X, Y and Z were equal partners in a firm. On 31st March, 2023, their Balances Sheet was as follows:

X, Y and Z were equal partners in a firm. On 31st March, 2023, their Balances Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors

General Reserve Workmen Compensation Reserve Capital A/cs: X Y Z |

77,000 26,000 32,000 1,20,000 |

Bank

Debtors Stock Investments Furniture Machinery Profit & Loss a/c Advertisement Suspence A/c |

47,000 23,000 1,10,000 17,000 10,000 35,000 11,000 2,000 |

| 2,55,000 | 2,55,000 |

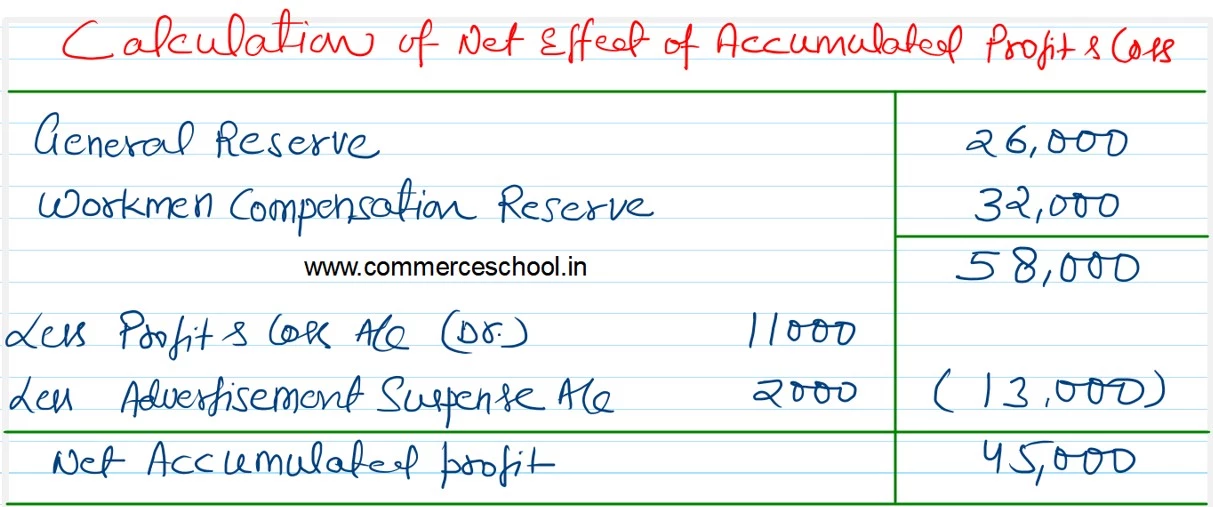

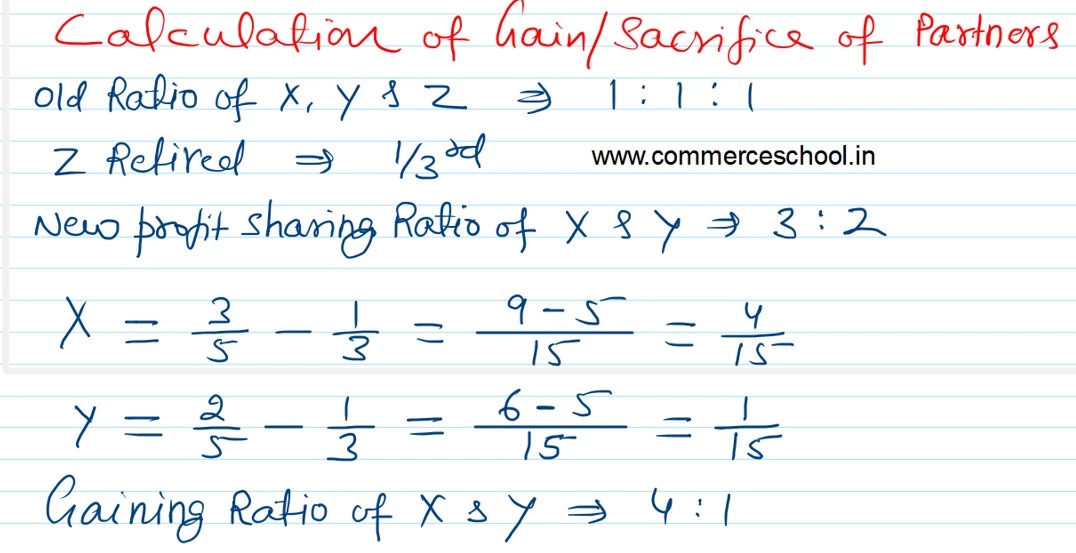

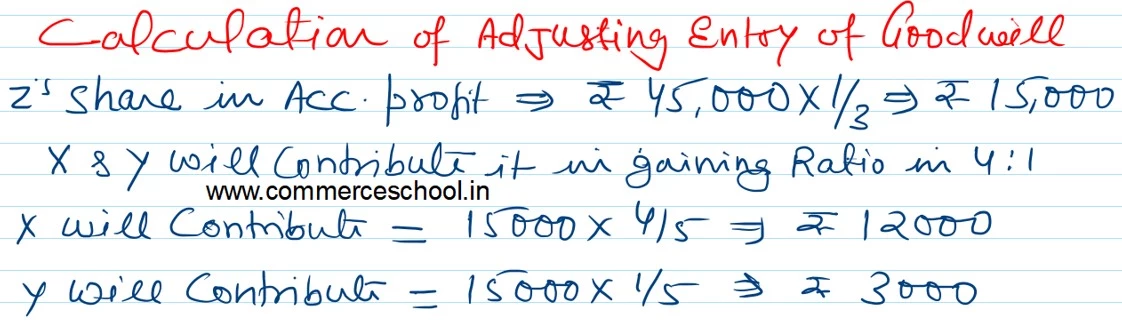

On the above date, Z retires from the firm and X and Y decided to share future profits in the ratio of 3 : 2. Partners decide to show accumulated profits, losses and reserves in the Balance sheet of the reconstituted firm at their original values.

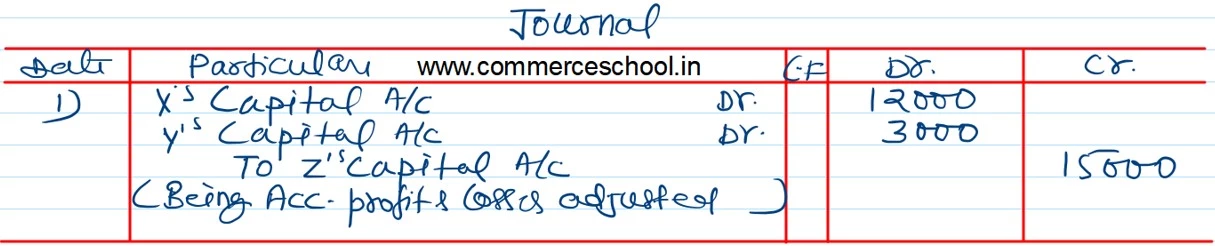

Pass an ‘Adjustment Entry’ for the treatment of accumulated profits, losses and reserves.

Anurag Pathak Changed status to publish