X, Y and Z were in partnership sharing profits and losses in the ratio of 7 : 2 : 1 and the Balance Sheet of the firm stood on 31st March, 2024, as under

X, Y and Z were in partnership sharing profits and losses in the ratio of 7 : 2 : 1 and the Balance Sheet of the firm stood on 31st March, 2024, as under:-

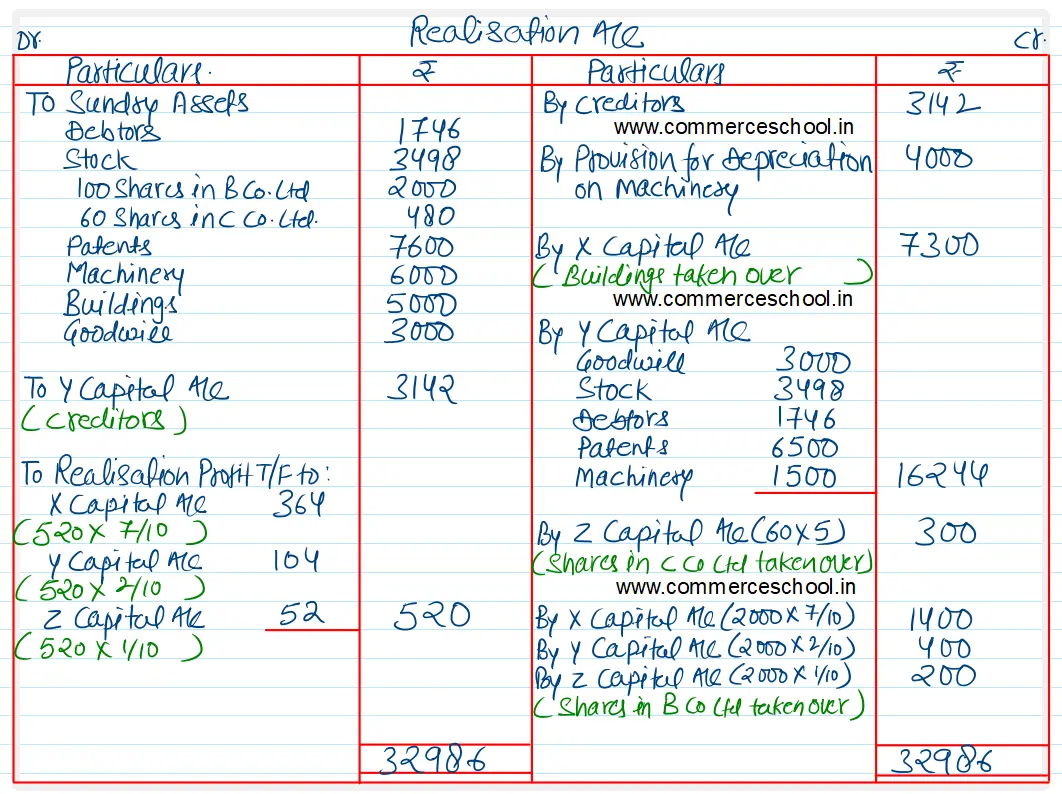

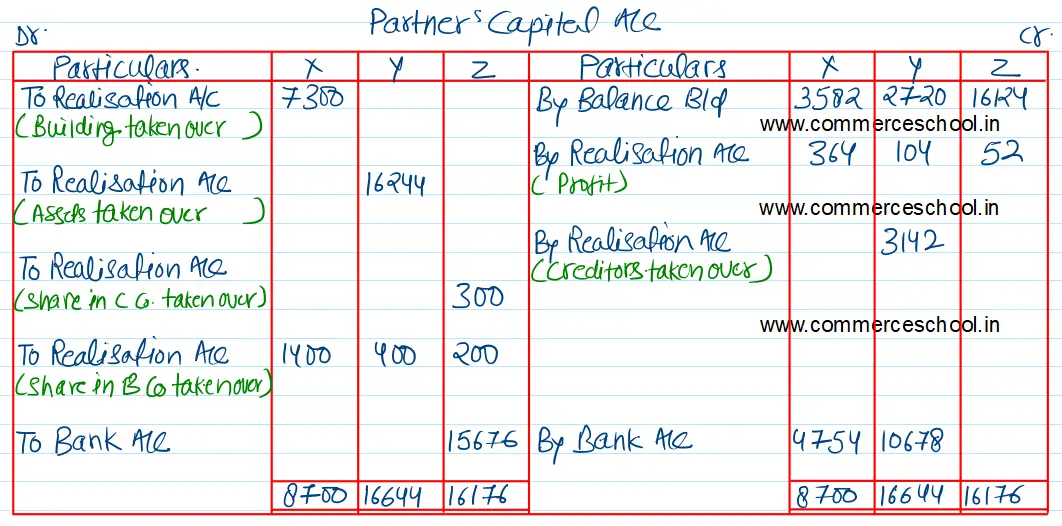

On 31st March, 2024, it was decided to dissolve the firm on the following terms:

(i) X is to take over the buildings at ₹ 7,300.

(ii) Y, who will continue with business, to take over Goodwill, Stock and Debtors at book values, Patents at ₹ 6,500 and Machinery at ₹ 1,500. He also agreed to pay the creditors.

(iii) Z agreed to take the shares in C Co. Ltd at ₹ 5 each.

(iv) The shares in B Co. Ltd. to be divided in profit sharing ratio.

Show the ledger accounts to record the dissolution.

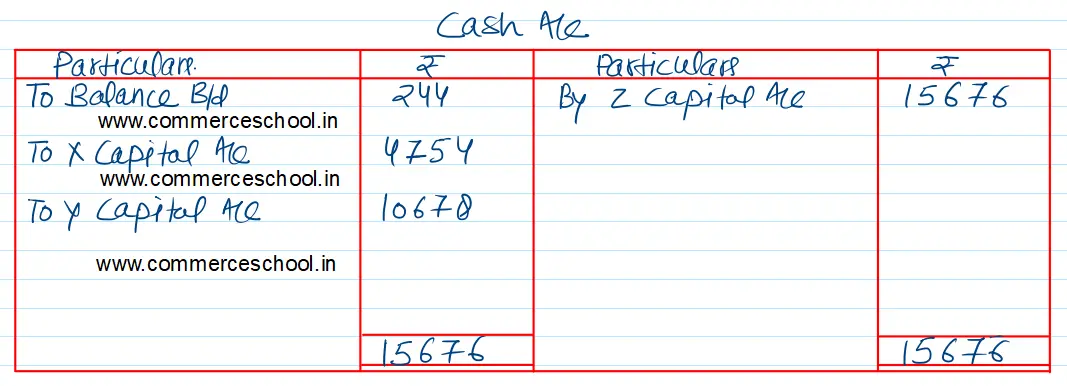

[Ans. Gain on realisation ₹ 520; Cash brought in by X ₹ 4,754 and Y ₹ 10,678; Final Payment to Z ₹ 15,676: Total of Cash A/c ₹ 15,676.]

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 3,142 | Cash in Hand | 244 |

| Provision for Depreciation on Machinery | 4,000 | Debtors | 1,746 |

| Capital Accounts: X Y Z | 3,582 2,720 16,124 | Stock | 3,498 |

| 100 Shares in B Co. Ltd 60 Shares in C Co. Ltd. | 2,000 480 | ||

| Patents | 7,600 | ||

| Machinery | 6,000 | ||

| Buildings | 5,000 | ||

| Goodwill | 3,000 | ||

| 29,568 | 29,568 |

Anurag Pathak Answered question