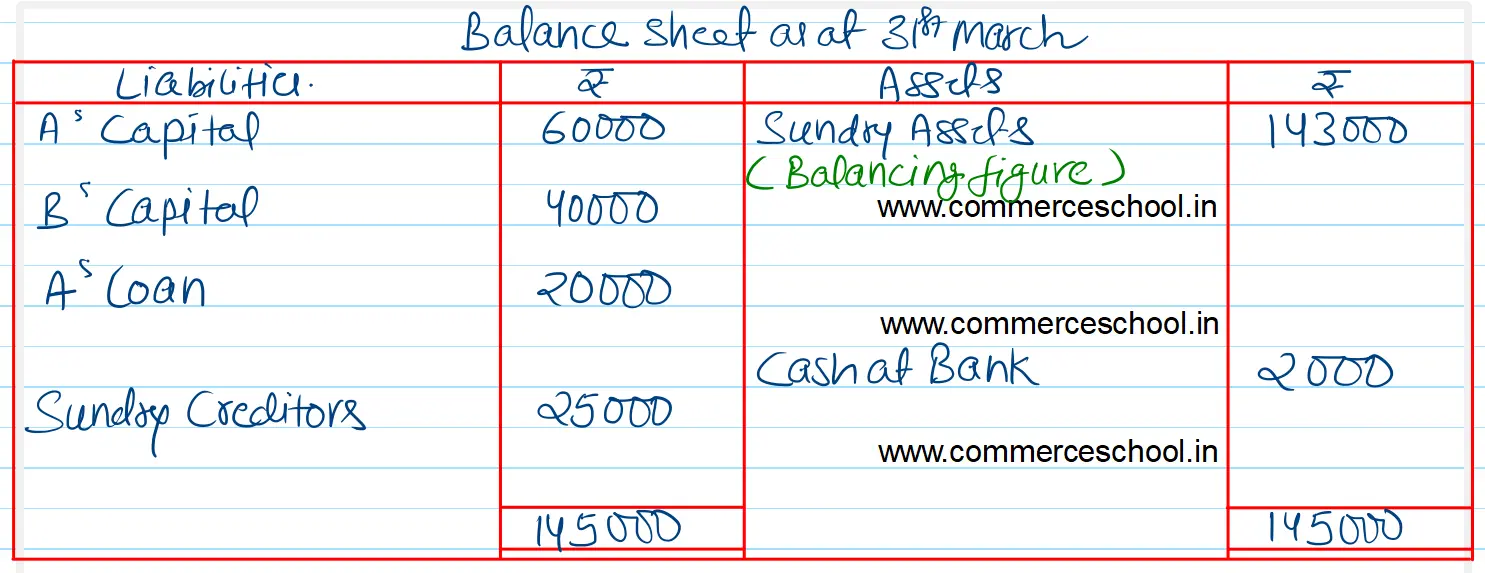

A and B dissolve their partnership Their position as at 31st March, 2024 was as follows: A’s Capital – ₹ 60,000 B’s Capital – ₹ 40,000 Sundry Creditors – ₹ 25,000 Cash at Bank – ₹ 2,000

A and B dissolve their partnership. Their position as at 31st March, 2024 was as follows:

