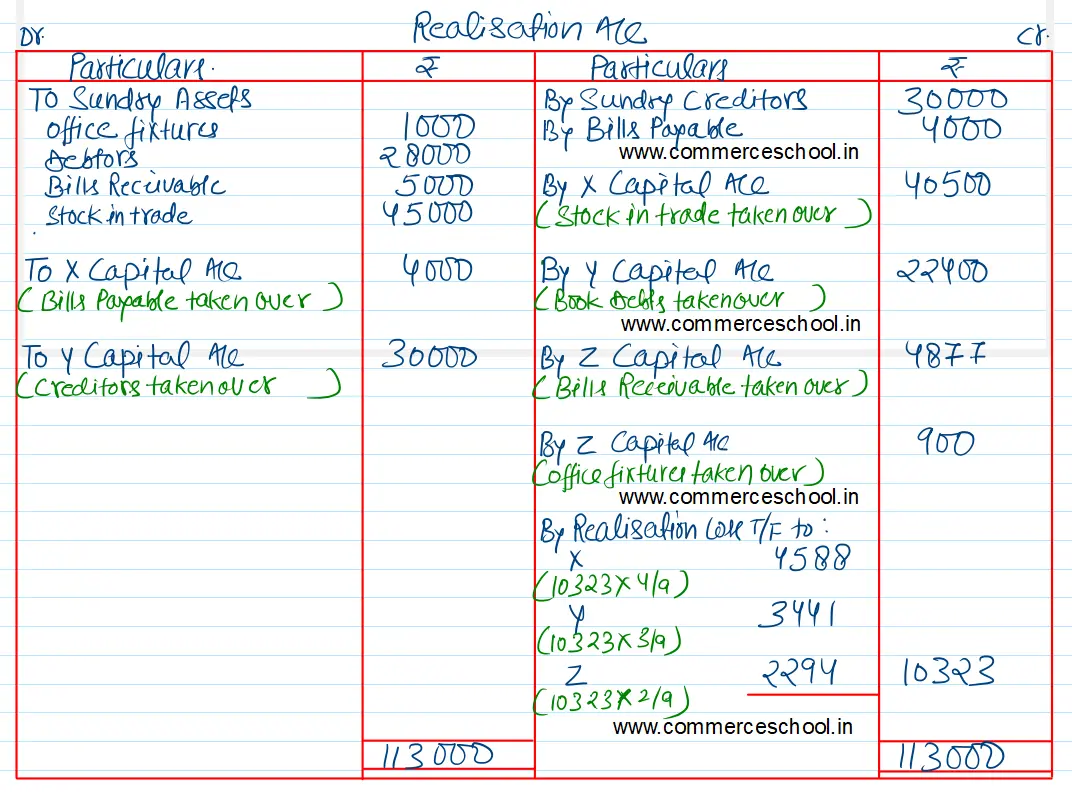

X agreed to take over the Stock-in-trade at a discount of 10% and pay off the Bills Payable.

Y agreed to take over the Book Debts at a discount of 20% and pay off the Creditors.

Z took over the Bills Receivable at ₹ 4,877 and Office Fixtures at a depreciation of 10%.

5% p.a. interest is to be credited to each partner on his capital.

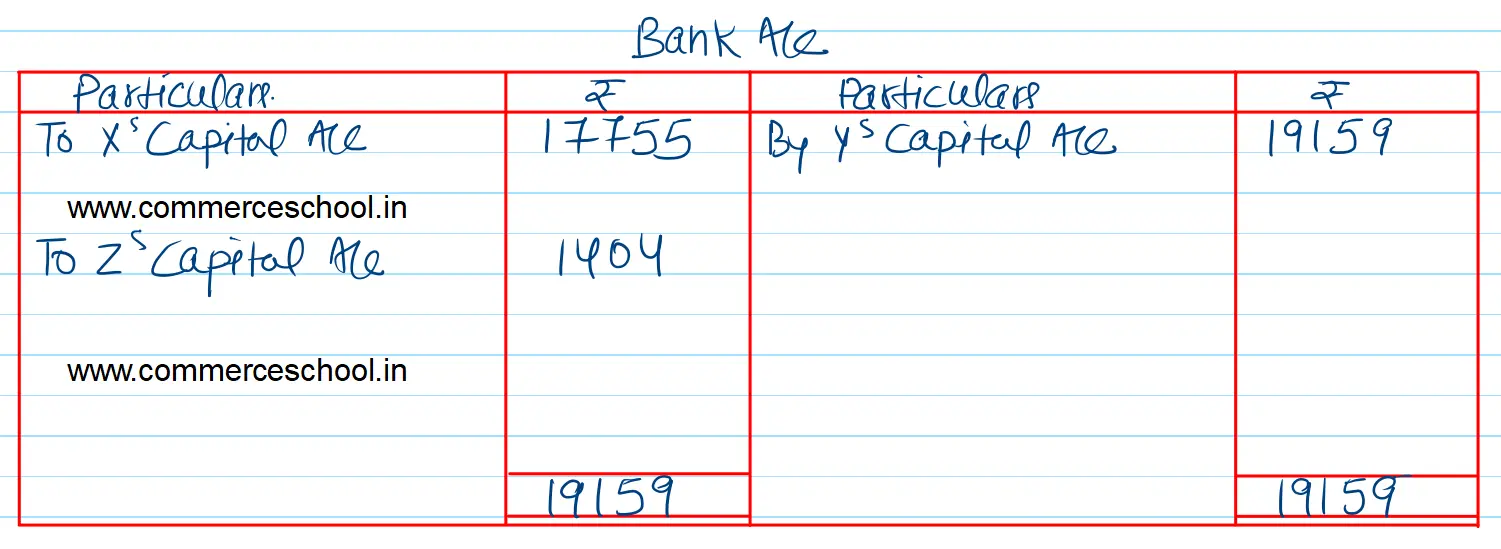

Prepare Realisation a/c and Capital A/cs of the partners and an account showing adjustment of profits or losses in the business.

[Ans. Loss (P&L A/c Dr. Balance) ₹ 15,000; Realisation loss ₹ 10,323; Cash brought in by X ₹ 17,755 and Z ₹ 1,404; Cash paid to Y ₹ 19,159.]