A’s Capital – ₹ 60,000

B’s Capital – ₹ 40,000

Sundry Creditors – ₹ 25,000

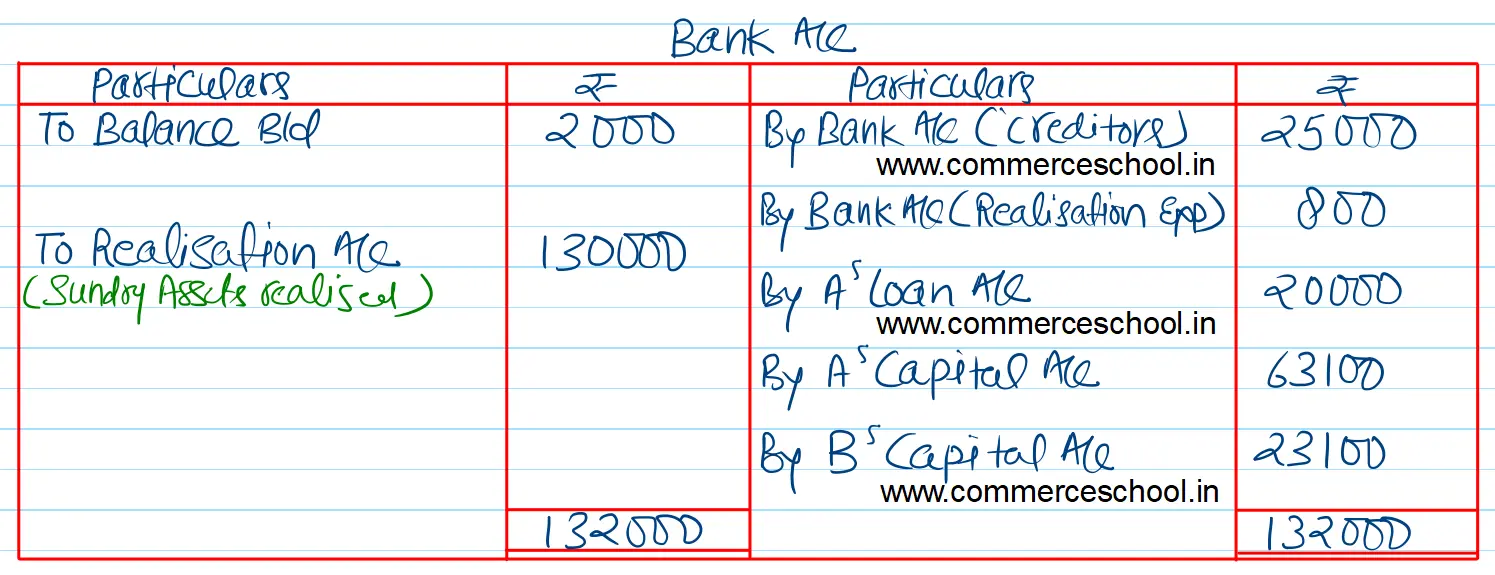

Cash at Bank – ₹ 2,000

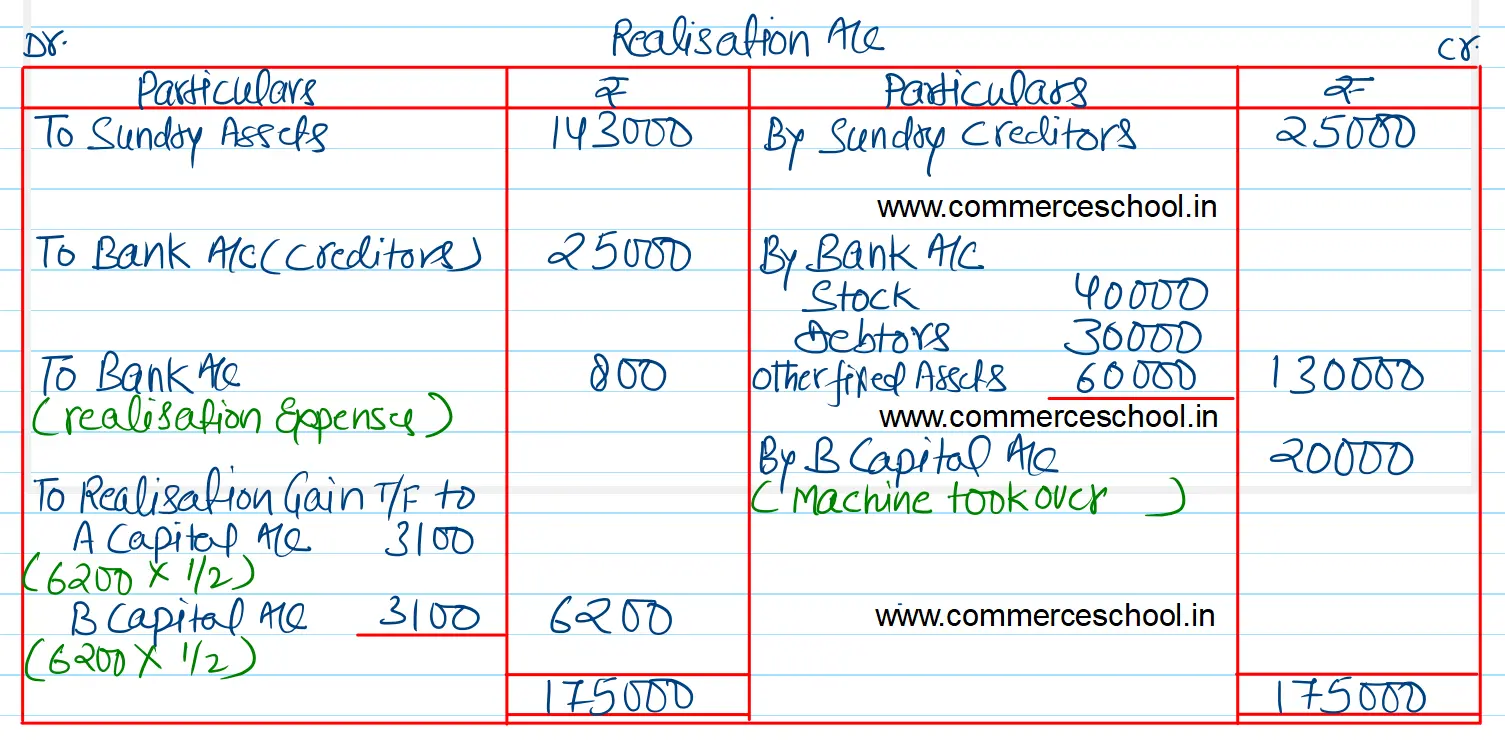

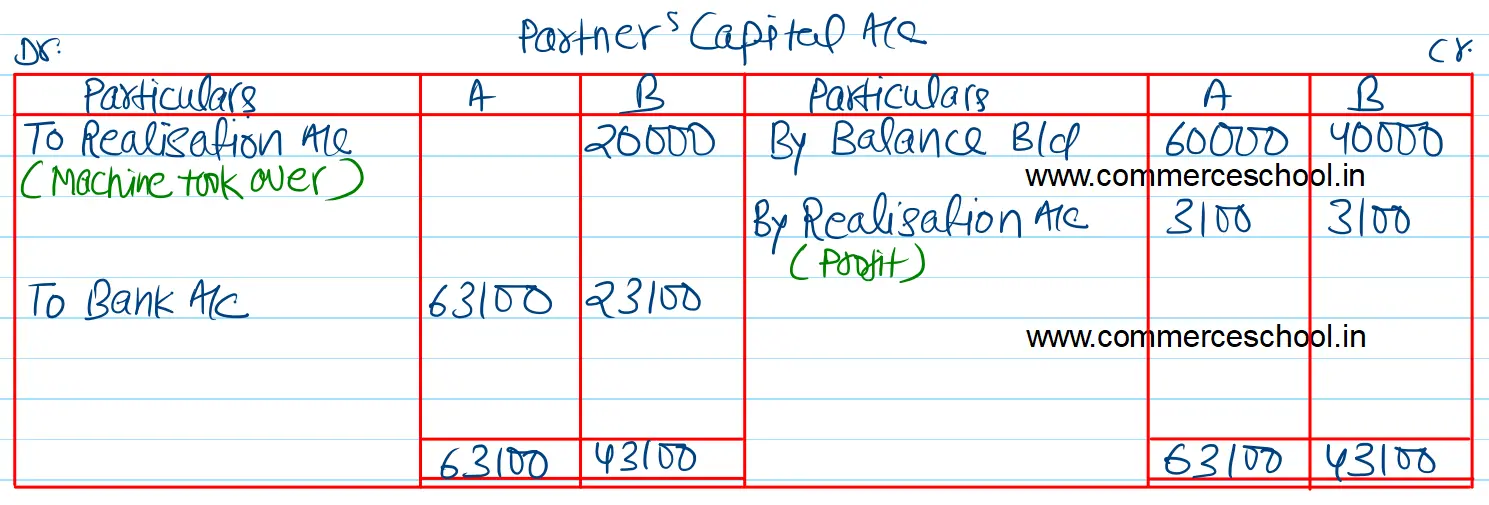

The balance of A’s Loan Account of the firm stood at ₹ 20,000. The realisation expenses amounted to ₹ 800. Stock realised ₹ 40,000 and Debtors ₹ 30,000. B took a machine at the agreed valuation of ₹ 20,000. Other fixed assets realised ₹ 60,000.

Prepare necessary accounts.

[Ans. Book value of Assets (other than cash) ₹ 1,43,000. Gain on Realisation ₹ 6,200. A is paid ₹ 63,100 (in addition to his loan) and B ₹ 23,100; Total of Bank A/c ₹ 1,32,000.]

Anurag Pathak Answered question